Petition to Determine Succession to Primary Residence (Under $750,000)

As of April 2025, a house can be transferred to heirs after a homeowner dies using a streamlined process in probate court instead of a full probate. (California Assembly Bill 2016 (2024), amending California Probate Code Sections 13150-13152.) This process is called a “Petition to Determine Succession to Primary Residence.” It can be used if:

- The house was the person’s main home in California, and

- The home’s market value is less than $750,000

(This limit used to be much lower, and the lower limit still applies if the owner died before April 2025. It also used to apply to any real estate, not just a primary residence.)

This guide explains how the process works and includes links to the forms you’ll need.

Forms and Templates

The people with the right to receive a share of the home are called “successors” or “successors in interest.”

- If there is a will, the successors are the people named in it.

- If there is no will, California’s inheritance laws decide who gets the property—usually the person’s spouse and/or children (or grandchildren, if one of the children has passed away and had kids).

Any successor can file the petition to determine their own portion of the property. But to clear title, all successors must participate.

Other people who might inherit must be told about it, and a court hearing will be scheduled. But this process is much easier, faster, and cheaper than a full probate case. It’s designed to help people transfer a home without needing a lawyer.

Be aware: If you use this petition, you become personally liable for the decedent’s unsecured debt (usually all debt except mortgages, liens, and car loans), up to the amount of your share of the home’s equity. In a full probate case, creditors have a shorter period to file claims, and debts must be settled before the assets are distributed. This may mean the home will have to be sold, but you will get your share of the sale without worrying about being sued for credit card debt, medical debts, court judgments, and other personal debts of the decedent.

Can you avoid court entirely?

Step by Step

1

Look for a Will and File It with the Court

If the person who died might have had a will, look carefully for it. Check places like:

- A file with important papers (birth or marriage certificates, passport, house deed)

- A safe-deposit box

- Their lawyer (if they had one)

You’re looking for the signed original or at least a copy, including any changes to it (called amendments or codicils).

If you find the will, you must file it with the court—along with any amendments or codicils. This should be done within 30 days of the person’s death or from the day you find the will, whichever is later. There’s no automatic penalty if you miss this deadline, but it’s best to do it on time.

You should also try to locate any trust documents, but they do not need to be filed in court.

2

Figure Out Who Inherits the Home

If there is a will, it will probably determine who gets the house. In some cases, a spouse or children who are left out of the will may be entitled to a share. In that situation it is important to talk to a lawyer to determine how to settle the estate.

If there is no will, California law decides who inherits. This usually means the spouse and/or children (or grandchildren from a child who already passed away). If there is no spouse or child, the law sets up a priority list for other relatives. You can find details in Nolo Press’s guide: “Intestate Succession in California.”

Unless you are the only person entitled to inherit, it’s important to coordinate with all other successors in interest. If all new owners do not agree to and sign petition, a portion of the property may remain unresolved, preventing a sale or refinance.

If one of the successors in interest wants to waive their right to inherit, they can do so by signing a letter or a quit claim deed waiving their rights in favor of the other(s).

3

Collect the Information and Documents You’ll Need

You will need all of the following, if they exist:

- The most recent deed for the home

- Original will or trust (if available)

- Any mortgages or liens on the home

You can get deed and loan information from the County Recorder’s Office or through a title company.

You should also check for other probate cases.

If someone else has filed (or plans to file) a probate case for the same person’s estate—either in California or another state—you must ask for their written permission to use this simpler process. Look for a case in the state and county where the person lived on the date of death, or where they own real estate.

4

File Forms with the County Assessor’s Office

You’ll need to file several forms, including:

- Change in Ownership Statement – Death of a Real Property Owner (Form BOE-502-D)

- A certified copy of the death certificate

- A copy of the will, if there is one

- A copy of the trust, including changes, if there is one

- A copy of a Domestic Partnership Declaration, if it applies

Deadline: File these within 150 days of the death, or along with the Inventory and Appraisal, whichever is sooner.

Find forms and more info from the County Assessor’s Office where the home is located.

For a useful outline of required forms in different situations, visit Sacramento County’s Assessor at: Navigating Loss: Death of a Property Owner.

