Claim of Exemption – Bank Levy

If you receive notice from your bank that funds have been withdrawn due to a court judgment (“levied”), and you want to object, act fast. You have 15 days (20 days, if you were served by mail) to file a Claim of Exemption. Here’s how.

Templates and Forms

Creditors commonly collect on court judgments by levying, or seizing, funds from a debtor’s bank or credit union accounts. To levy an account, the creditor must have a valid court judgment against you. The creditor must then ask the court for a Writ of Execution, which is an order directing the Sheriff to enforce the judgment, and hire the sheriff or a process server to serve your bank or credit union. The bank provide you with a Notice of Levy (EJ-150) to let you know. The bank or sheriff will hold the seized funds for up to 20 days, allowing you the opportunity to seek to stop or reduce the levy by filing a Claim of Exemption (EJ-160).

NOTE: If the judgment was obtained by default, you may be able to ask the court to set aside the judgment, and allow you to present a defense to the claim. This is a separate process and will not stop the levy! For more information, see the Step-by-Step guide on Relief from Default Judgments on our website.

Upon receiving the order to levy, the bank will typically freeze the funds in the affected account(s) (up to the amount of levy), or will give those funds to the sheriff. Only funds in the account at the time of the levy will be frozen or seized. (For this reason, creditors often levy accounts after the first of the month when most people have just received paychecks.) You will receive a Notice of Levy (EJ-150) along with other documents to alert you to the levy.

IMPORTANT: Remember, once you receive these documents you have 15 days (20 days, if you were served by mail) to file your Claim of Exemption (EJ-160), Financial Statement (WG-007/EJ-165) and Declaration (MC-030) with the sheriff’s department listed on the Notice of Levy (EJ-150). If you mail it by a service that gives you a tracking number, such as USPS Priority Mail, the postmark date counts as the date of “filing.” Otherwise, the date the Sheriff receives it is the date of filing.

There are a number of exemptions for different types of income which may apply to lessen or halt the bank levy. Important ones include Social Security payments, pension and government benefits. In addition, if you can show that the money in the account is needed for the basic necessities of life, it will be exempt.

One of the documents that you should receive with your Notice of Levy (EJ-150) is Exemptions from the Enforcement of Judgments (EJ-155). This form lists the various asset types that may be exempt from collection. An adaptation of this document, with hyperlinks to the applicable code sections, is available on the Law Library’s website. It is very important to read and understand the specific exemption(s) that may apply to you, because not all of these exemptions are complete (for example, employment wages are only 80% exempt), and some have limits on the amount of the exemption (for example, $8625 in a vehicle’s equity is exempt).

Automatic exemptions: Pension payments and government benefits are automatically exempt as long as they are direct-deposited into your account. Up to $4400 in Social Security funds ($6575 if two payees use the account) and up to $2175 in other benefits ($3250 for two payees using the same account) is shielded from being frozen by the bank or seized by the sheriff. These amounts are adjusted annually.

If a judgment creditor attempts to levy your bank account, you will be mailed a Notice of Levy (EJ-150), along with some other informational documents.

The court may order some or all of the funds in an account exempt if:

- The money in the account is from a source that is exempt by law. Social Security is one example, but there are many others; or

- The money in the account is required for the basic necessities of life.

Even if the court orders funds in the account exempt from collection, the judgment still exists, and will continue to accrue 10% simple interest each year (5% for judgments entered after January 1, 2023 for medical expenses or personal debt).

Effective Sept. 1, 2020: California law exempts a minimum amount in one account, regardless of its source. (Exception: if the debt is for child or spousal support (alimony), or for wages you owe someone, this exemption does not apply.) This amount changes annually on July 1. For the period of July 1, 2024 – June 30, 2025, the exempt amount is $2170. If the exemption for public benefits or pensions is larger, that exemption applies instead.

This new exemption is limited to one (1) bank account per debtor. If you have more than one account, and want to specify which account is protected by the automatic exemption, you may file an application with the court, using the forms Ex Parte Application for Order on Deposit Account Exemption (EJ-157), Declaration Regarding Notice and Service for Ex Parte Application for Order on Deposit Account Exemption (EJ-158), and Order on Application for Designation of Deposit Account Exemption (EJ-159).

If you do not specify, the bank will decide which account is exempt.

Before filling out the forms, gather the following information:

Notice of Levy

Have a copy of the Notice of Levy handy so you have all the info about the case and the levying account.

