Deed of Trust and Promissory Note

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

Deed of trust is not used for transferring property to a trust

A trust deed is not used to transfer property to a living trust (use a Grant Deed for that). Other than the terminology, trust deeds and living trusts have nothing in common. A living trust is used to avoid probate, not to provide security for a loan. Visit our page on Estate Planning for more information on that topic.

Templates and Forms

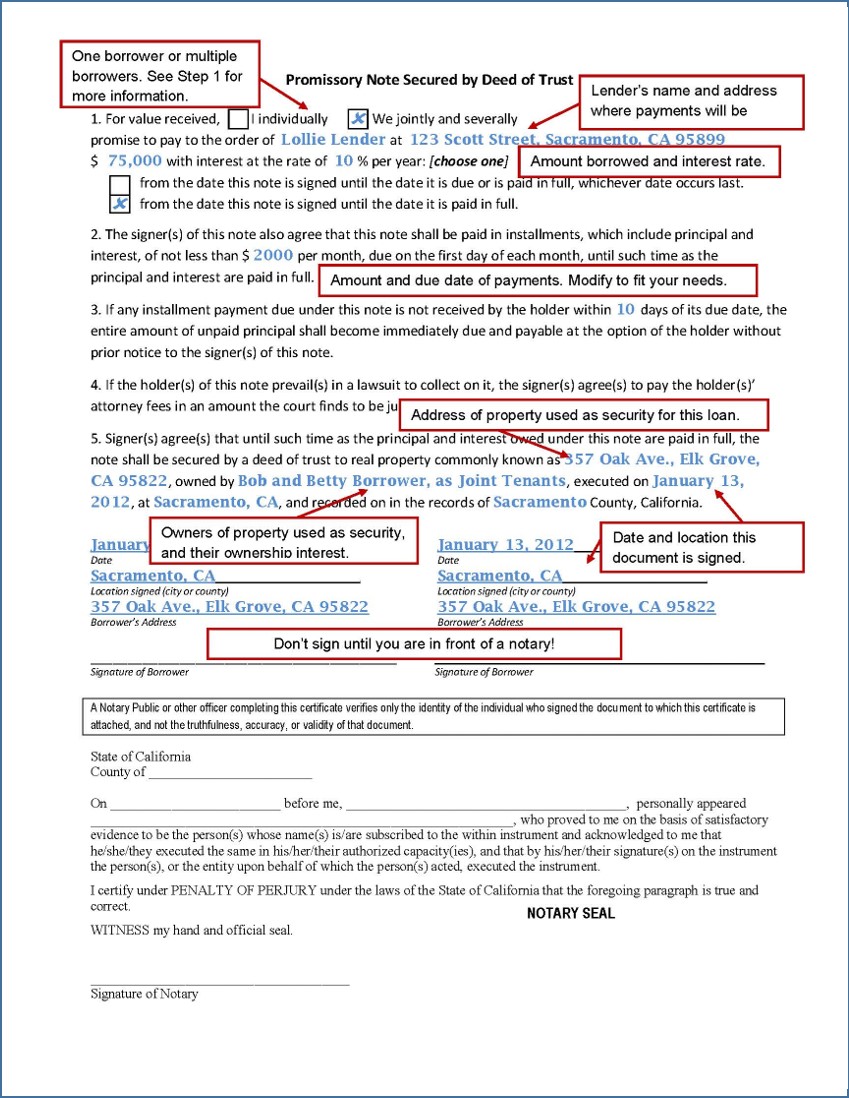

A trust deed is always used together with a promissory note (also called “prom note”) that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property. This means that the trustee has no control over the property as long as the borrower (aka property owner or “trustor”) makes the agreed-upon loan payments and keeps the other promises in the trust deed. If the borrower defaults, however, the trustee has the power to sell the property to pay off the loan without having to file an action in court. The lender (also known as “beneficiary”) is then repaid from the proceeds.

Step-by-Step Instructions

1

Determine the Parties to The Agreement

There will be three parties to these agreements. Identifying these parties ahead of time will make it easier to complete the forms.

Beneficiary

The beneficiary, more commonly known as the lender, is the person or company that lends the borrower money, and who will be entitled to be repaid from the proceeds of a foreclosure. If the lender is a corporation, be sure to include language such as “Lender is a corporation organized and existing under the laws of California” in your documents.

