Homestead Declaration: Protecting the Equity in Your Home

Under California law, a homeowner is entitled to the protection of a certain amount of equity in the home that is his or her principal residence (home). The protected amount is called the “homestead exemption.”

Related Guide:

Exemption from the Enforcement of Judgment

All homeowners automatically have a homeowner’s exemption, which protects part of their equity from involuntary sales (foreclosures). Recording a declaration of ownership extends this protection to voluntary sales.

Templates and Forms

- Homestead Declaration – PDF

- Homestead Declaration – Spouses as Declared Owners – PDF

- Abandonment of Homestead – PDF

The protected amount was recently significantly increased to $300,000 or the countywide median sales price for a single-family home, up to $600,000, whichever is greater.

The homestead exemption does not prohibit the sale of the property. The property can be sold if the sale would produce enough money to:

- Pay all existing liens that are secured by the property

- Pay off all mortgages and loans secured by the equity in the home

- Pay the costs of selling the home

- Allow the homeowner to keep equity in the amount protected by the homestead exemption

In addition to this protection, a homeowner’s primary place of residence is exempt from foreclosure for judgments on consumer debt, unless the home was put up for collateral for that loan. CCP § 669.730.

Rather than prohibiting the sale, the homestead exemption merely ensures that the homeowner receives the amount of the exemption before the creditors are paid from the sale proceeds. The exempt funds received from the voluntary sale of the property remain exempt from debt collection attempts for six months, and can be used to purchase another residence.

The homestead exemption does not apply in the following situations:

- Judgments obtained prior to the recording of the homestead declaration

- Debts secured by encumbrances on the premises executed by the owner before the declaration was recorded

- Obligations secured by mechanics’ liens on the premises

- Voluntary encumbrances on the premises, such as mortgages or deeds of trust

- Judgments for child, family, or spousal support

Homestead Exemption Types

There are two types of Homestead Exemptions:

Automatic: applies only upon forced sale of the property. The automatic exemption requires continuous residence from the date the judgment creditor’s lien attaches until the date the court determines that the dwelling is a homestead. If a creditor attempts to sell the home, the burden of proof is on the homeowner to prove to the court that an automatic homestead exemption exists.

Declared: applies both to forced and voluntary sales of the property. Exempt proceeds from a voluntary sale are protected if another home is purchased within 6 months. Homeowners must reside in the dwelling on the date the homestead declaration is recorded. If a creditor attempts to sell your home, the burden of proof is on the creditor to prove to the court that your homestead declaration is invalid.

Requirements

The homestead exemption applies only when certain requirements are met. These requirements, described in California Code of Civil Procedure (CCP) Section 704.710, are:

- The residence must be the principal dwelling of the judgment debtor or his or her spouse.

- The judgment debtor, or their spouse, must reside at the dwelling on the date the judgment creditor’s lien attached.

- The judgment debtor and/or their spouse must reside continuously thereafter until the date of the court determination that the dwelling is a homestead.

Eligible Properties

Homestead exemptions are available for a variety of dwelling types. “Dwelling” means a place where a person resides and may include, but is not limited to, the following:

- A house or mobile home, together with the outbuildings and the land upon which they are situated.

- A boat or other waterborne vessel.

- A condominium, as defined in Section 783 of the Civil Code.

- A planned development, as defined in Section 11003 of the Business and Professions Code.

- A stock cooperative, as defined in Section 11003.2 of the Business and Professions Code.

- A community apartment project, as defined in Section 11004 of the Business and Professions Code.

Amount of Exemption

Under CCP Sections 704.720 – 704.730, the amount of the homestead exemption is the greater of the following:

- The countywide median sale price for a single-family home in the calendar year prior to the calendar year in which the judgment debtor claims the exemption, not to exceed six hundred thousand dollars ($600,000).

- Three hundred thousand dollars ($300,000).

These amounts adjust annually for inflation.