Three months of bank statements

You will need to submit proof of the sources of the money in your bank account and your monthly expenses.

At least one month of pay stubs

If your income varies from month to month, more pay stubs will be required. You will need these to list your income, deductions for taxes and other deductions, and total take-home pay.

List of monthly expenses

Expenses for you, your spouse, and other dependents. Expenses include rent or house payments, food, utilities, clothing, insurance, child care or school, transportation, existing debt payments, etc.

Step-by-Step Instructions

1

Complete the Necessary Forms

The forms commonly used in this procedure are:

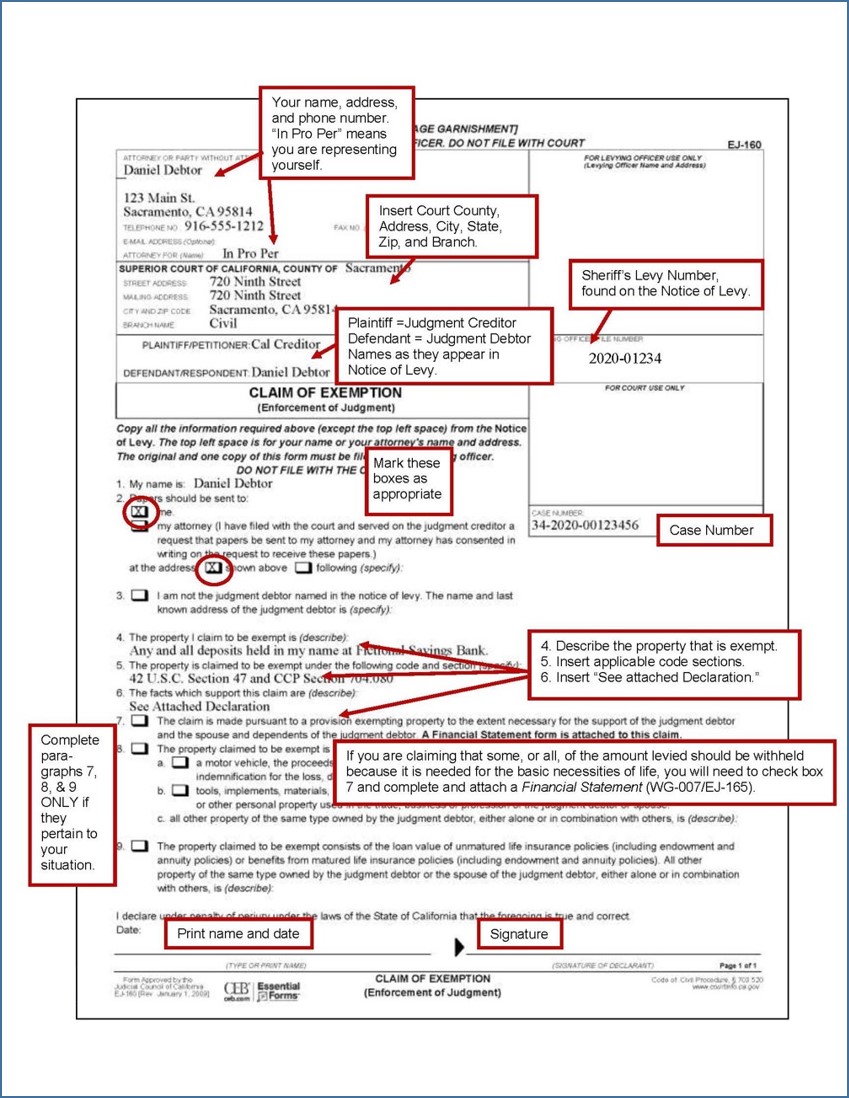

- Claim of Exemption (EJ-160)