5

Get the Home Appraised by a Court-Appointed Probate Referee

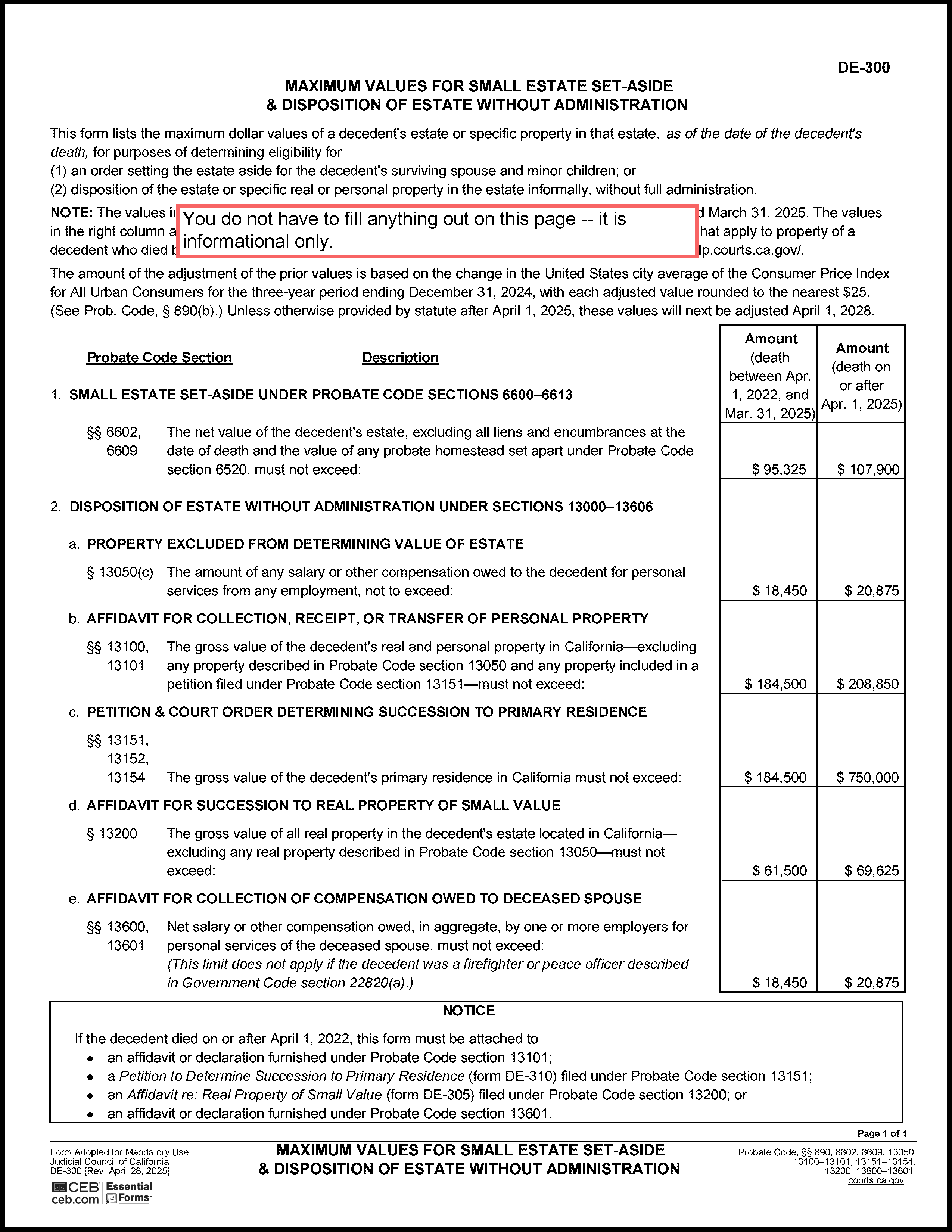

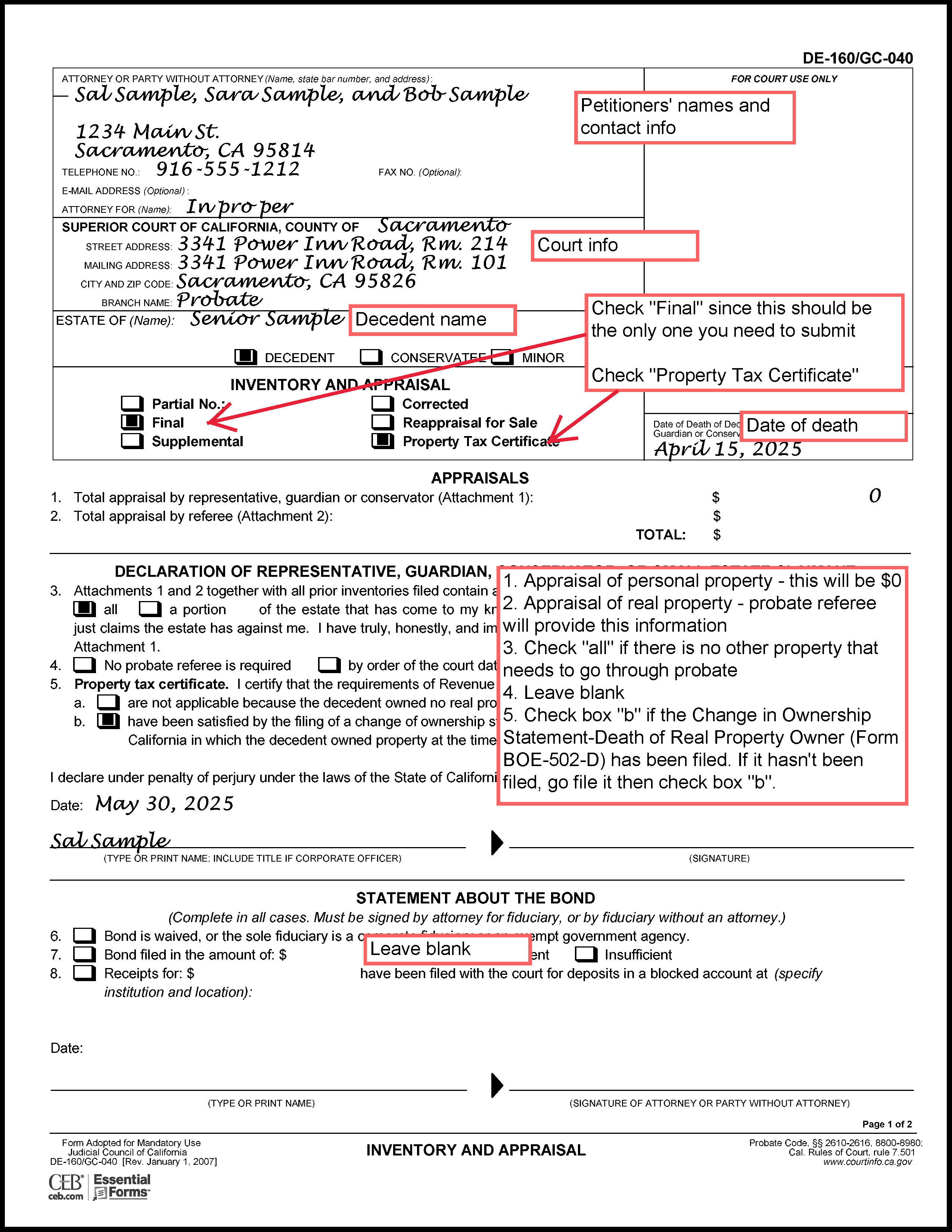

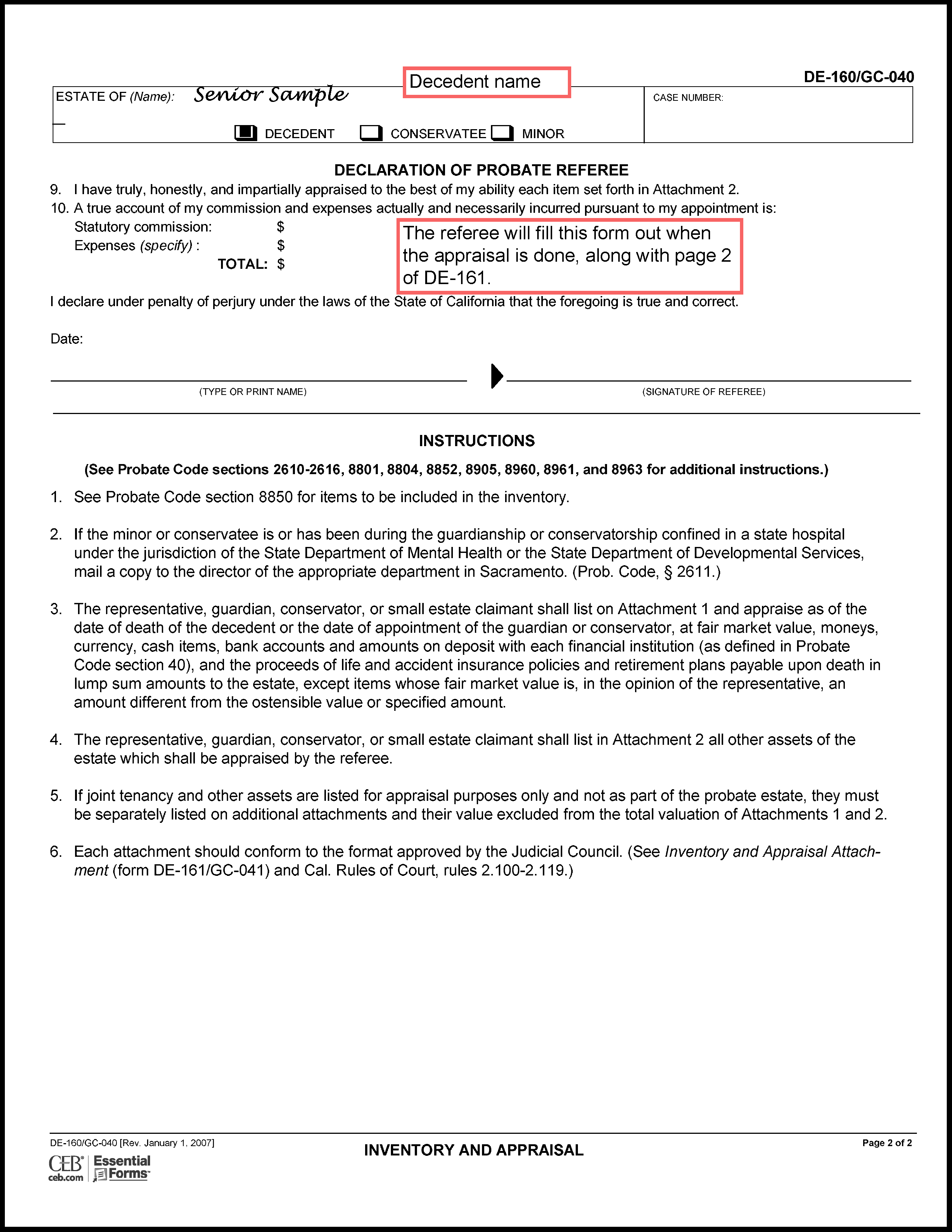

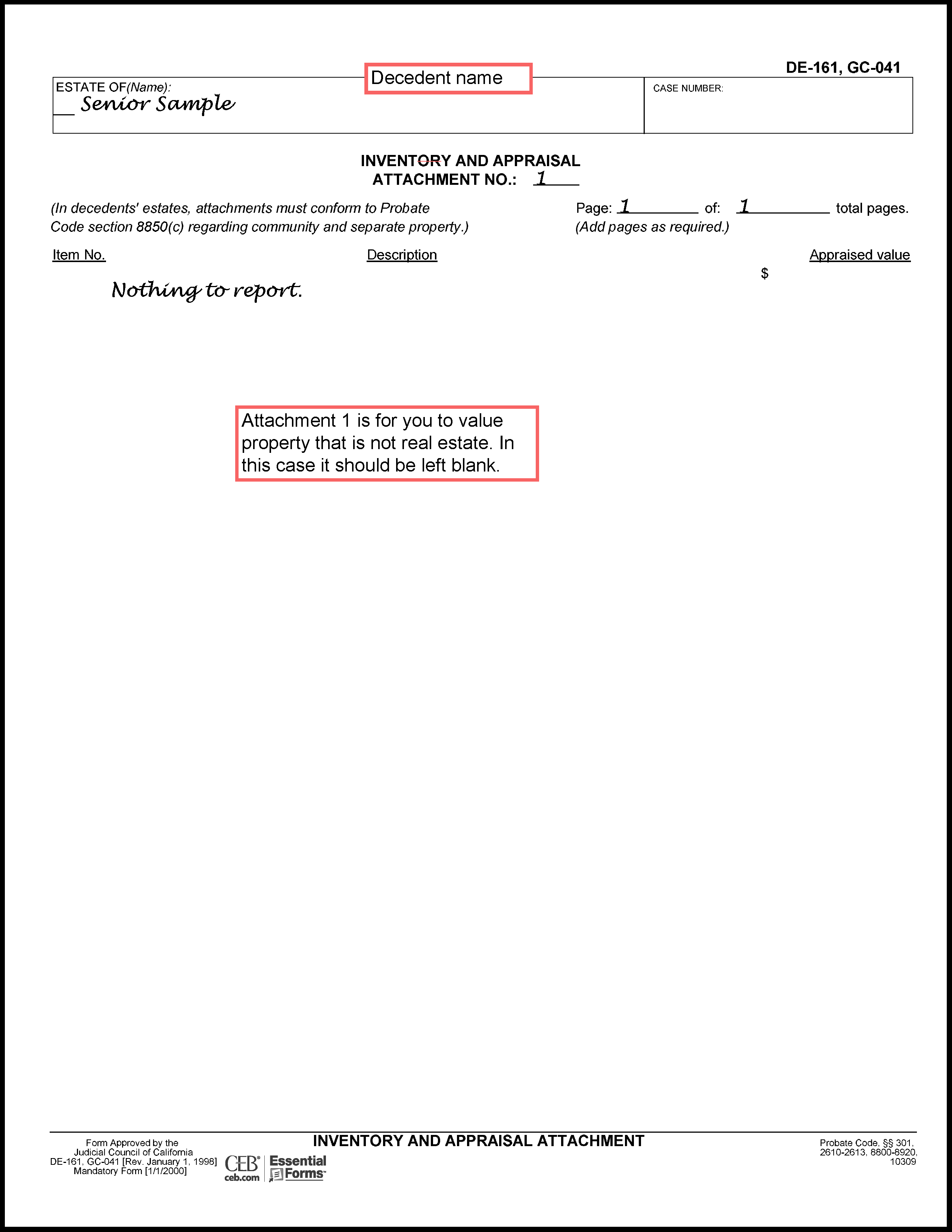

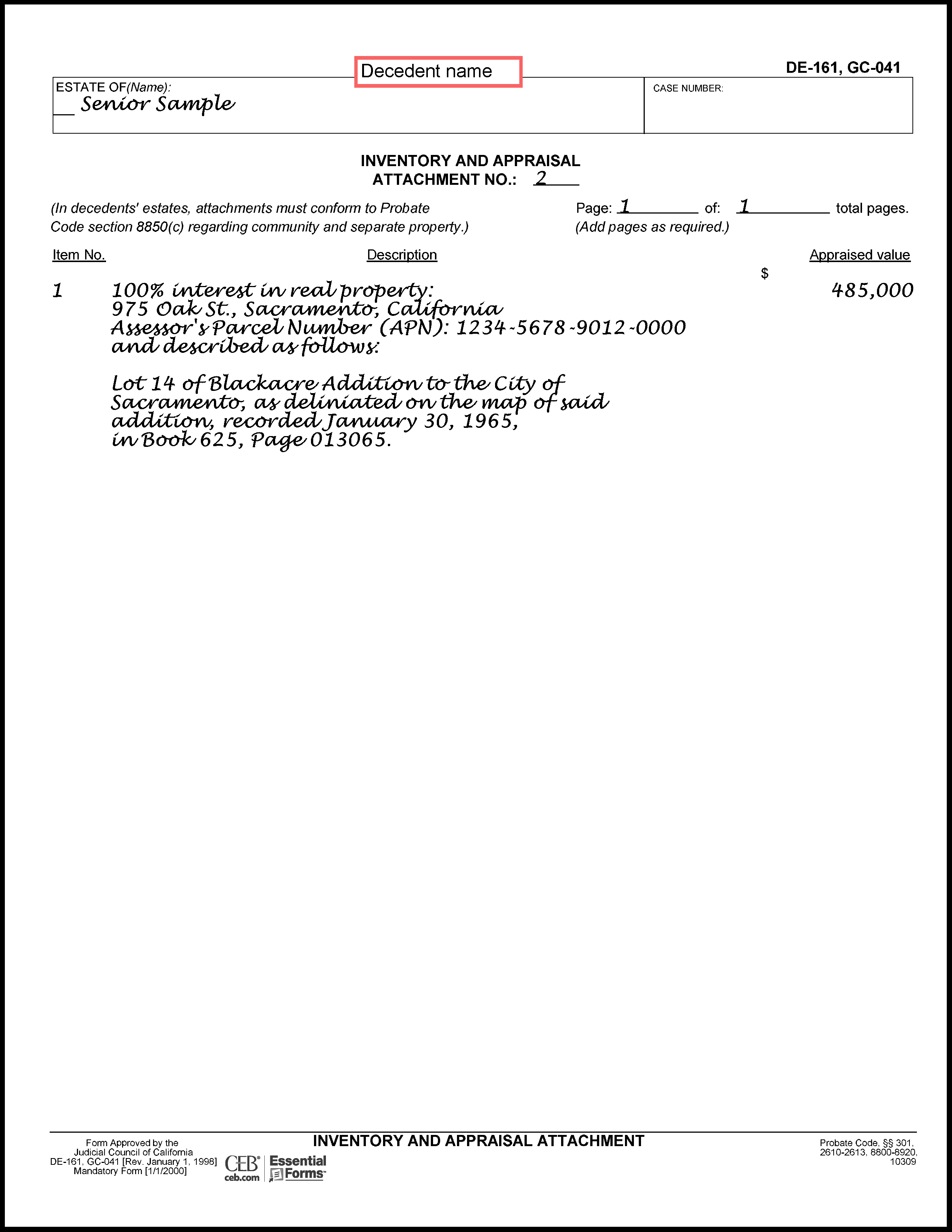

Contact a Probate Referee (someone the court assigns to value property) for an Inventory and Appraisal using forms DE-160 and DE-161. You’ll need this to show the home is worth less than $750,000.

- Before filing: Choose any county-appointed referee you like.

- After filing: Use the referee assigned to your case.

The referee will charge .01% of the appraised value in most cases, plus reasonable expenses. This amount is set by California law. (Cal. Probate Code § 8961.)

Warning: use one of the probate referees approved by your county court. They are the only appraiser the court will accept. If you use another appraiser, you will have to pay twice.

Helpful Links:

