Transferring Title to Beneficiaries after a Transfer on Death Deed Takes Effect

The “Revocable Transfer on Death Deed,” also called “TOD Deed” or “beneficiary deed,” is a simple way to plan who inherits a home. The current owner or “transferor” names the intended heirs as “beneficiaries.” When the owner dies, the beneficiaries receive the property without going to court, although they do have to notify all heirs (Cal. Probate Code 5681) and file or record several documents.

In addition, the beneficiaries accept liability for all of the owner’s unsecured debts, such as credit cards and other loans, and may have to give up the home if a creditor files in court. (Prob. Code 5672.) If you do not wish to accept the property and the debt, you can file a disclaimer in the County Recorder’s Office within 9 months of the death.

Templates and Forms

- Affidavit of Death: Transfer on Death (TOD) Deed (PDF) |or| Affidavit of Death: Transfer on Death (TOD) Deed (DOCX)

- Notice to Heirs–Transfer on Death (TOD) Deed (PDF)

As of Jan. 1, 2022, beneficiaries must notify all heirs and file multiple papers.

This guide provides instructions and samples for the steps a beneficiary must take after the TOD transferor dies.

Steps: After the owner passes away, the beneficiary or beneficiaries take the following steps:

- Send each of the owner’s legal heirs a Notice of Revocable Transfer on Death Deed, a copy of the deed, and a copy of the death certificate;

- Notarize and record an Affidavit of Death of Transferor (including declaration of notice to heirs) and death certificate with the County Recorder;

- File a Preliminary Change of Ownership Report (PCOR) with the County Assessor;

- If the owner received Medi-Cal benefits, notify the California Department of Health Care Services of the death and provide a copy of the death certificate.

Because it is sometimes difficult to determine who the “legal heirs” are, or to find them, you may need to hire a lawyer to help you with this process.

Samples of the Notice to Heirs and Affidavit of Death of Transferor are attached to the end this guide.

Step by Step Instructions

1

Obtain a certified death certificate and copy of the TOD deed

You will need copies of the TOD deed in Step 2 and Step 3.

If you do not have a copy of the TOD deed, you can purchase one from the Recorder’s Office. In Sacramento, this costs $1 per page. You can contact the Sacramento office at (916) 874-6334 or visit one of the office locations (see the Sacramento County Clerk/Recorder’s website for addresses and more information).

You will also need a certified death certificate to record along with the Affidavit of Death. If you arranged the burial or cremation, you may receive several of these from the funeral home. Otherwise, you can obtain one from the county recorder’s office 4-6 weeks after the death.