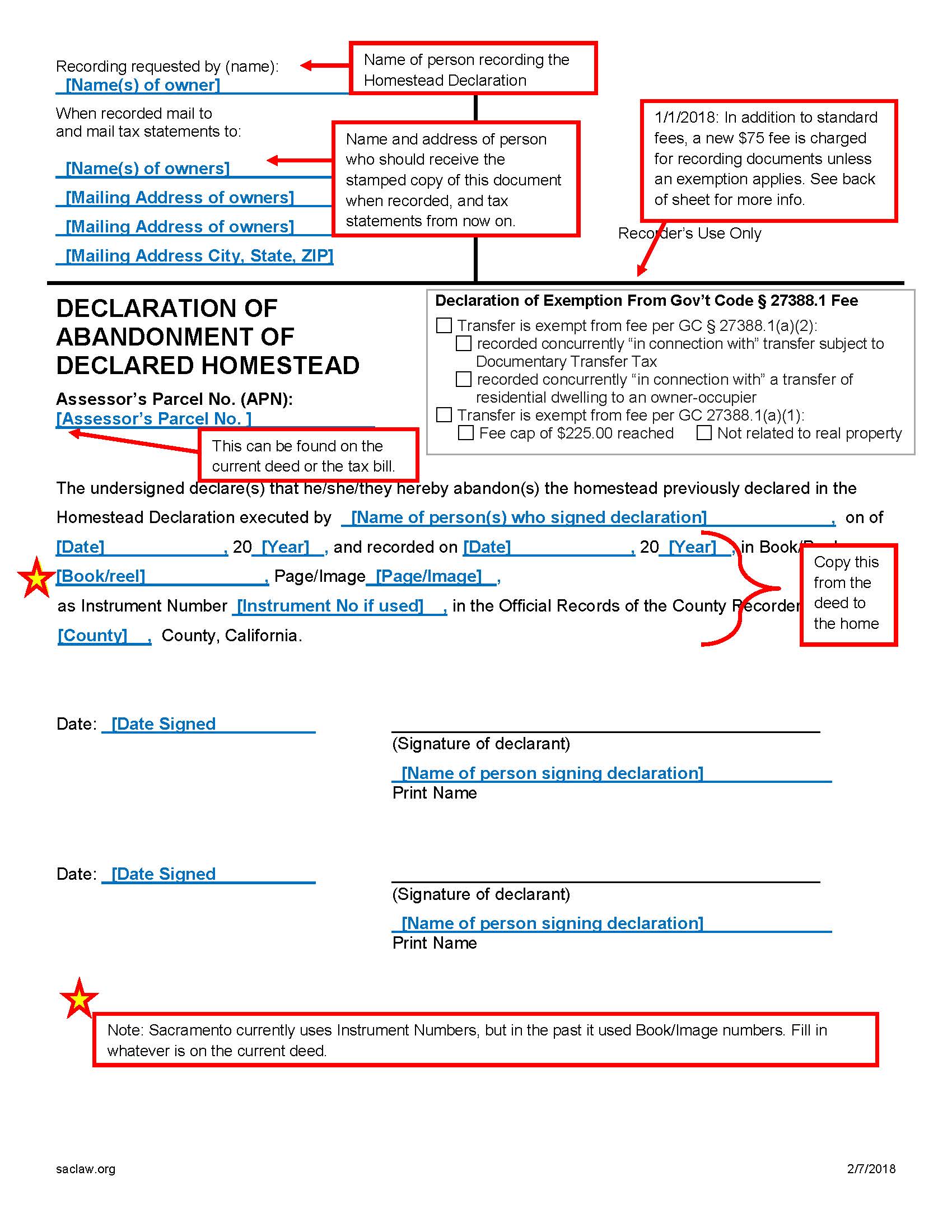

Abandonment of Homestead

By operation of law: If a homestead declaration is executed or recorded on a different property, the first declared homestead is abandoned. Additionally, abandonment is implied when the debtor establishes another dwelling as his or her personal residence, even when there is no declaration of homestead made. A party may not have two homesteads simultaneously.

By declaration: A property owner can record a Declaration of Abandonment of Declared Homestead.

