Memorandum of Costs after Judgment

When you win a lawsuit, you can collect the total amount of the judgment entered by the court, plus any costs incurred after judgment and accrued interest on the total amount.

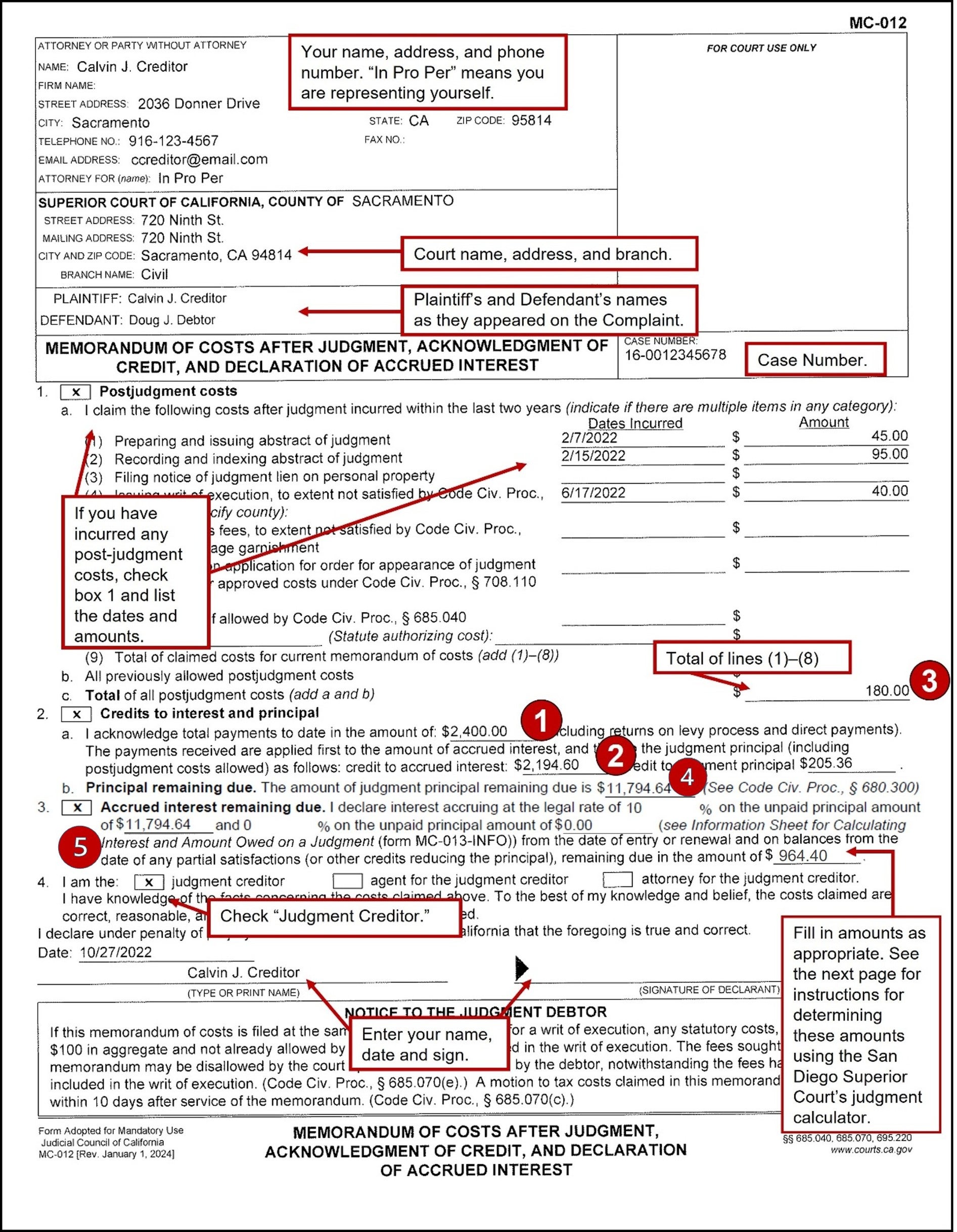

To have costs and interest added to the amount owed, you must file and serve a Memorandum of Costs After Judgment (MC-012). On this form, you must include the exact amount of all allowable costs, the payments credited toward the principal and interest, and the amount of accrued interest.