2

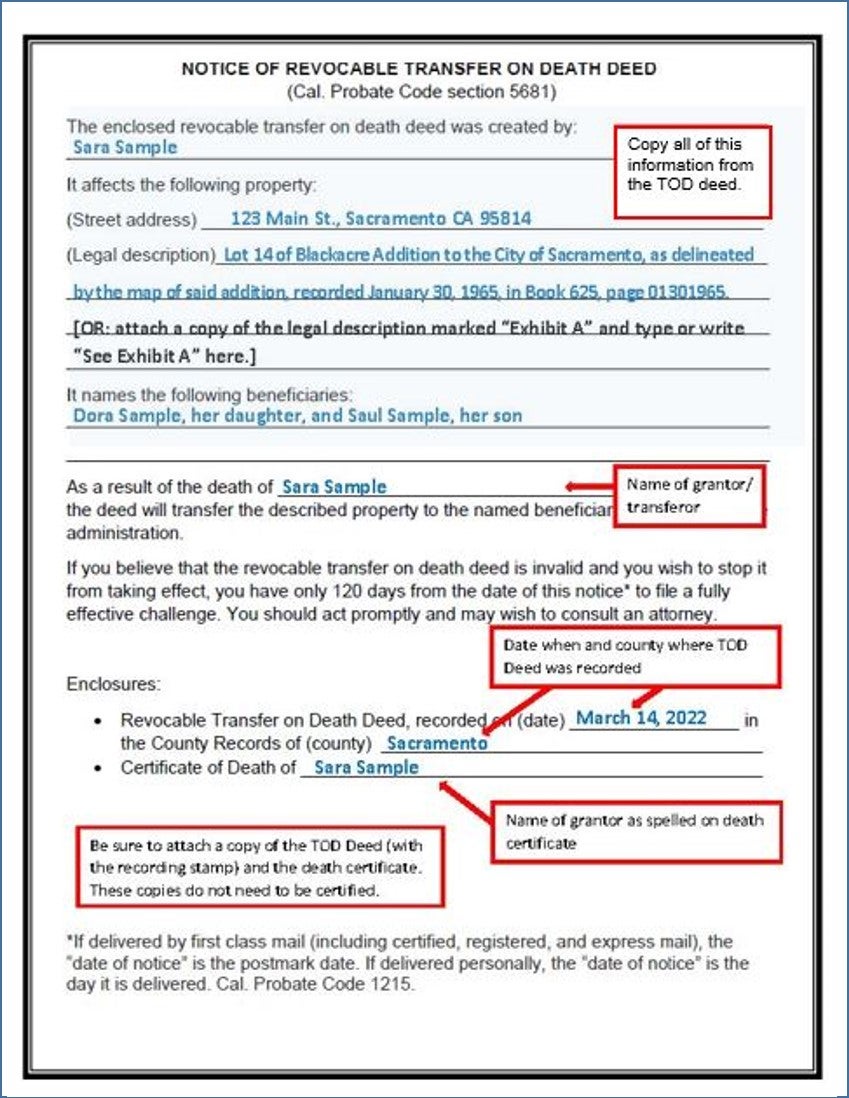

Send notice to the legal heirs

You must send a “Notice of Revocable Transfer on Death Deed” to all legal heirs. You must include a copy of the recorded Transfer on Death Deed and of the death certificate. A sample Notice of Revocable Transfer on Death Deed with instructions is available at the end of this guide.

If there is more than one beneficiary, only one must send the notice and sign the Affidavit of Death of Transferor in Step 3.

Who are the “legal heirs?”

The legal heirs are the relatives who are legally entitled to inherit if no will exists.

Married/domestic partners: If the deceased person was married or in a domestic partnership at the time of death, the legal heirs are the spouse and the deceased person’s:

- children (or grandchildren of a child who has died);

- if no children or grandchildren: parents;

- if no living parents: siblings, including half-siblings (or children of predeceased siblings).

Not married/no domestic partner: Legal heirs are the deceased person’s:

- children (or grandchildren from a child who has died);

- if no children or grandchildren: parents;

- if no living parents: siblings (or children of a sibling who has died);

- if no living siblings or nieces or nephews: the deceased person’s grandparents;

- if no living grandparents: certain relatives of any spouse who had already died, if any;

- if no predeceased spouse: other next of kin (cousins);

- if no next of kin: the state of California.

See Chapter 3 of How to Probate an Estate in California, by Lisa Fialco, Nolo Press, for details.

Figuring out exactly who needs to receive notice can be tricky. You may need to hire a lawyer to assist with making sure this requirement is properly met or to help you locate a hard-to-find heir.

3

Fill out the Affidavit of Death, including Notice to Heirs (do not sign)

