Transfer on Death (TOD) Deed: Naming Beneficiaries – Step by Step Guide

The “Revocable Transfer on Death Deed,” also called “TOD Deed” or “beneficiary deed,” is a simple way to leave a residence to your beneficiaries without the need for probate. The current owner or “transferor” names the intended heirs as “beneficiaries.” The deed has no effect until the transferor dies, so you can change your mind, refinance, or sell the property if you choose. When you die, the beneficiaries receive the property without going to court, although they do have to notify all heirs and file or record several documents.

Templates and Forms

As of Jan. 1, 2022, TOD deeds must now be signed by two witnesses, and after the donor dies, the beneficiaries must notify all heirs and file multiple papers.

Advantages:

- Avoids probate, if done correctly and if no unexpected family changes occur (like beneficiaries who die before transferor);

- Simple, inexpensive alternative to a living trust or other probate avoidance techniques;

- Can be revoked at any time during the lifetime of the transferor;

- Same tax advantages as transfers by trust or inheritance under a will.

Disadvantages:

- Technical requirements are simple but very strict, and errors can void the TOD deed;

- The home is not protected from your debts. If you die with a mortgage or other debt, your beneficiaries may get nothing;

- If you co-own the property as joint tenancy or community property with right of survivorship, the other owner receives your share of the property upon your death. The TOD deed has no effect unless you outlive your co-owner. If co-owners want to use a TOD deed, they must each sign a separate one;

- Title companies may refuse to issue title insurance for three years after your death, blocking sales or refinancing of the property, out of concern the TOD deed will be challenged;

- If a beneficiary dies before the transferor, their share won’t go to their heirs. Instead, the remaining beneficiaries split it. If no beneficiaries survive, your home will probably need to go through probate;

- After your death, the beneficiaries must take several steps to transfer the property, including notifying any possible heirs, allowing them to challenge the TOD deed.

Filling Out and Recording a TOD deed

These steps help you fill out a “Revocable Transfer on Death (TOD) Deed,” which you can download from our website at the link above.

1

Locate the Current Deed for the Property

You will need information from your current deed (the deed you received when you bought or received the property) in Step 2.

If you do not have a copy of the current deed, you can purchase one from the Recorder’s Office. In Sacramento, this costs $1 per page. You can call the Sacramento office at (916) 874-6334 or visit one of the office locations (see Sacramento Clerk/Recorder website for addresses and more information).

Make sure you are looking at the deed which gives you ownership of the property. Look for a name like “Grant Deed,” “Quitclaim Deed,” “Interspousal Deed,” “Corporation Deed,” or “Transfer Deed.” Ignore any “Deed of Trust.” That is related to the mortgage on your property. It will not have all the information you need.

2

Read the “Common Questions” Listed on Page 3-4 of the TOD Deed

Before you sign the deed, you are required to read the questions and answers about how the TOD deed works. They are written in small type on page three and four contain important information you need to know prior to filling out the deed, including how to complete it; how to revoke it; its effects on taxes, Medi-Cal eligibility and reimbursement requirements; and more.

Prefer a larger version? Download a large-print version of the common questions from our website.