Borrower(s)

If there are two or more borrowers, they will be borrowing the money “jointly and severally.” This means each debtor is responsible (liable) for the entire amount of the debt. A creditor may collect from whichever debtor has the “deep pocket” (lots of money); the debtor who pays may demand contributions from the other debtors. Joint borrowers will want to carefully consider whether or not they wish to be jointly responsible with their co-borrower.

When the property used as security for the loan is owned by more than one person, you may want to consider who you will name as borrowers and owners of the property on the deed of trust. The names of all owners of the property, and their spouses, must be included to give the entire property (all owners’ interests in the property) as security. A co-owner can only give as security his or her interest in the property. In other words, a lender wants to be sure that all owners and their spouses sign the deed of trust as a condition of lending the money (unless the lender is willing to take as security one co-owner’s interest in property).

Trustee

When a bank or savings and loan finances the purchase of real estate, the trustee is almost always a title or trust company. Sometimes real estate brokers act as trustees. Attorneys commonly write in the name of a title company as trustee on a trust deed, without consulting the title company. Title companies even give out trust deed forms with their names already printed in the “trustee” space. They don’t mind being named as trustee because a trustee has nothing to do unless the borrower defaults. If that happens, most title or escrow companies turn the deed over to a professional foreclosure firm.

2

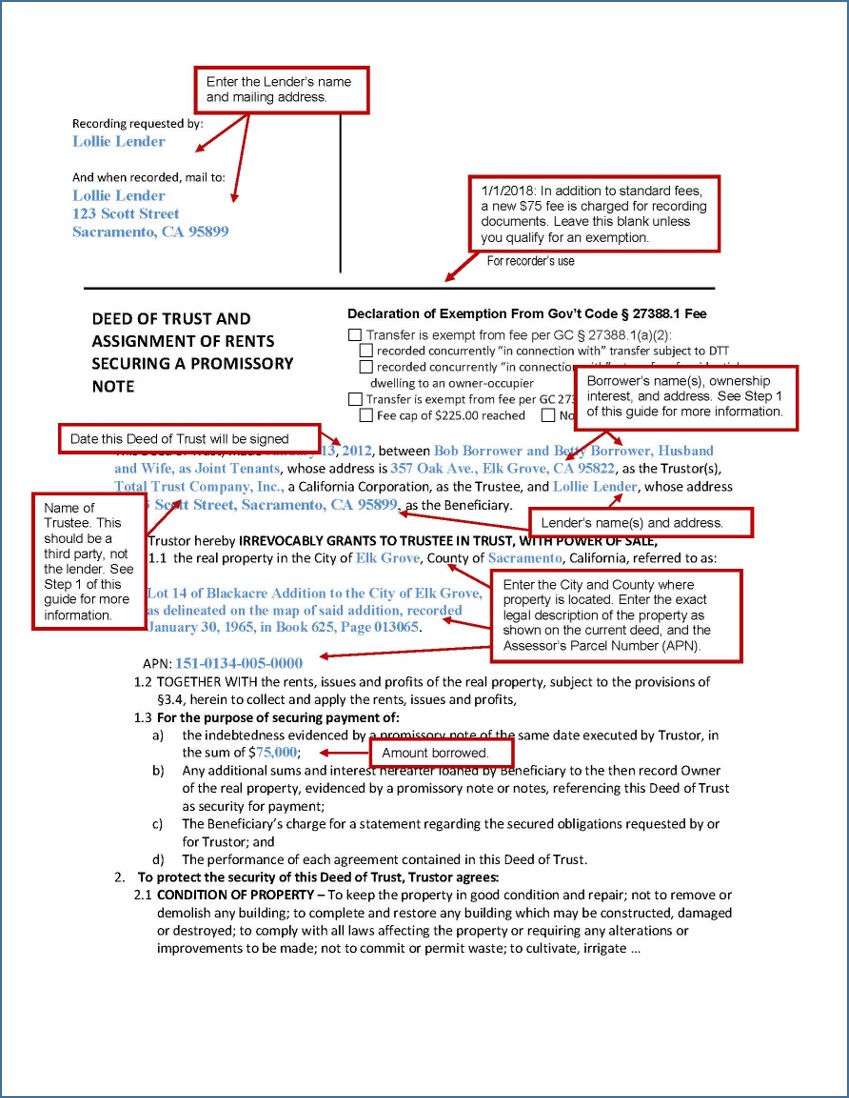

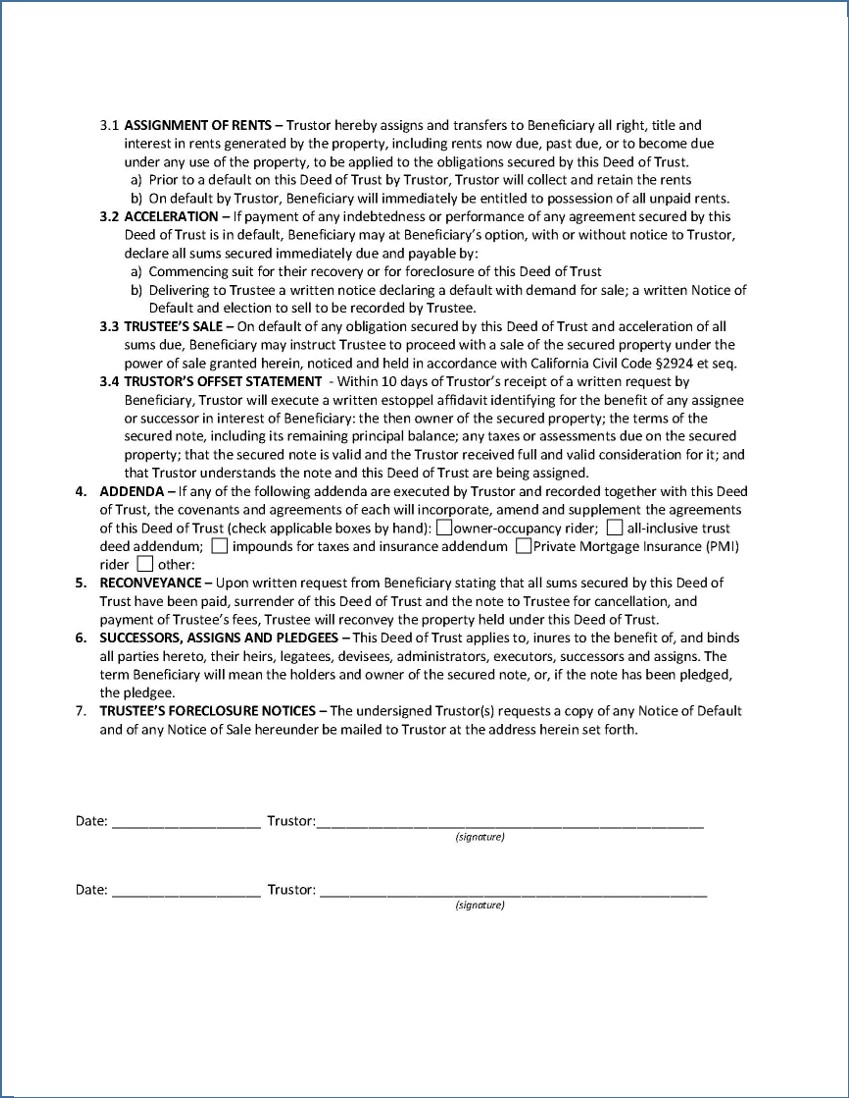

Prepare the Deed of Trust and Promissory Note

