Wage Garnishment

After you win your lawsuit and receive a judgment against the other party, your next step is to attempt to collect what you are owed. The court does not collect your judgment for you; you must do it yourself. If the judgment debtor has a job, you may be able to take a portion of their wages until your judgment is paid in full.

Templates and Forms

- Writ of Execution (EJ-100)

- Application for Earnings Withholding Order (Wage Garnishment) (WG-001)

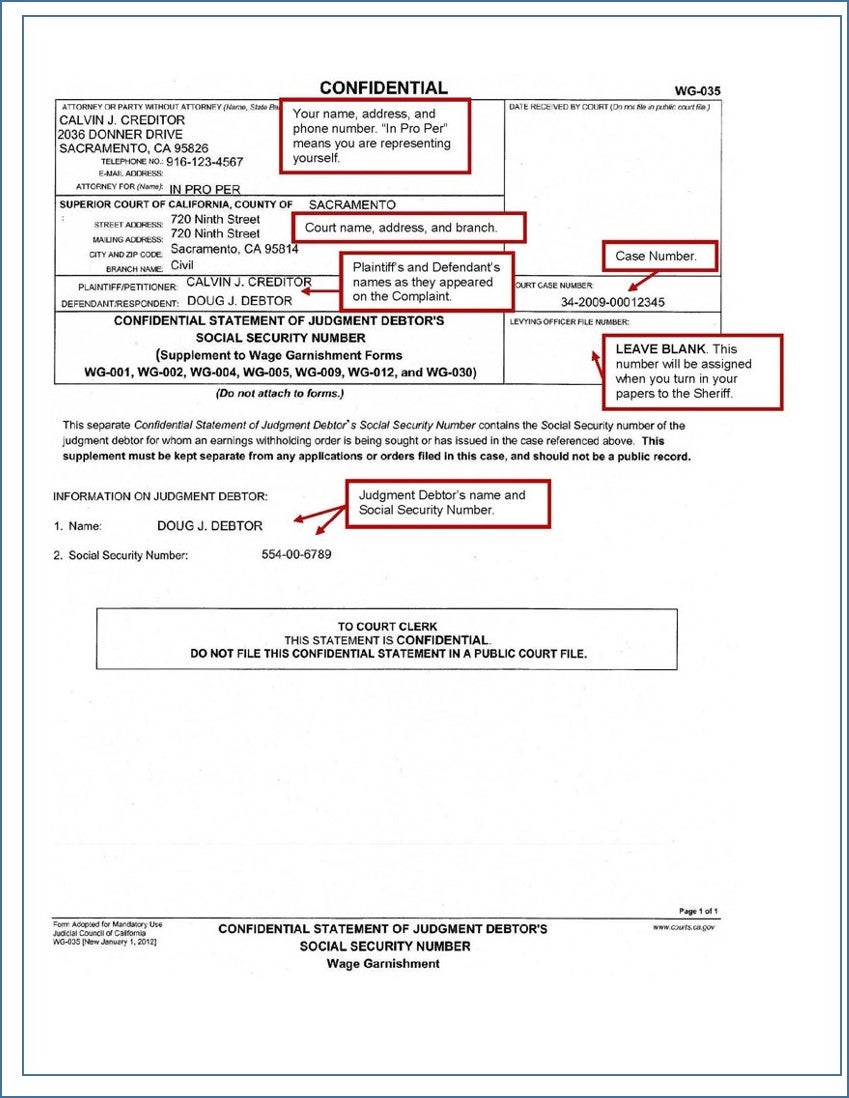

- Confidential Statement of Judgment Debtor’s Social Security Number (WG-035)

Under both State (CCP § 706.050) and Federal (15 USC 1673) law, judgment creditors may garnish up to 20% of the debtor’s disposable earnings (or more, if the debtor earns more than 40 times minimum wage). The 20% is the total for all garnishments, so if another garnishment is already in place, there may not be any funds available for you to collect until other creditors are paid in full. Additionally, you can only garnish wages if a third party employs the debtor; you cannot garnish wages if the debtor is self-employed.

Step-by-Step Instructions

1

Obtain a Writ of Execution

To garnish the judgment debtor’s wages, you must first obtain a writ of execution from the court. A writ of execution is a court order instructing the Sheriff to enforce your judgment in the county where the assets are located. This may not be the county where the party works, or the county where the judgment was issued.