Templates and Forms

Costs

Under California Code of Civil Procedure (CCP) § 685.040, a judgment creditor is entitled to reimbursement for the “reasonable and necessary” costs of enforcing a judgment. The law provides a detailed list of the types of costs that can be recovered, including the costs of issuing the writ of execution; levying officers’ fees for processing writs or levies; debtor’s examination fees; and fees for preparing, issuing and recording an abstract of judgment or notice of lien (CCP § 685.050 et seq).

Attorneys’ fees related to the enforcement of a judgment are generally not reimbursable, unless specifically allowed by law, or the underlying judgment includes an award of attorney’s fees (CCP § 685.040). The law does not provide for reimbursement of costs such as postage or photocopying, nor can the judgment creditor be compensated for their time or mileage related to enforcement efforts. Once approved by the court, costs become part of the judgment (CCP § 685.090). To be reimbursable, costs must be reported to the court within two years of being incurred (CCP § 685.070(b)). For this reason, many judgment creditors regularly file a Memorandum of Costs After Judgment (MC-012) with the court.

Interest

Unpaid judgment amounts accrue interest at the legal rate of 10% per year (CCP § 685.010; 7% if the judgment debtor is a state or local government entity, California Constitution, Article XV, §1). Costs approved by the court are included as part of the judgment amount, and thus accrue interest.

Additionally, upon renewal of a judgment, the unpaid judgment amount and accrued interest are calculated to determine the renewed judgment amount. For this reason, many judgment creditors will renew a judgment as soon and as frequently as possible, i.e., every five years. For more information, see the Step-by-Step guide on Renewal of Judgments. Interest begins to accrue on the day the judgment is entered. CCP § 685.020(a). If the judgment is payable in installments, interest accrues from the date each installment is due.

Crediting payments

Payments received by the judgment creditor must be credited in the specific order detailed in CCP § 695.220. Payments are credited first toward costs incurred by the levying officer under CCP § 685.050(b) (e.g., the fees associated with processing a writ of execution). After that, payments are credited toward fees due to the court under California Government Code (Govt Code) § 6103.5 (court fees waived because a party was a government entity) or Govt Code § 68637 (waived filing fees). Payments are then credited toward accrued interest, and lastly toward the principal judgment amount.