The Deed of Trust and Promissory Note must be in a format that the Sacramento County Clerk/Recorder’s Office will accept. Customizable templates may be downloaded from these links:

Sample filled-in forms with instructions are available at the end of this Guide.

3

Get the Signatures Notarized

Notarization is required before recording these documents with the County Recorder. The notary’s acknowledgment of the trustor’s signature is formal proof that the signature is genuine. You can find a notary at your bank, a mailing service, or in the Yellow Pages. with instructions are available at the end of this Guide.

4

Record the Signed Documents at the County Recorder’s Office

Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder’s Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864. You will need to pay a fee (you can check the current recording fees in Sacramento). The clerk in the recorder’s office will take your original documents and stamp them with the date, time, a filing number, and book and page numbers. The original documents will be mailed back to you. Note: trust deeds are exempt from the documentary transfer tax. California Revenue and Taxation Code § 11921.

5

What Happens Next?

If the borrower pays off the loan without defaulting (as happens in most cases), the beneficiary (lender) will request the trustee execute and record a deed reconveying the property to the borrower. You can find a Deed of Full Reconveyance on the Find A Form page of our website.

For more Information

At the Law Library:

Deeds for California Real Estate KFC 170 .R36 (Self Help)

Samples

The Deed of Trust must be in a format the Sacramento County Recorder’s Office will accept. See the sample templates of the Deed of Trust and the Promissory Note below.

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.