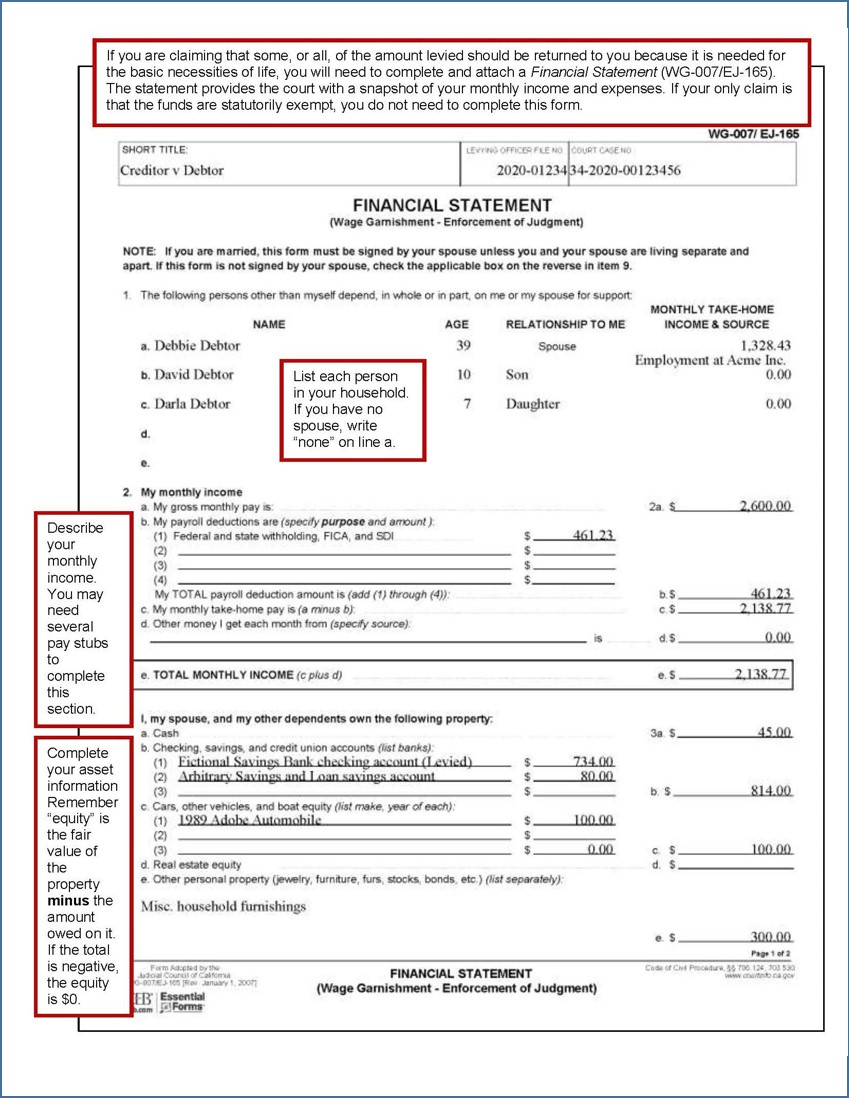

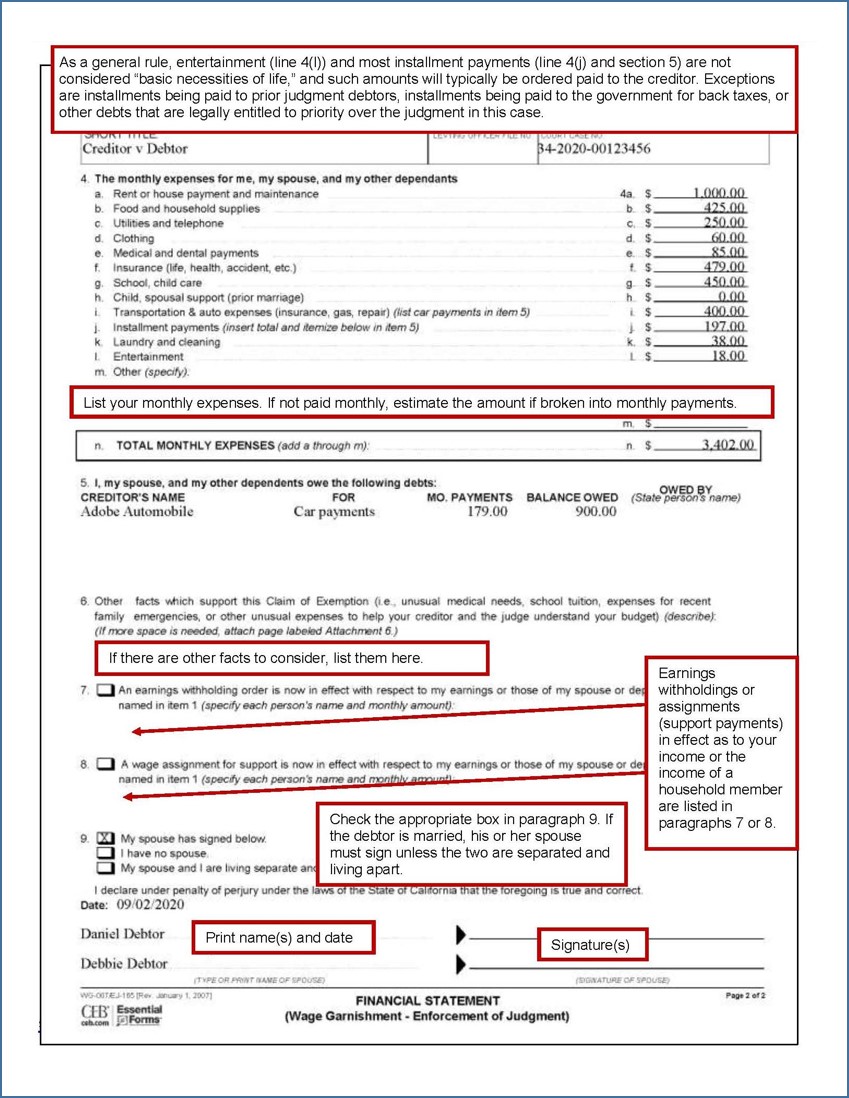

- Financial Statement (WG-007/EJ-165) (if you’re claiming the funds are necessary for the