Step-by-Step Instructions

1

Calculate Your Costs and Interest

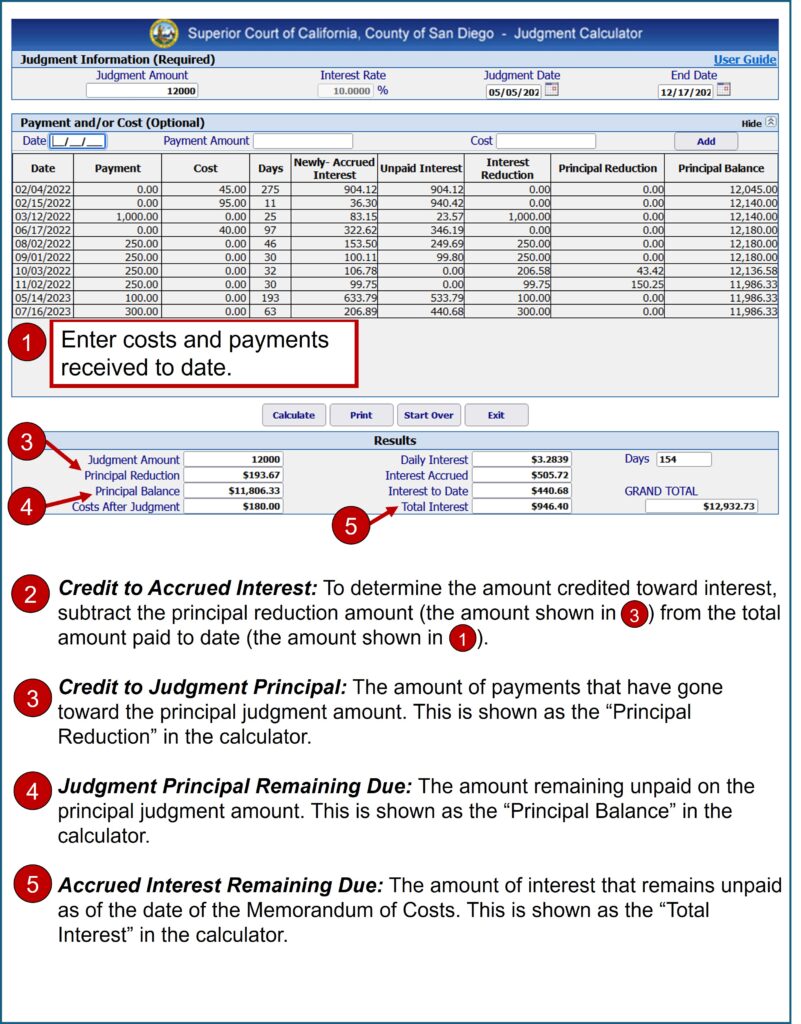

On your Memorandum of Costs After Judgment (MC-012), you must include the exact amount of all allowable costs, the payments credited toward the principal and interest, and the amount of accrued interest. This means you are responsible for calculating these amounts.

