Affidavit for Collection of Personal Property (Small Estate Affidavit) Step by Step Guide

In certain circumstances, personal property may be transferred to the decedent’s successors without a formal probate. If the decedent’s estate qualifies under California Pro. Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

Templates and Forms

- Small Estate Affidavit (Affidavit for Collection of Personal Property) – PDF or

- Small Estate Affidavit (Affidavit for Collection of Personal Property) – DOCX

- Maximum Values For Small Estate Set-Aside & Disposition of Estate Without Administration (DE-300)

Personal property refers to anything that isn’t real estate. Common types of personal property include furniture, jewelry, and household goods, as well as bank accounts, stocks, and money due to the decedent.

Step-by-Step Instructions

1

Determine If This Is the Appropriate Procedure

Personal property may be collected using the Affidavit for Collection of Personal Property if:

- At least 40 days have elapsed since the death of the decedent

- No administrative proceedings are pending or have been conducted for the decedent’s estate

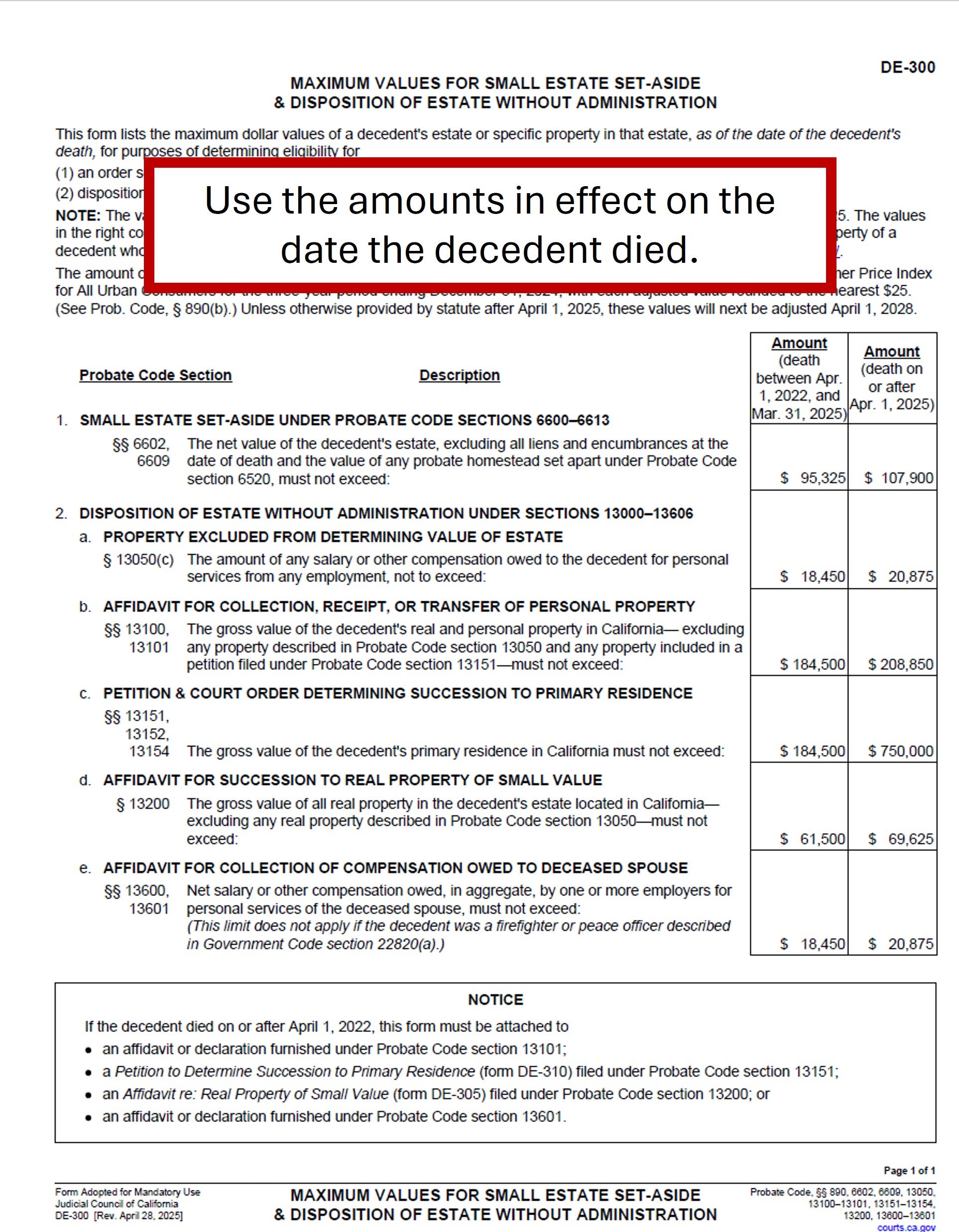

- Estate does not exceed $166,250 in value (if death occurred before April 1, 2022) $184,500 (death on or after April 1, 2022) or $208,850 (death on or after April 1, 2025). Many types of property are excluded when calculating the value of the estate (see Pro. Code § 13050 for exclusions).

- All people entitled to inherit must sign the affidavit (or provide the person signing with a notarized power of attorney; it can limit the power to collection of this specific property).

2

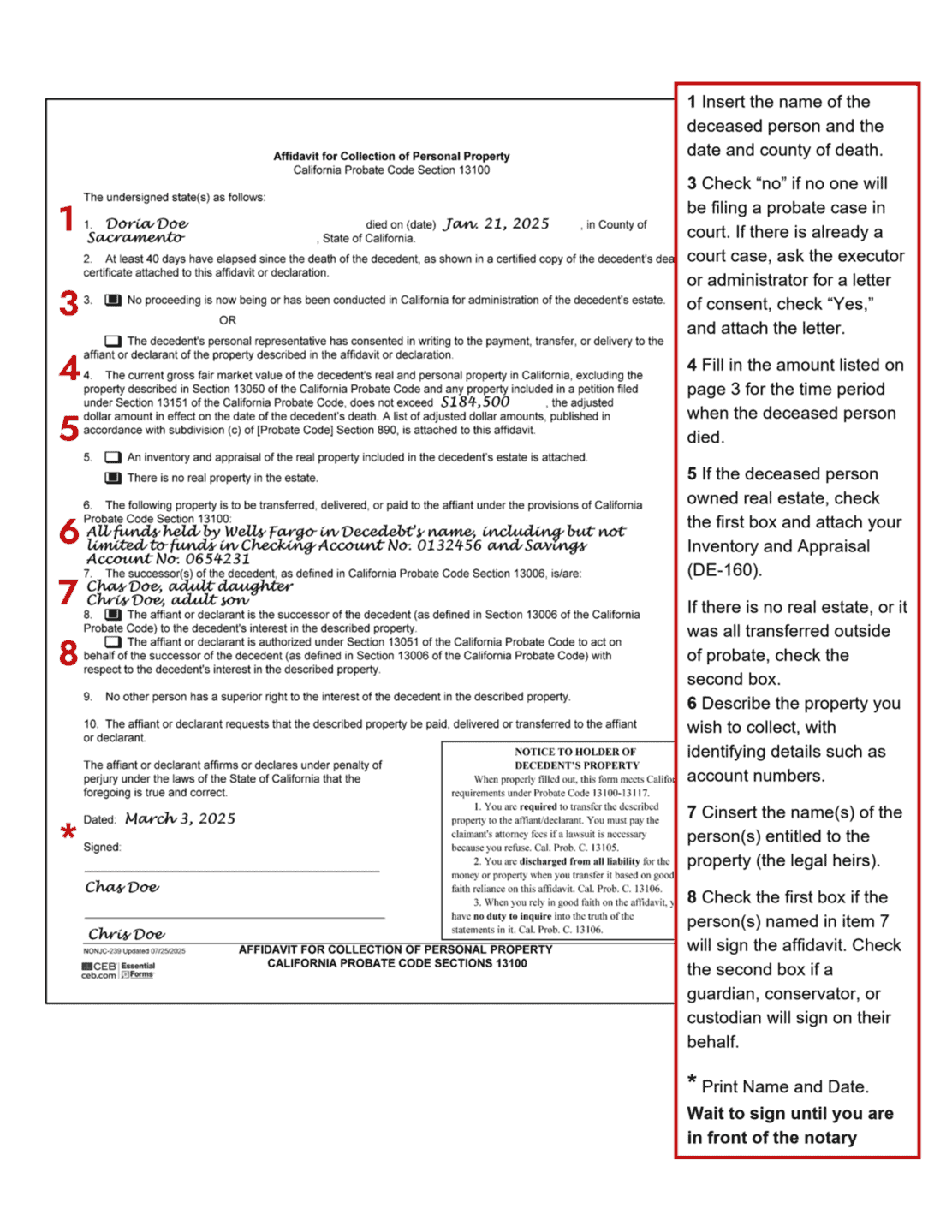

Complete the Affidavit

Instructions for completing the Affidavit for Collection of Personal Property are included at the end of this guide.