3

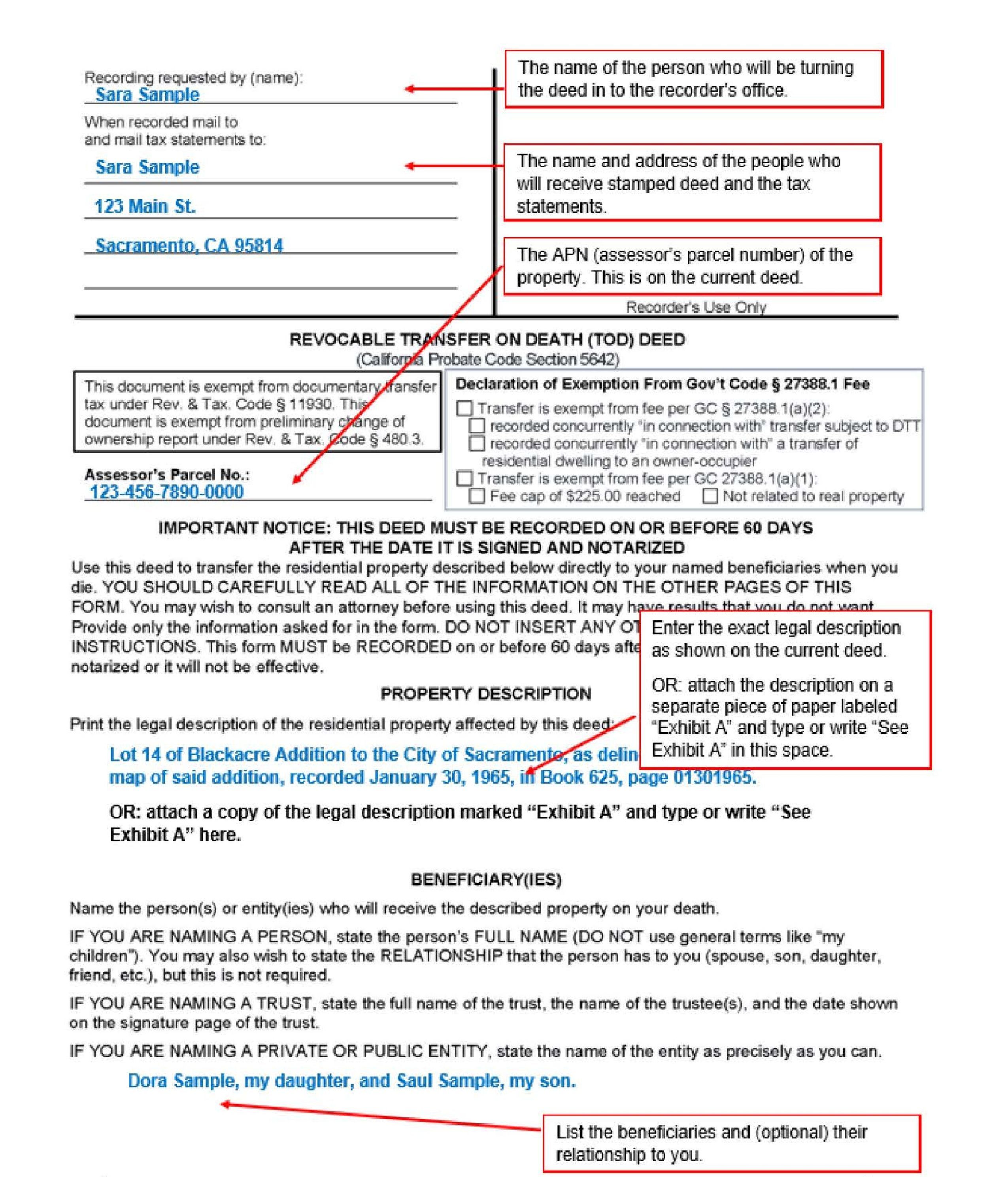

Fill Out the TOD Deed (Do Not Sign)

The TOD deed can be typed, filled out online then printed, or neatly handwritten in dark blue or black ink.

You will need the following information:

- Assessor’s Parcel Number.

- Your name as spelled on the current deed.

- Names of “beneficiaries” (your intended heirs).

- The legal description of the property. This must match the current deed exactly. Attach the legal description as an exhibit if it is too long for the page.

A sample completed “Revocable Transfer on Death (TOD) Deed” with more detailed instructions is available at the end of this guide.