6

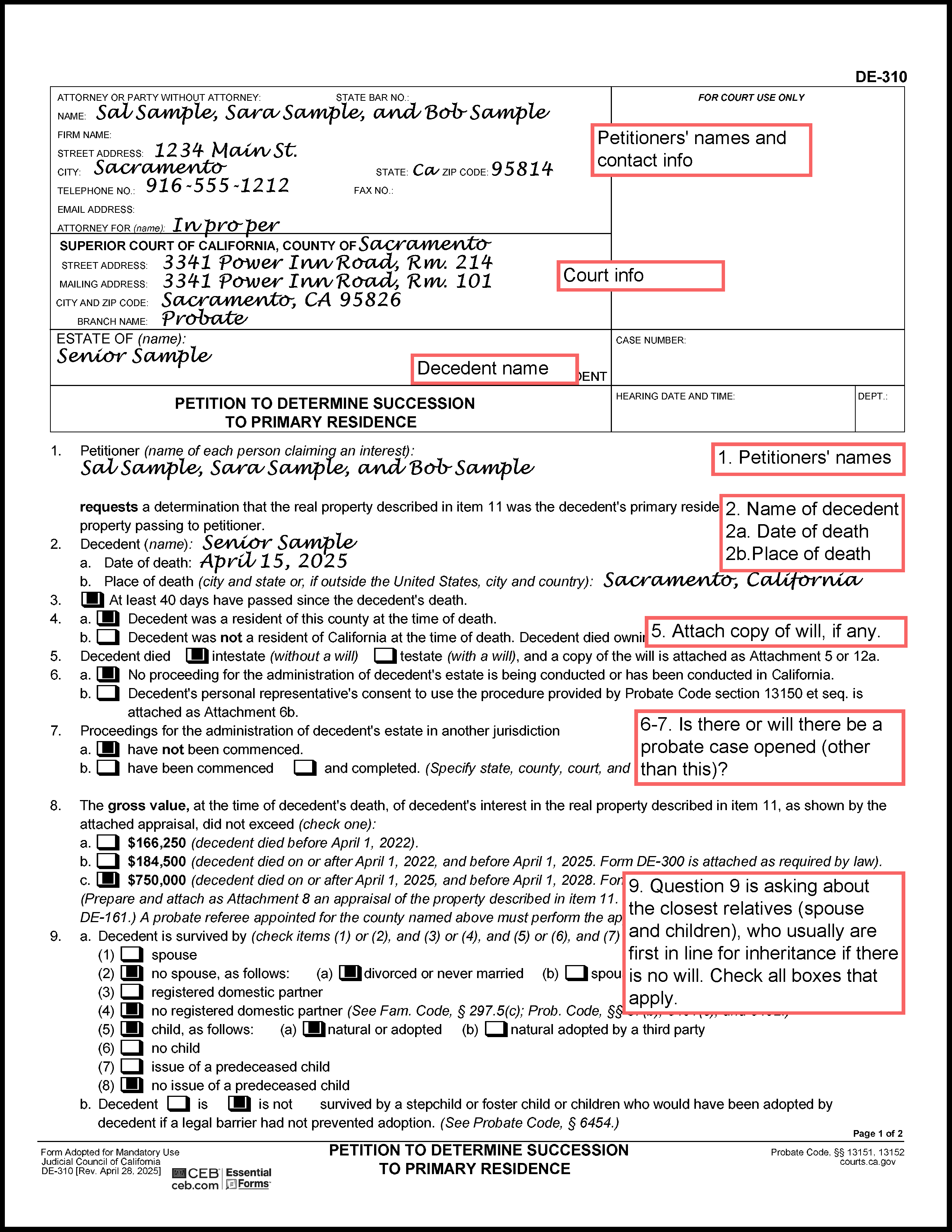

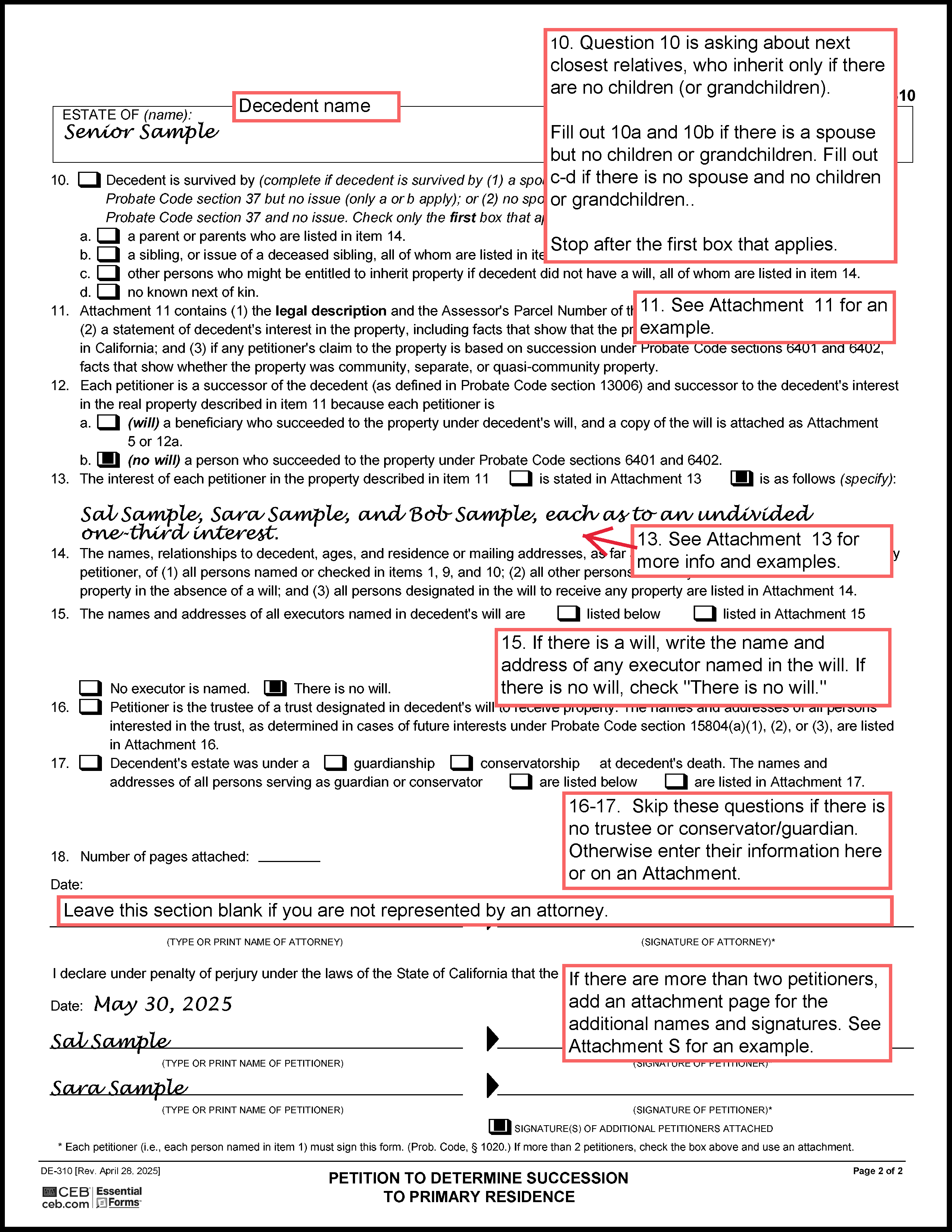

Fill Out and File the Petition and Order

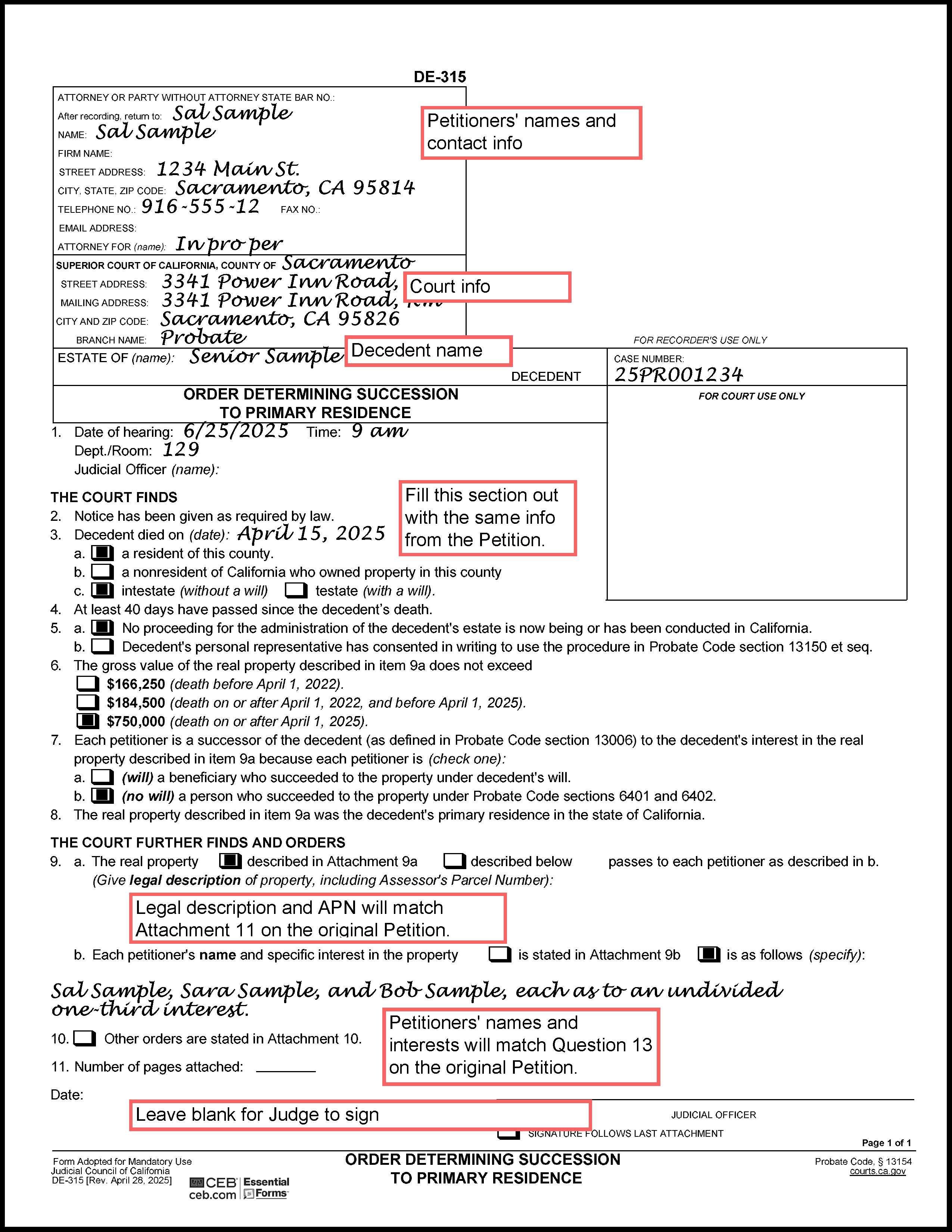

After at least 40 days have passed since the person’s death, file a Petition (DE-310) and Order (DE-315) in the county where the person lived when they died.

This petition asks the court to order that you now legally own the property.

Attach these items to the Petition:

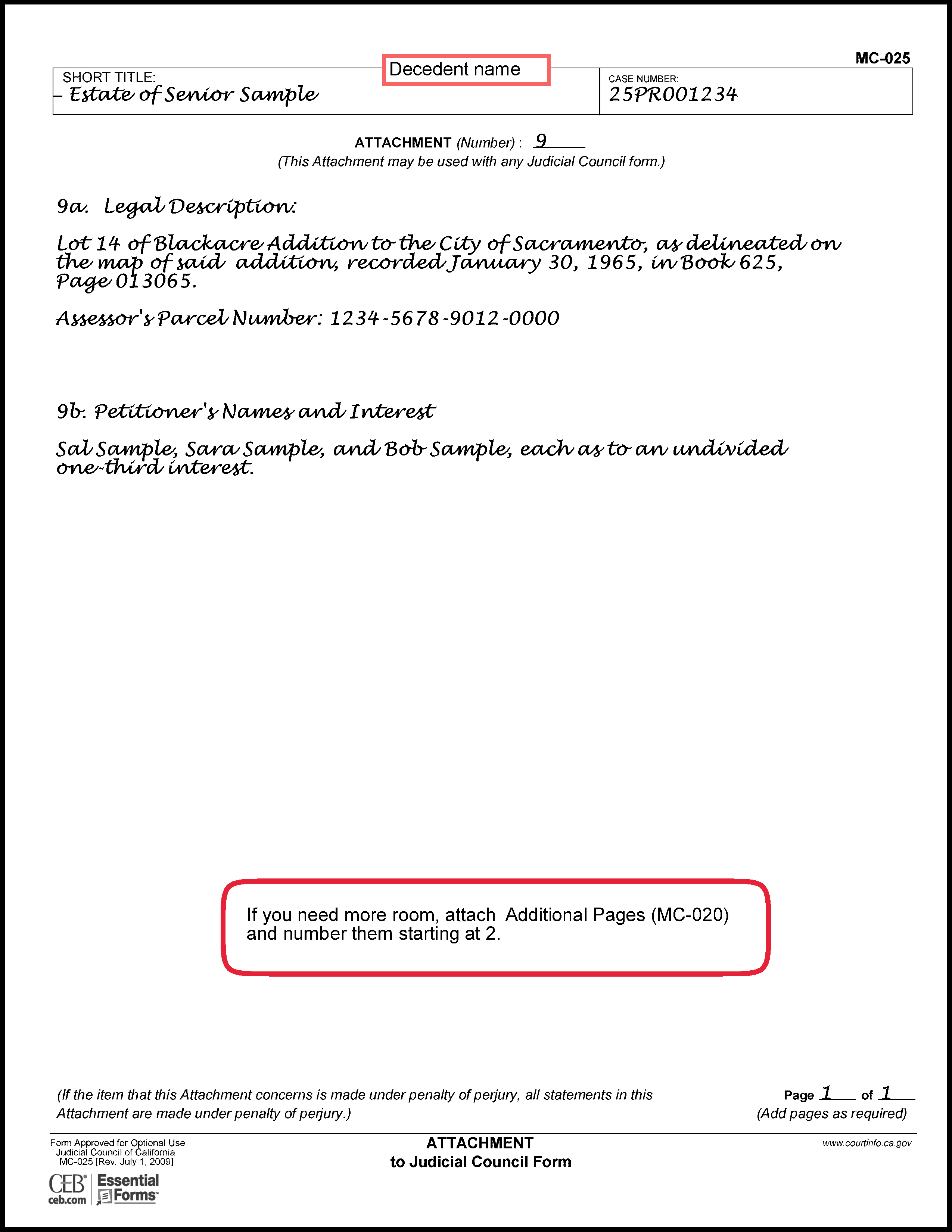

All Petitions will need:

- Inventory and Appraisal (DE-160 & DE-161), showing the value of the property (Attachment 8)

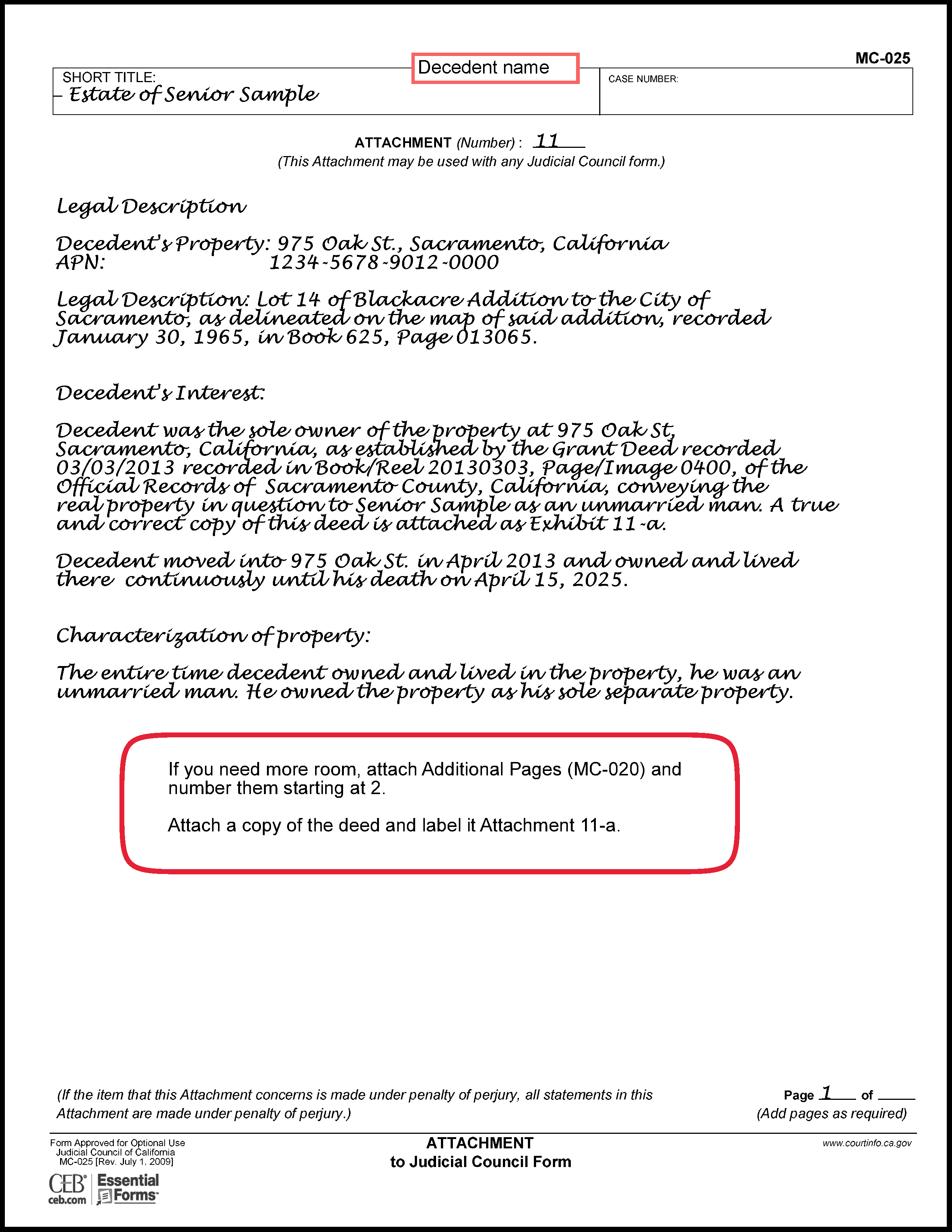

- Attachment 11:

- Legal description of the property and its APN (Assessor’s Parcel Number)

- Statement that the property was the decedent’s main home

- If any petitioner’s claim is based on marriage, explain whether the property was separate property, community property, or quasi-community property

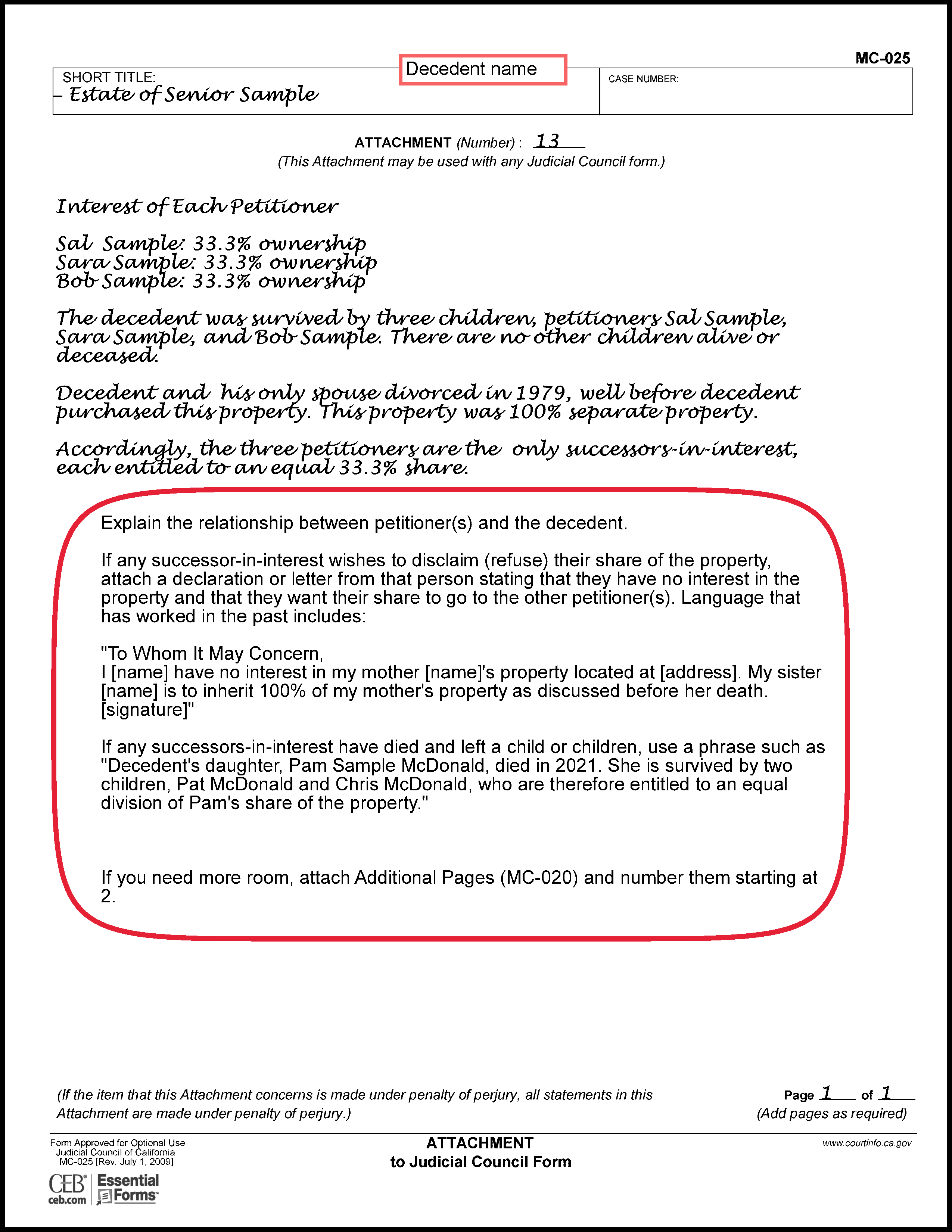

- Attachment 13: Who should own what percentage of the property now that the decedent has passed away. If any successor in interest has waived their share, attach the waiver or quitclaim deed they signed to show why they are not a new owner.