Although Pro. Code § 13101 states that a declaration under penalty of perjury is sufficient, many institutions require a notarized affidavit, especially when securities are involved. Contact the institution to determine if notarization is necessary.

If there are several assets to be transferred, they may all be included on one affidavit, or a separate affidavit may be used for each. If more than one person is entitled to inherit a particular asset, all of them must sign a single affidavit.

The Affidavit for Collection of Personal Property must be accompanied by:

- DE 300 Maximum Values for Small Estate Set-Aside & Disposition of Estate Without Administration

- A certified copy of the death certificate

- Evidence that the decedent owned the property (e.g., stock certificate, bank passbook, storage receipt)

- Reasonable proof of the identity of the person(s) signing the affidavit (e.g., driver’s license, passport)

- An Inventory and Appraisal of all real property owned by the decedent in California, if any. This appraisal must be performed by an approved probate referee. Pro. Code § 13103

The court can provide you a list of approved referees. For more information about the Inventory and Appraisal, see How to Probate an Estate in California (KFC 205 .N57).

If stocks or bonds are being transferred, you will also need to attach:

- An Affidavit of Domicile signed by the person(s) entitled to the securities

- A Transmittal Letter signed by the person(s) entitled to the securities

- A Stock or Bond Power, signed by the person(s) entitled to the securities

More Information:

Samples of these additional attachments are available in How to Probate an Estate in California from Nolo Press, Chapter 11.

3

Collect the Decedent’s Property

Present the completed Affidavit and required attachments to the person or institution having custody of the property.

Tips

When the Bank Insists on the “Letters” To Transfer Property

Adapted, with the kind permission of author Richard Wills, from “Washington State Probate,” at his Washington State Probate website.

Probably the most popular use of a “Small Estate Affidavit,” also called “Affidavit for Collection of Personal Property,” is to access a Decedent’s bank or securities account. The practical (as opposed to legal) problem is that banks, brokerages, transfer agents, and institutions in general are used to transferring such accounts through a probate proceeding, in which the Personal Representative delivers a copy of his/her Letters to the institution and requests the transfer. That’s the method that institutions are familiar with, and they have come to see it as “the proper (and only) procedure” for making the transfer. Consequently, far too often, when a Successor presents a Small Estate Affidavit to an institution, the institution responds “We need Letters to make the transfer.”

How to respond? In a word, be persistent and play “broken record” (repeat items 2 through 7 below over and over to the agent):

- To prepare for the transfer, download and print out a copy of the relevant statutes: Pro. Code § 13100-13116.

- Include the copies in your written request or hand the copies to the agent and politely ask the agent to read them, especially Pro. Code § 13100.

- If you are dealing with a securities transfer agent, politely ask the agent to read Pro. Code §§ 13100(c) and 13105(a)(2).

- Politely inform the agent that your use of a Small Estate Affidavit complies with California law, and that California law does not require either a probate proceeding or the delivery of Letters for the transfer to be made.

- If further resistance is met, politely inform the agent that if the institution refuses to make the transfer, California law allows you to bring an action in Court against the institution to compel the transfer and for it to reimburse you for your attorney’s fees and costs to obtain a Court Order to Compel the Transfer. Pro. Code §13105(b).

- If further resistance is met, ask to speak to their manager.

- If further resistance is met, ask to speak to their legal department.

Be forewarned, so that you may properly prepare. In your author’s experience, the grand champions of resistance to Small Estate Affidavits are downtown branches of large banks (e.g., Bank of America, US Bank, etc.), and East Coast (particularly New York) securities transfer agents.

For More Information

On the Web

California Courts Self-Help Website: “Simplified Procedures to Transfer An Estate“

This discusses the small estate affidavit as well as other ways property can be transferred without going to court.

At the Law Library

How to Probate an Estate in California KFC 205 .N57 (Self Help)

Electronic Access: From any computer (Library or home) via the Legal Information Reference Center.

Sample Affidavit

[Notary form omitted]

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.