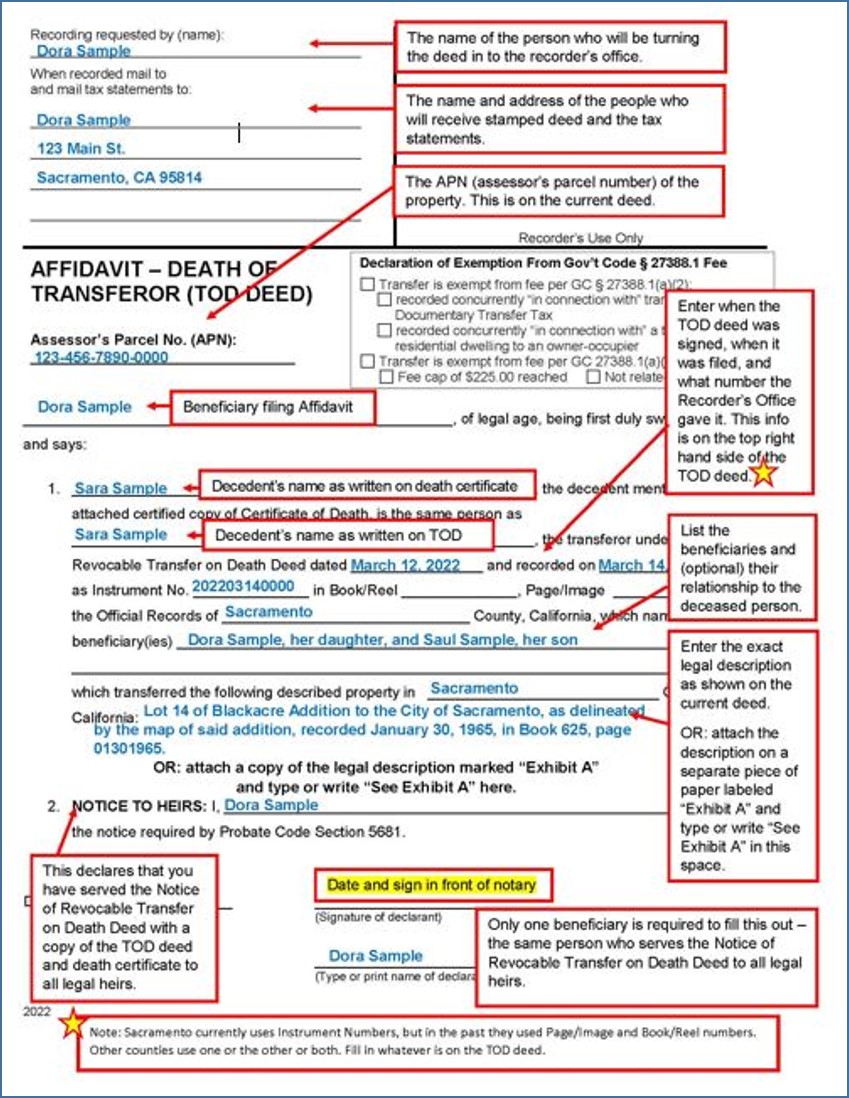

The Affidavit of Death of Transferor should be typed, filled out online and printed, or neatly filled out in in dark blue or black ink. You will need the following information from the TOD deed and death certificate:

- Name of transferor as spelled on TOD deed and as spelled on death certificate.

- The date the TOD deed was signed

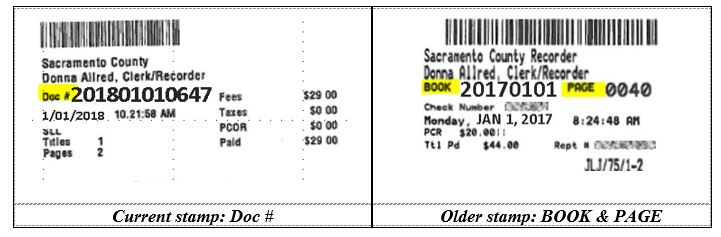

- The date it was recorded, and recorder’s instrument (document) number or book/reel and page/image numbers from the upper right of the TOD deed. (In Sacramento, older documents will have book and page numbers; newer documents may just have a document number.)

- The names of all “beneficiaries” (people named in the TOD deed) and their relationship to the transferor, as written on TOD deed.

- The legal description of the property. This must match the TOD deed exactly. Attach the legal description as a separate page labeled as an exhibit if it is too long to fit in the available space.

A sample completed “Affidavit of Death of Transferor” with more detailed instructions is available at the end of this guide.

4

Sign the Affidavit in front of a notary

Sign the Affidavit in front of a notary. The notary will charge a fee for this service. You can find notaries at many banks, mailing services, and title companies.

The beneficiary who served the Notice to Heirs must sign. Other beneficiaries, if any, do not need to.

5

Record the Affidavit at the County Recorders’ office

Record the Affidavit in the county where the property is located, along with the certified copy of the death certificate. The Recorder’s Office charges a recording fee (currently $20/first page plus $3 for additional pages). Current Sacramento fees are available at the County Clerk/Recorder’s website.

6

Optional: Fill out and record a Grant Deed from yourself to yourself

This sounds silly, but when you sell or refinance the property, the buyer or lender will look for a “Grant Deed” to be sure you own the property. Recording one makes the chain of title as clear as possible. See our Completing and Recording Deeds guide for more information.

Additional steps

Inform the County Assessor’s office: You may be required to file certain forms at the County Assessor’s office. In Sacramento County, you can get information on the Sacramento County Assessor’s website.

Contact any mortgage lenders, homeowners’ association, or other lien holders to update those records in your name as well.

For help

Senior Legal Hotline

Toll Free: (800) 222-1753; Sacramento County: (916) 551-2140

Legal Services of Northern California

Free legal assistance for Sacramento residents age 60 and over on almost any civil issue, including property transfers and deeds.

Capitol Pro Bono

916-551-2102

Free estate planning assistance for low-income residents.

For More Information

On the Web:

California Advocates for Nursing Home Reform (CANHR)

“Transferring Your Home with a Transfer on Death Deed (‘TOD Deed’)–What You Need to Know”

Information on the advantages and disadvantages of TOD deeds. CANHR also has a referral service to help you find attorneys specializing in elder law.

At the Law Library:

How to Probate an Estate in California KFC205 .N57 2021

Chapter 3 of this book explains how to determine who the legal heirs are.

Electronic Access: From any computer (Library or home) via the Legal Information Reference Center.

Real Property Ownership and Taxation KFC 195 .A16 C3

This book, published by CEB, discusses transferring property subject to a TOD deed in chapter 11.

Electronic Access: On the Law Library’s computers, using OnLaw.

Samples

Transfer on Death Deed-Affidavit of Death of Transferor

Notice to Heirs

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.