Depending on your situation, you may also need one or more of the following:

- Copy of the will, if there is one (Attachment 5 or 12a)

- Consent from the probate executor to file this petition, if someone else has already started a probate case (Attachment 6b)

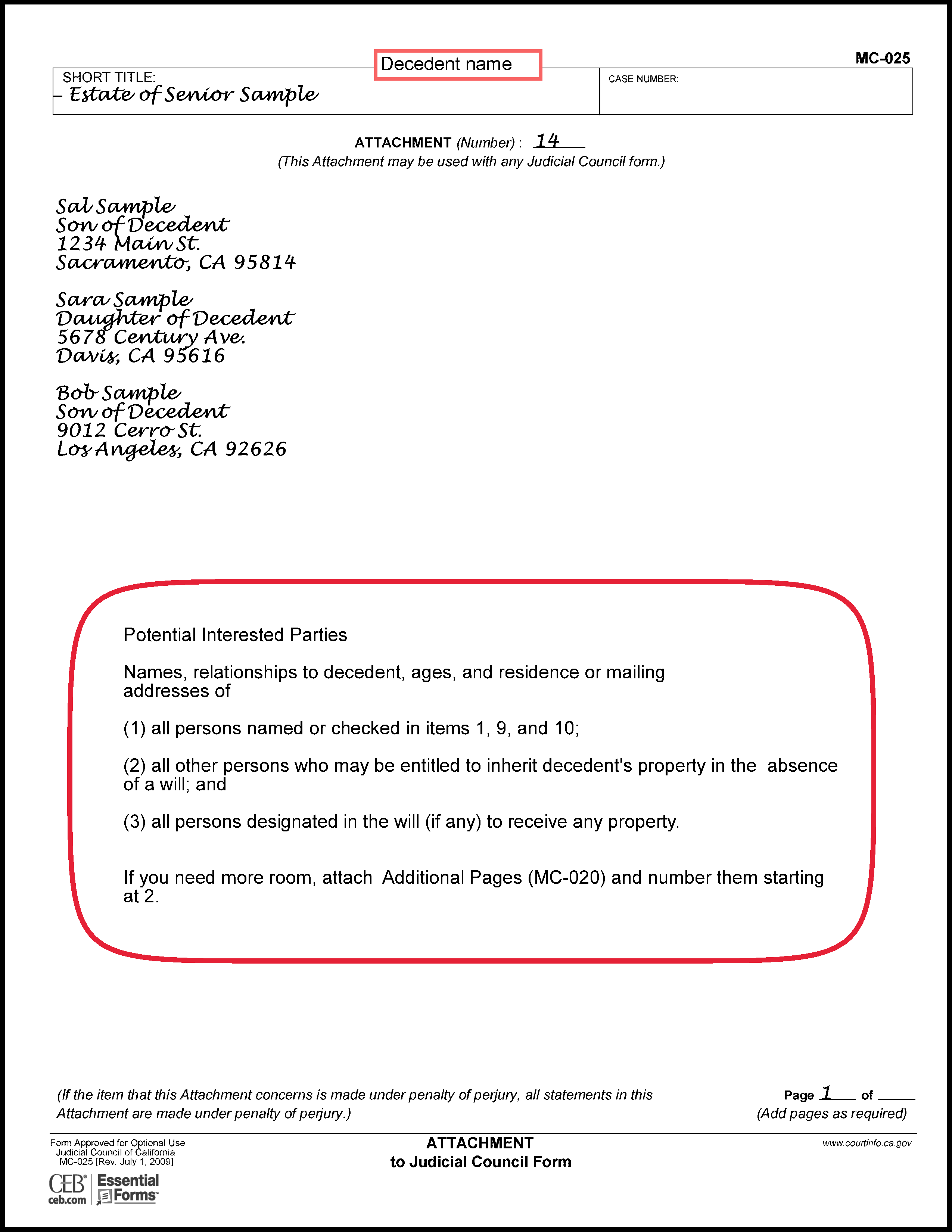

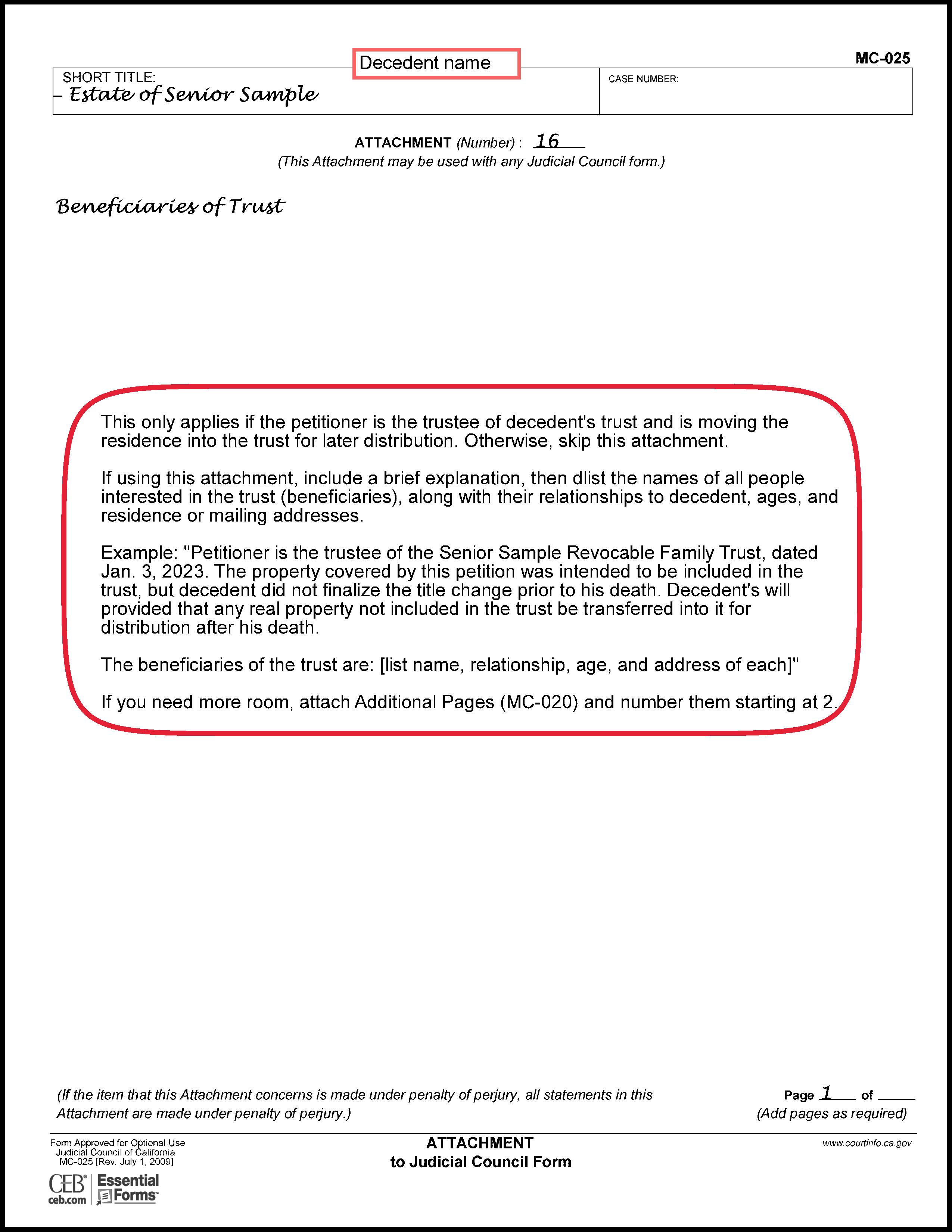

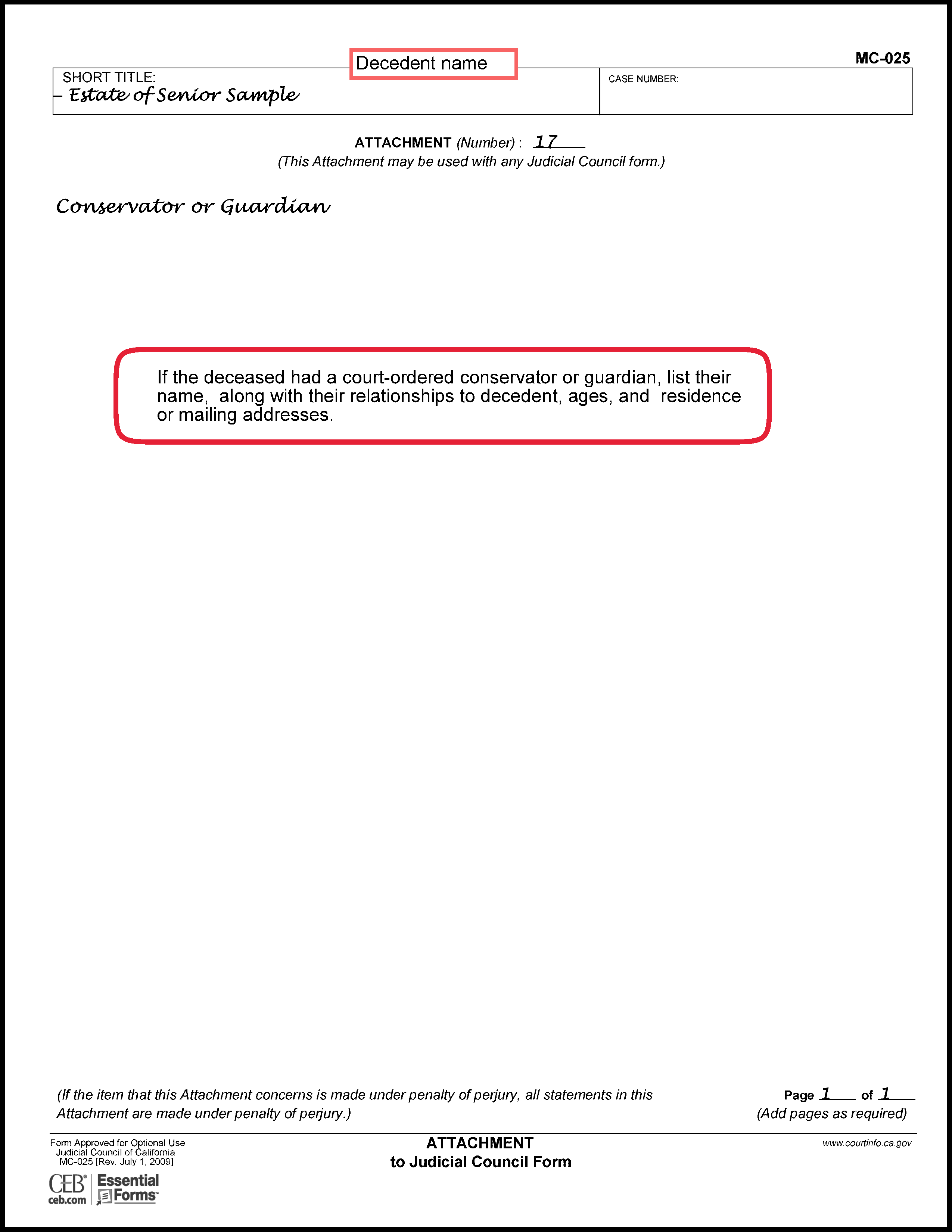

- Attachments 14–17: Names, relationships, ages, and addresses of:

- Anyone else with a potential claim to inherit (14), if any

- Executors named in the will (15), if any

- People named in a trust (16), if any