basic necessities of life)

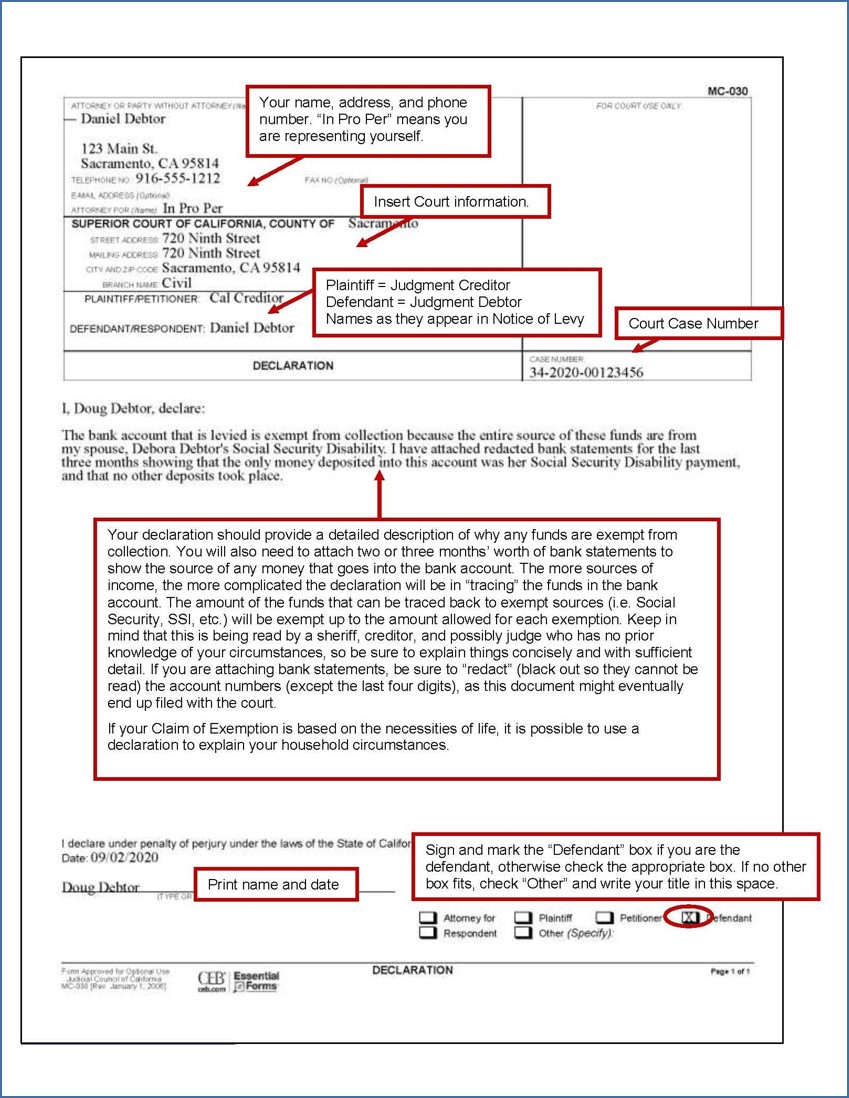

- Declaration (MC-030)

Sample completed forms with instructions are included at the end of this guide.