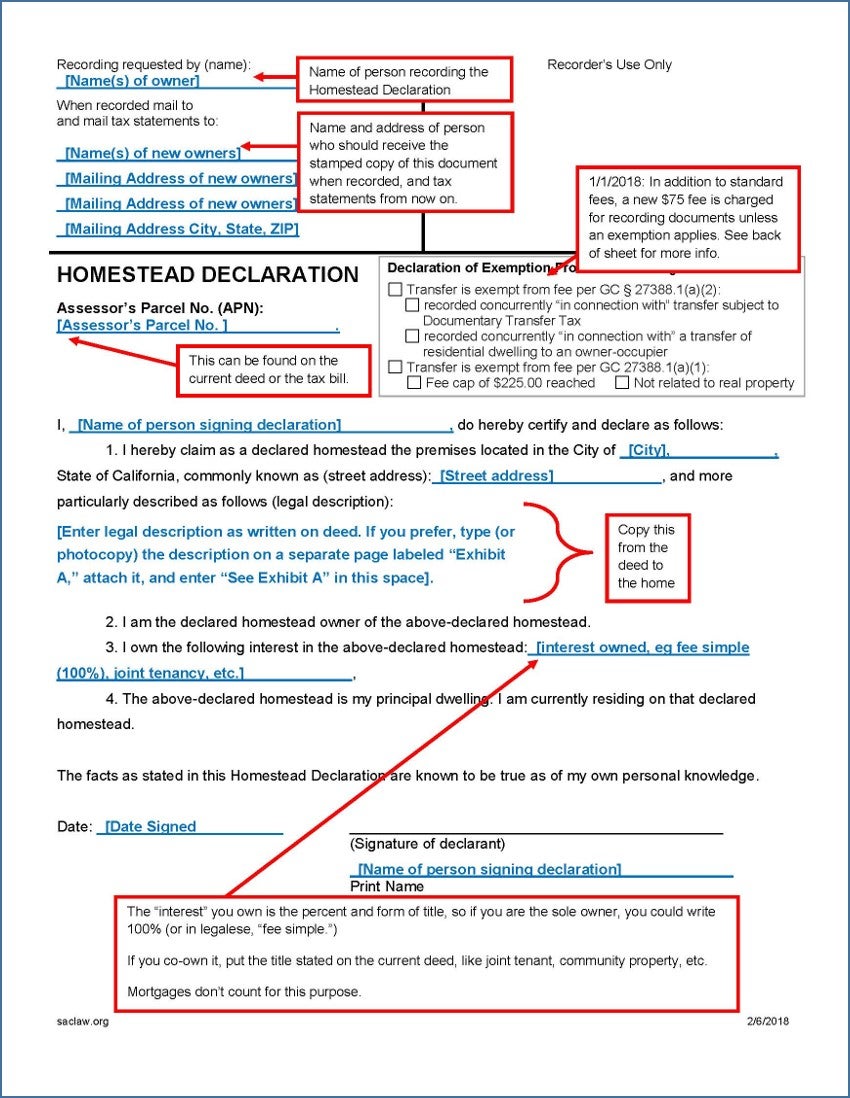

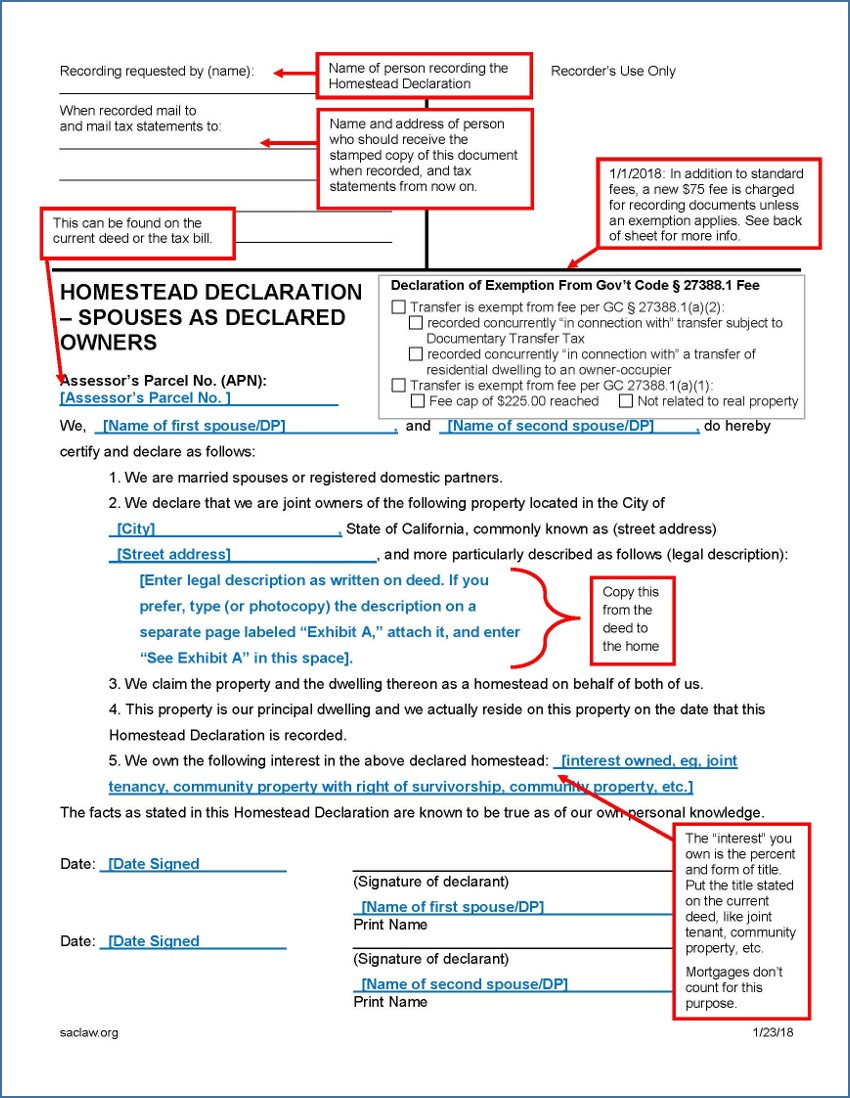

Step 1: Complete the Required Forms

Evaluate if you qualify for a Homestead Exemption. Determine if you are filing as an individual or as spouses. Homestead documents must be in a format that the Sacramento County Clerk/Recorder’s Office will accept. Customizable templates may be downloaded from these links:

Sample filled-in forms with instructions are available at the end of this Guide.

Step 2: Notarize

The Homestead Declaration must be notarized and then filed in the Recorder’s Office of the county in which the property is located.

Step 3: Record the Homestead Declaration at the Recorders Office

The Recorder’s Office charges a recording fee (currently $20/first page plus $3 for additional pages). Current Sacramento County fees are available on the County Clerk/Recorder’s website. The document will be recorded the same day it is received at the Recorder’s Office.

Building Homes and Jobs Act Fee (SB 2)

There is an additional $75 fee on mortgage refinances and other real estate transactions that are exempt from Documentary Transfer Tax, including Homestead Declarations. Some exceptions apply. Contact your county recorder’s office to determine the total amount you will need to pay.

For More Information

Sacramento County Recorders Office

3636 American River Drive, Ste. 110

Sacramento, CA 95864

916-874-6334

At the Law Library

California Jurisprudence KFC 80 .C35 (Ready Reference)

Vol. 37, Homesteads.

California Real Estate, Law and Practice KFC 140 .B45

Vol. 10, Ch. 344.

Electronic Access: On the Law Library’s computers, using LexisAdvance.

Miller and Star California Real Estate KFC 140 .M51

Vol. 12, Ch. 43.

California Legal Forms, Transaction Guide KFC 68 .C32 (Ready Reference)

Vol. 12, Ch. 27B.

Electronic Access: On the Law Library’s computers, using LexisAdvance.

California Forms of Pleading & Practice KFC 1010 .A65 C3 (Ready Reference)

Vol. 25, Ch. 294

Electronic Access: On the Law Library’s computers, using LexisAdvance.

Samples

These declarations must be notarized. The downloadable forms include a notary page.

Homestead Declaration

Homestead Declaration – Spouses as Owners

Declaration of Abandonment of Homestead

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.