- Conservators or guardians (17), if any.

For the Order (DE-315):

- Fill in as much as you can so the judge can review and sign it.

- If you run out of space on questions 8a or 8b, use form MC-025 for extra pages.

- Most people can skip question 10 unless they need a specific extra order.

File everything at the correct courthouse and pay the fee (or submit a Fee Waiver form).

In Sacramento, go to Ridgeway Family Courthouse, 3341 Power Inn Road, Sacramento CA 95826, or file online.

7

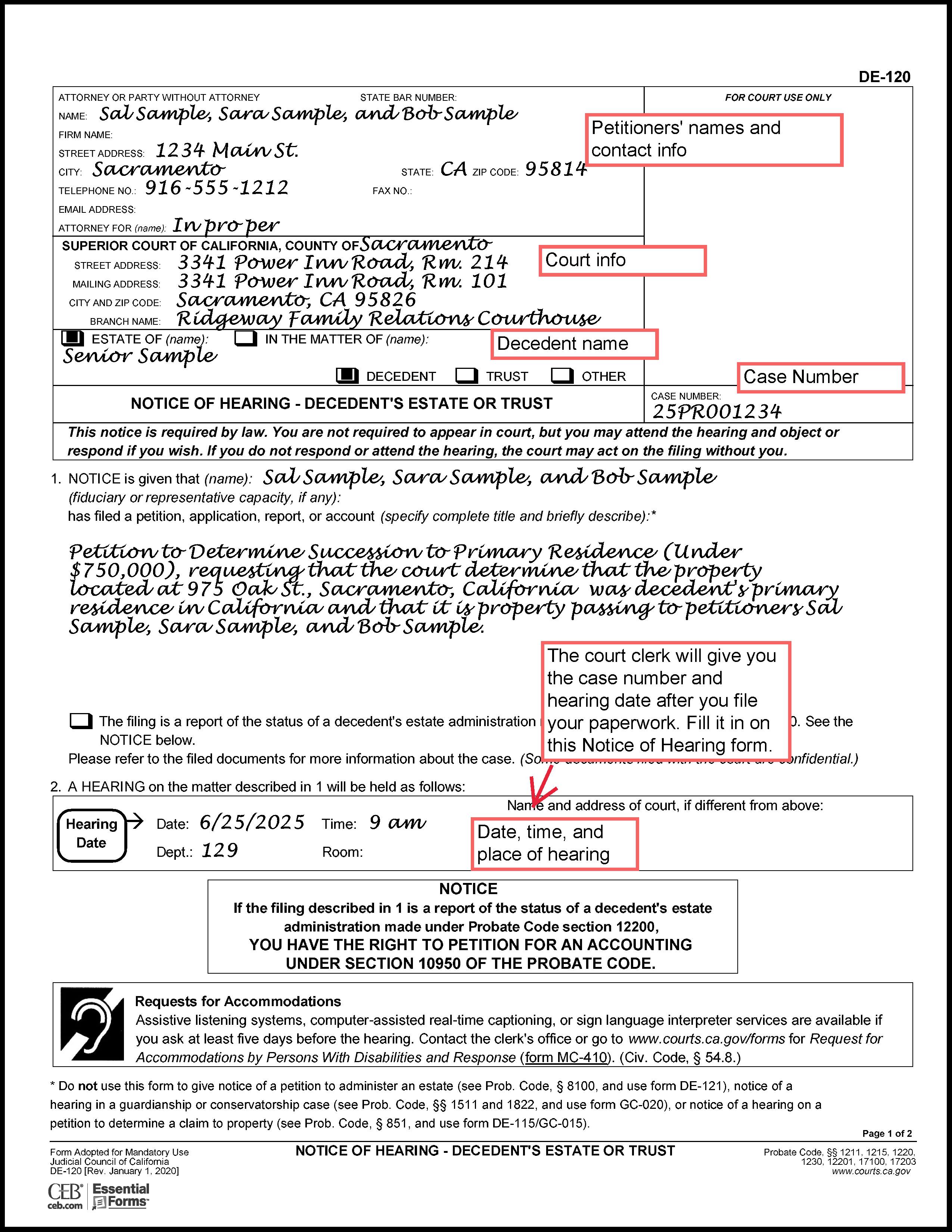

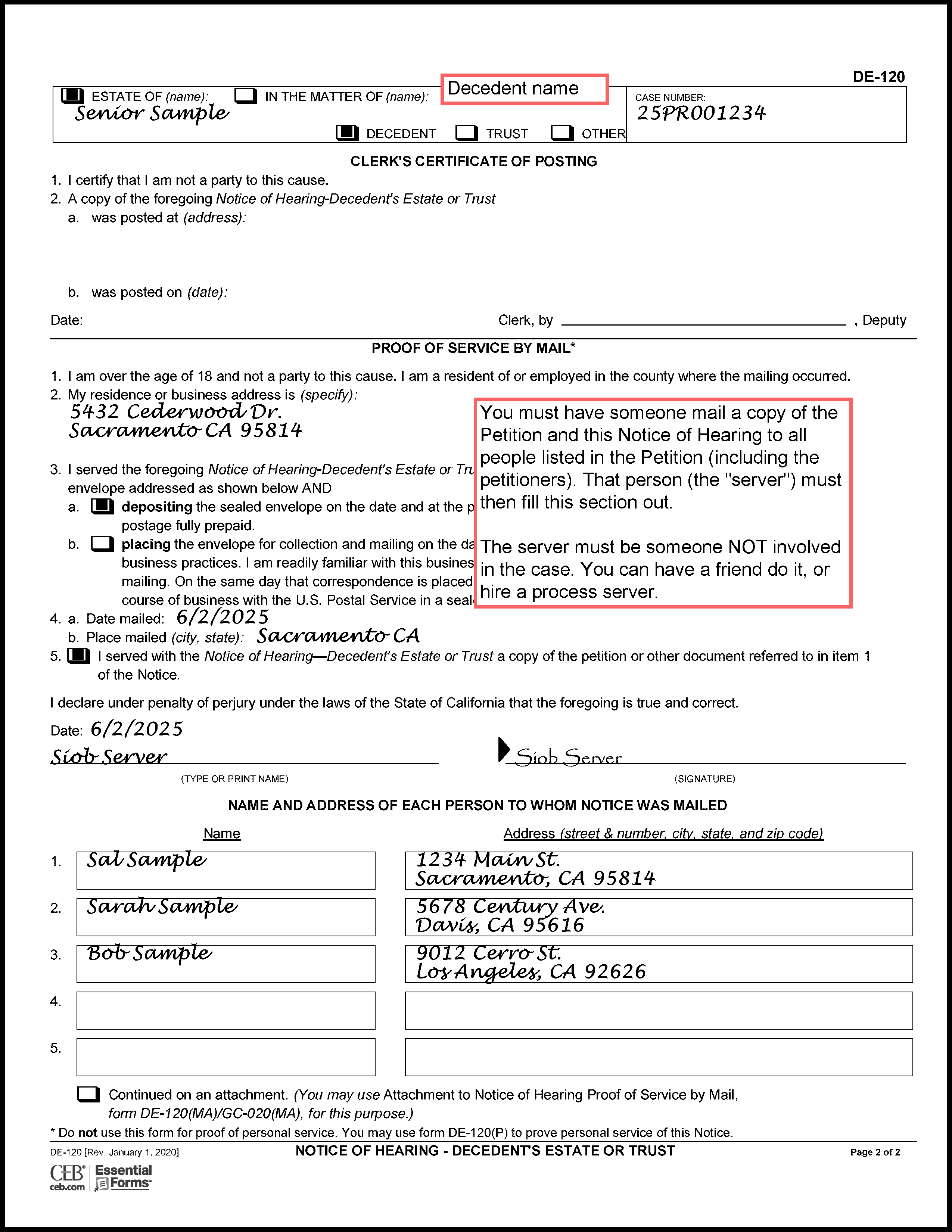

Serve Copies of the Petition and Notice of Hearing (DE-120)