2

Copying and Assembling

Make two copies of each:

- Claim of Exemption (EJ-160)

- Financial Statement (WG-007/EJ-165) (if applicable)

- Declaration (MC-030)

If you are submitting a Financial Statement (WG-007/EJ-165), attach one copy to each copy of your Claim of Exemption (EJ-160).

3

Turn in Your Papers

Turn in your papers from Step 3 to the levying officer listed on the Notice of Levy (EJ-150). This is usually the sheriff’s department. Deadline: 15 days to do this (20 if you were served by mail). If you send in your forms by mail, you must send them before the last day:

- Delivered in person: must be received by close of business on or before the last day

- Mail: must be received by the sheriff by close of business on or before the last day, so mail at least a few days ahead, or use trackable mail

- Trackable mail (certified mail or a delivery service): must be postmarked on or before the last day.

The sheriff will mail one copy to the judgment creditor and keep the second. Keep the other copy you made in Step 2 for your records.

4

Creditor Can Oppose the Claim of Exemption

The levied money will be held until either: 1) 10 days go by and the creditor does not oppose your claim of exemption; or 2) the judge makes a decision on the claim of exemption. If the creditor does not oppose your claim of exemption, the garnished money will be returned to you.

If the creditor opposes your claim of exemption, you will receive a Notice of Opposition to Claim of Exemption (EJ-170) and Notice of Hearing on Claim of Exemption (EJ-175) that will set a court date for a judge to make a decision, probably within the month. You do not need to file anything; the judge will rely on your Claim of Exemption.

5

Checking the Tentative Ruling the Day Before the Hearing

In Sacramento (and most counties), the judges read the papers and decide how they are going to rule ahead of time. Then their decisions are posted on the court’s online case portal at 2 p.m. the business day before the hearing date. The parties must check the tentative ruling online or call the department to hear the decision.

If You Agree With The Tentative Ruling…

You do not need to do anything. If the other party disagrees, they must contact you and the court by 4:00 pm the same day. If the other party does not contact you by 4:00 pm, the Tentative Ruling will become the order of the Court at the hearing.

If You Disagree With The Tentative Ruling...

Call the opposing party by 4:00 p.m. and tell them that you are appearing, and that they can appear via Zoom.

Call the Law and Motion Oral Argument Request Line at (916) 874-2615 by 4:00 p.m. Leave a message with the following information: 1. Your name, and that you want to appear; the item number (to the left of your case number on the Tentative Ruling); that you have let the other parties know you are appearing, and that they can appear via Zoom.

If Neither Party Calls…

If neither you nor the opposing party requests oral argument, the court will simply make the tentative ruling the official order of the court. If you go to court anyway, you will find that the hearing is cancelled.

6

Attending the Hearing

If you or the other party request oral argument, arrive or log onto Zoom early. There will probably be other cases scheduled at the same time; there is usually a list posted on the wall outside the courtroom that lists the order in which cases will be heard. Go into the courtroom or Zoom waiting room and check in with the bailiff or clerk.

Remote (Video or Telephone) Hearings are an Option

For most types of motions, you can appear remotely by connecting on the Zoom app. The tentative ruling will explain how to connect.

When your name is called, be ready to speak and to answer any questions the judge has. You will only have a few minutes. After both sides speak, the judge may make a decision right away, or may “take it under consideration” and mail out the decision in a few days.

For help

SH@LL (Self-Help at the Law Library)

609 9th Street, Sacramento CA 95814

(916) 476-2731 (Appointment Request Line)

Services Provided: SH@LL provides general information and basic assistance to self-represented litigants on a variety of legal issues. All assistance is provided by telephone. Visit “What we can help with” for a list of qualifying cases.

Eligibility: Must be a Sacramento County resident or have a qualifying case in the Sacramento County Superior Court.

For assistance with a Claim of Exemption- Bank Levy, you must provide:

- Notice of Levy

- Three months of bank statements issued prior to and including or ending with the levy date

- At least one month of pay stubs (more if income varies monthly)

- A list, including the amounts of, your monthly expenses (e.g., rent, utilities, insurance, etc.)

Samples

.

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.