4

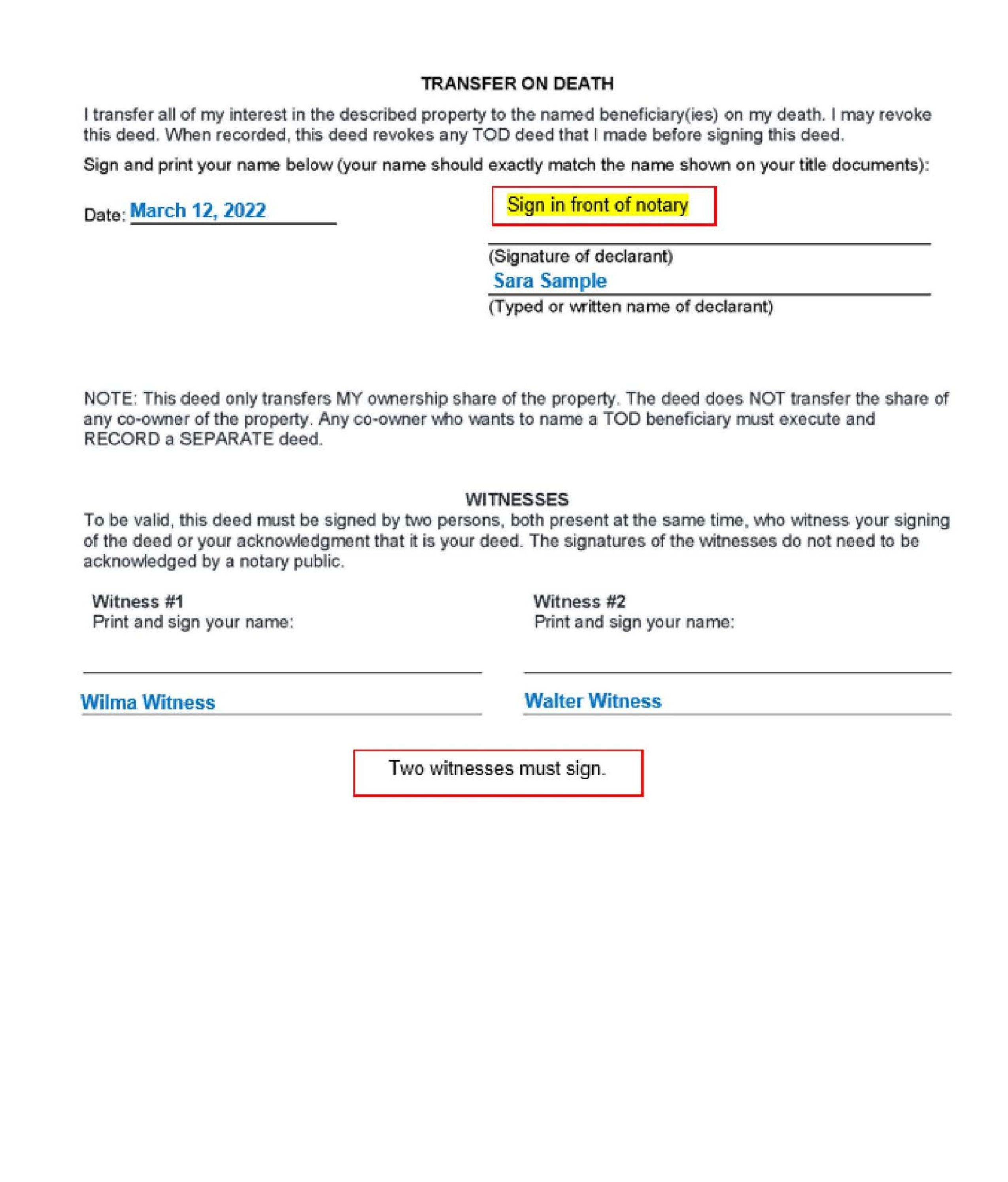

Sign in Front of a Notary; Have Two Witnesses Sign

You will need to sign the TOD deed in front of a notary. The notary will charge a fee for this service. You can find notaries at many banks, mailing services, and title companies.

Two witnesses need to sign. Their signatures do not need to be notarized. They must either witness you signing, or witness you acknowledging the form. (In other words, you must tell them, in person, what the form is and that you have signed it.)

Beneficiaries do not need to sign the TOD deed, but it is legal for them to be a witness. However, if anyone challenges the TOD deed, the court must presume that the beneficiary/witness tricked or forced you to sign, and must invalidate the deed unless the beneficiary can prove otherwise.

5

Record the Deed at the Recorder’s Office within 60 Days of Notarizing It

You must record a TOD deed within 60 days of notarizing it or it becomes invalid. This is the easiest way for TOD deeds to fail.

Record the TOD deed in the county where the property is located. The Recorder’s Office charges a recording fee and additional fees as set by state law. Current Sacramento fees are available at the County Clerk/Recorder’s website.

For help

Senior Legal Hotline

Toll Free: (800) 222-1753; Sacramento County: (916) 551-2140

Legal Services of Northern California

Free legal assistance for Sacramento residents age 60 and over on almost any civil issue, including property transfers and deeds.

Capitol Pro Bono

916-551-2102

Free estate planning assistance for low-income residents.

For More Information

On the Web:

California Advocates for Nursing Home Reform (CANHR)

“Transferring Your Home with a Transfer on Death Deed (TOD) – What You Need to Know”

Links several resources discussing advantages and disadvantages of TOD deeds, including a webinar for estate planning attorneys. CANHR also has a referral service to help you find attorneys specializing in elder law.

At the Law Library:

California Estate Planning (KFC 195 .A16 C3)

This book, published by CEB, discusses TOD deeds some of their tax and other implications, and possible alternatives in chapter 7.

Electronic Access: On the Law Library’s computers, using OnLaw.

Samples

Revocable Transfer on Death Deed

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.