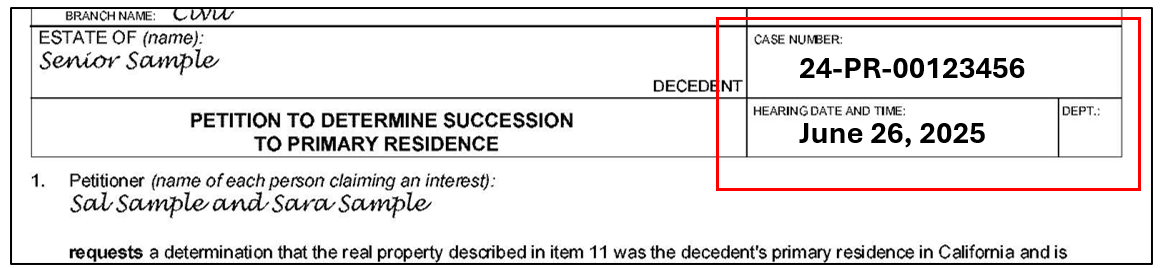

When you file, the court will give you a hearing date. Write it on the first page of your Petition, or make copies of the one the court clerk stamps.

Fill out a Notice of Hearing (DE-120), leaving the “Proof of Service” portion blank.

Within 5 court days of filing (and at least 15 days before the hearing), have someone else (not you or a family member) either mail or personally deliver a copy of the Petition and all attachments and Notice of Hearing to each person listed in Attachments 14, 15, 16, and 17.

The person who mails or delivers the papers is called the server.

If they serve the papers by mail, they must fill out and sign the Proof of Service portion on page 2 of the Notice of Hearing. If there is not enough room to list all of the people who are served by mail, attach Attachment to Notice of Hearing Proof of Service by Mail (DE-120(MA)).

If the server served any of the people by personal delivery, the server must fill out Proof of Personal Service of Notice of Hearing (DE-120(P)) for those people. If there is not enough room to list all of the people who are personally served, attach Attachment to Notice of Hearing Proof of Personal Service (DE-120(PA)).

8

Check for Probate Calendar Notes

About two weeks before your hearing, check the court’s website for probate calendar notes. These are messages from the court telling you if anything is missing or needs to be fixed in your paperwork. You must follow certain steps to respond to these probate notes.

In Sacramento, there’s a special form for responding to these notes — Response to Calendar Notes (PR-E-LP-022). In other counties, check with the probate clerk to find out the required format.

9

Preparing for and Attending the Hearing

After completing and filing any probate notes, call the court clerk to ask if you need to attend the hearing. If everything looks good and no one objects, you might not have to go. Also ask how to get a copy of the signed court order.

If you do need to attend, many counties (including Sacramento) let you join by video or phone. Call ahead or check the court’s website to learn how to join remotely and whether you need advance permission. In Sacramento, you must file and serve Notice of Remote Appearance (RA-010) as early as possible if you wish to appear remotely. The Sacramento court’s remote appearance instructions are posted on its website, saccourt.ca.gov.

10

Record the Court Order

Once the judge signs your Order Determining Succession to Primary Residence (DE-315):

- Ask for a certified copy.

- Record it at the County Recorder’s Office where the property is located.

- Also submit a Preliminary Change of Ownership Report (PCOR) (Form BOE-502 A).

This step officially updates the public record. You’re done!

11

(Optional) Record a New Deed

You can also file a new deed (usually a grant deed) to show the names of the new owners. This helps if the property is sold later or if the new owners want to clarify how they hold title (for example, joint tenants or tenants in common).

- Joint tenants: if one owner dies, the other gets the full property.

- Tenants in common: each owner’s share goes to their heirs.

If you don’t choose, the default is tenants in common.

For More Information

The law library has several books on probate that will cover this procedure, but most have not yet been updated to explain this new procedure.

The Kern County Law Library has published a how-to video on this process, which you can watch for free:

The video covers a number of Summary Procedures. The portion on Petition to Determine Succession to Primary Residence begins at 47:17.

Samples and Instructions

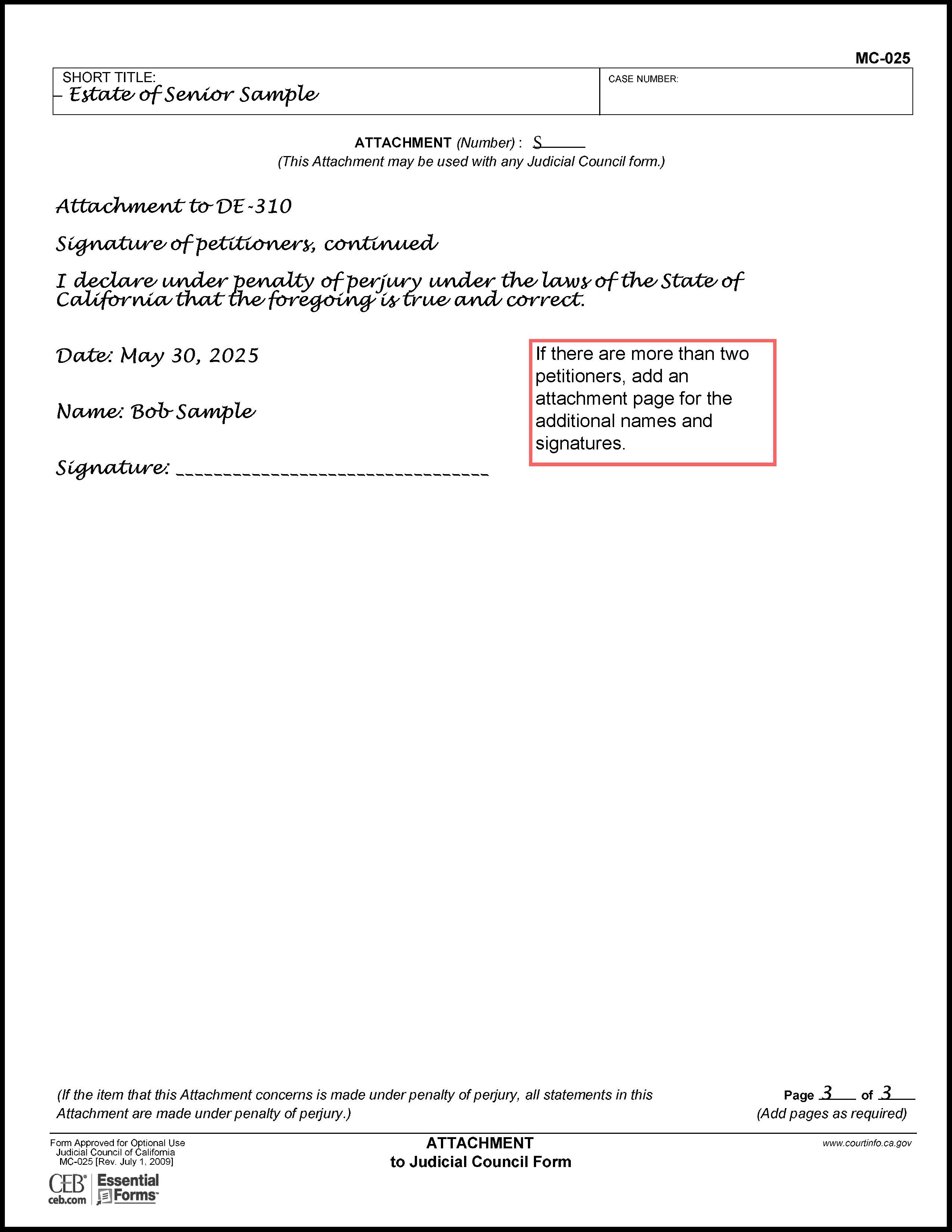

Petition to Determine Succession to Primary Residence (DE-310)

Order Determining Succession to Primary Residence (DE-315)

Notice of Hearing (DE-120)

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.