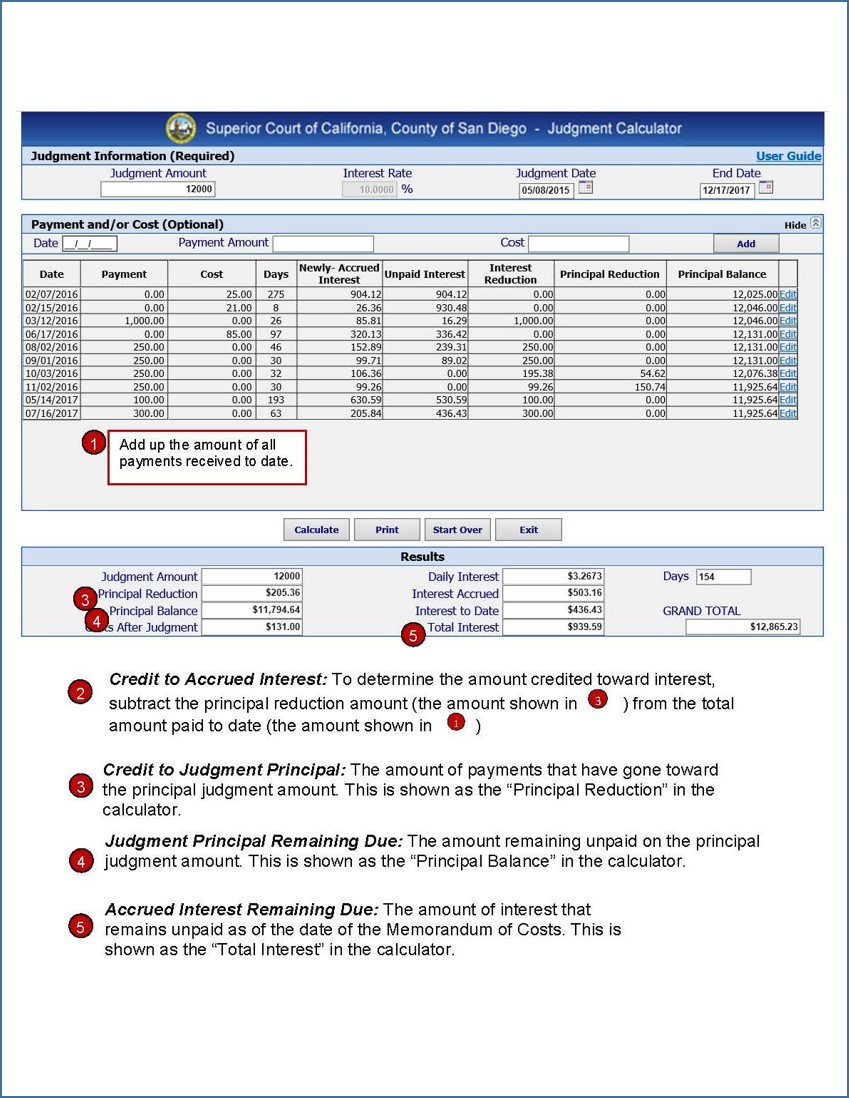

The California Courts’ Information Sheet for Calculating Interest and Amount Owed on a Judgment (MC-013-INFO) provides detailed instructions for making these calculations by hand. However, it is much easier to use the San Diego Superior Court’s free online calculator that will calculate the amount due on a specific day. All you do is input the judgment amount, date, and payment history, and the program does all the calculations for you. (Note: this calculator is set to 10%, which does not apply to some consumer debts.)

2

Complete and Copy Your Form

The Judicial Council form used in this procedure is:

A sample completed form with instructions is included at the end of this Guide.

Make one (1) photocopy of the completed form.

3

Serve Your Memorandum of Costs After Judgment

Have the photocopy of your Memorandum of Costs After Judgment (MC-012) served on the judgment debtor, either personally or by mail. Service must be made by someone over 18 who is not a party to your case. After service, your server must complete the proof of service on the second page of the Memorandum of Costs After Judgment (MC-012).

4

Make Photocopies

Make two (2) photocopies of the Memorandum of Costs After Judgment (MC-012) with the signed proof of service.

5

File Your Documents

File the original and two photocopies of your Memorandum of Costs After Judgment (MC-012). In Sacramento County, these will be filed in the drop box in room 102 of the Gordon D. Schaber Courthouse at 720 Ninth Street in downtown Sacramento. Provide the court with a self-addressed stamped envelope so they can return of your documents to you. The court will process the paperwork, and return the two photocopies, stamped “Endorsed/Filed,” to you. The court will retain the original papers for its file.

The Memorandum of Costs After Judgment (MC-012) may be filed as a stand-alone document, or along with another document such as a Writ of Execution (EJ-130) or an Application for and Renewal of Judgment (EJ-190). If filed with another document, the other document can be issued immediately if your claimed costs are less than $100. If your costs are more than $100, the clerk will wait 10 days (15 days, if served by mail) to issue your document, to allow the judgment debtor to oppose your costs by filing a Motion to Tax Costs (CCP § 685.070). If the debtor does not contest it, your Memorandum of Costs After Judgment (MC-012) is automatically approved.

6

Oppose the Debtor’s Motion to Tax Costs, if Filed

If the debtor files a Motion to Tax Costs, you will be served with a copy of the motion. If you choose to oppose the motion, you must act quickly. Your response must be filed and served at least nine court days before the scheduled hearing date. For more information on opposing a Motion to Tax Costs, see California Points and Authorities (KFC 1010 .B4 (Ready Reference)), Chapter 60, also available electronically on the Law Library’s computers, using Lexis Advance.

For Help

SH@LL (Self-Help at the Law Library)

609 9th Street, Sacramento CA 95814

(916) 476-2731 (Appointment Request Line)

Services Provided: SH@LL provides general information and basic assistance to self-represented litigants on a variety of legal issues. All assistance is provided by telephone. Visit “What we can help with” for a list of qualifying cases.

Eligibility: Must be a Sacramento County resident or have a qualifying case in the Sacramento County Superior Court.

For More Information

Online

California Courts Self-Help Website: “Add Costs and Interest to What’s Owed”

At the Law Library

California Forms of Pleading and Practice KFC 1010 .A65 C3 (Ready Reference) Chap. 174

Electronic Access: On the Law Library’s computers, using Lexis Advance.

California Practice Guide: Enforcing Judgments and Debts KFC 1065 .A9 S3 Chap. 6

How to Collect When You Win a Lawsuit KFC 1065 .Z9 H69 (Reference) Chap.16

Samples

Memorandum of Costs after Judgment (MC-012)

San Diego Superior Court Judgment Calculator

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.