1.a

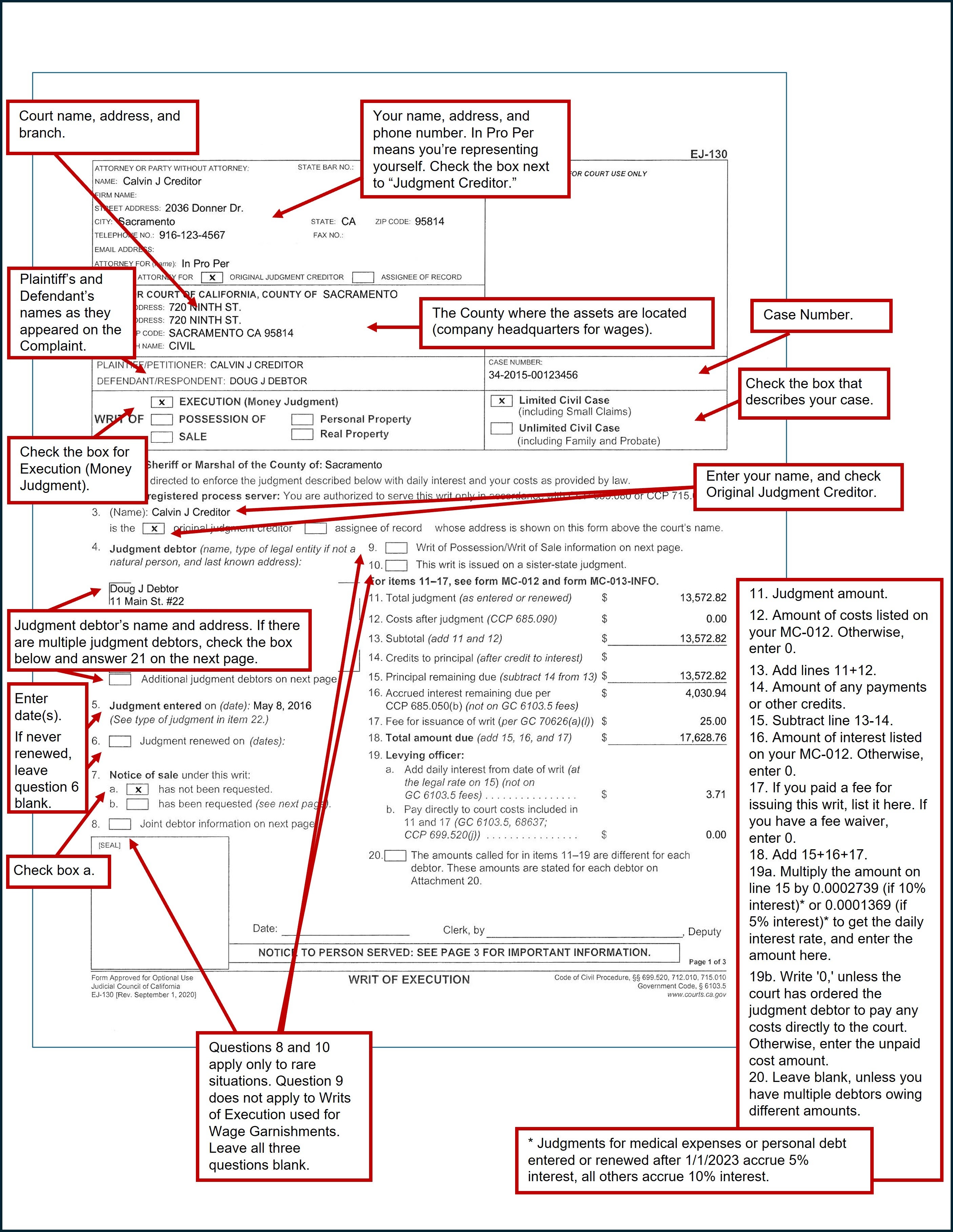

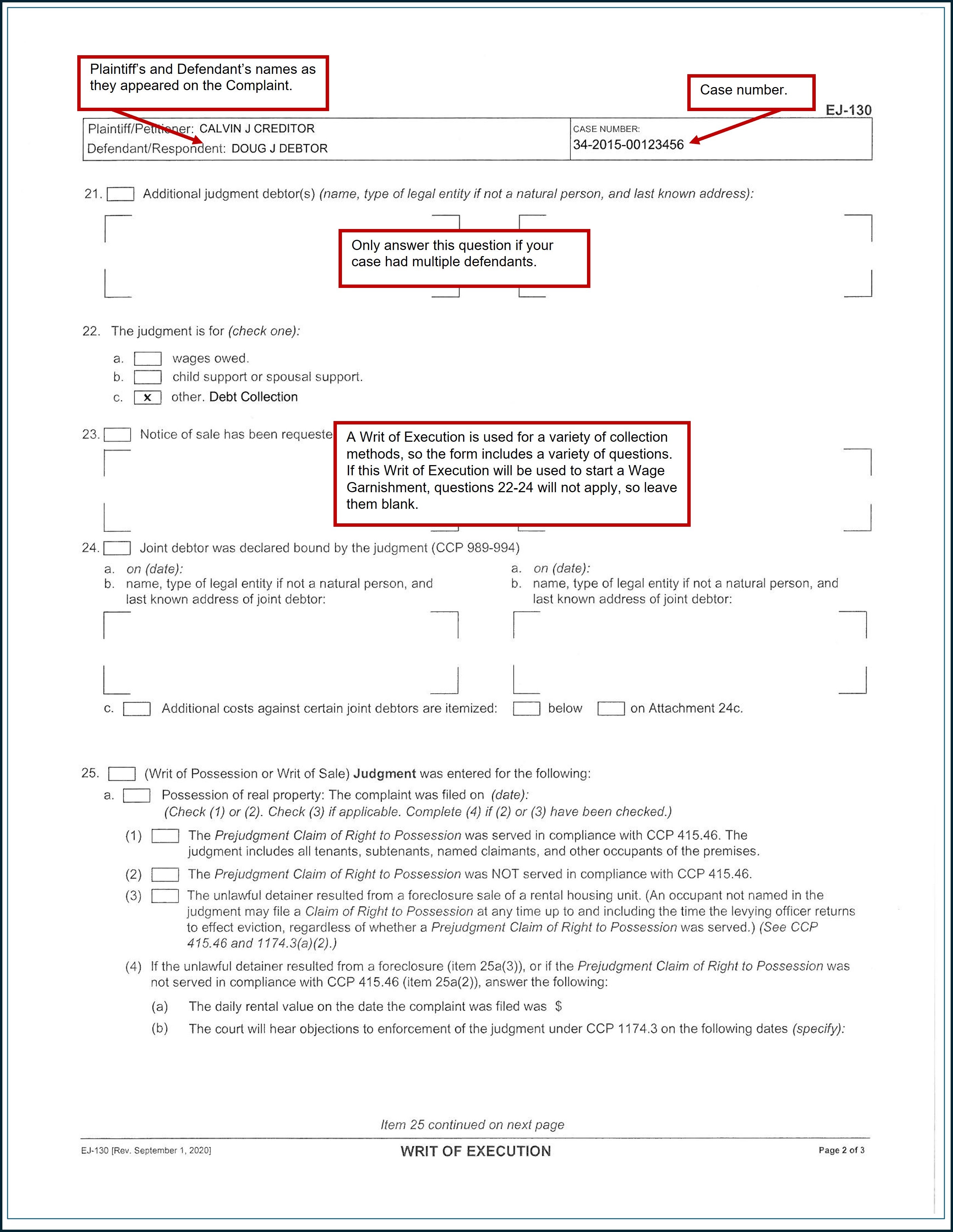

Complete the Writ of Execution (EJ-130) form

The Judicial Council form used to obtain a writ of execution is:

Instructions for completing this form are available at the end of this Guide.

1.b

Adding Costs and Interest (optional)

If you want to add additional costs incurred after entry of judgment (e.g., the cost of issuing the writ of execution, levying officers’ fees, fees for the debtor’s examination, etc.) or accrued interest on your judgment amount, you must file a Memorandum of Costs after Judgment (MC-012) with your Writ of Execution (EJ-130). You must serve your Memorandum of Costs after Judgment (MC-012) on the judgment debtor prior to filing. The judgment debtor has 10 days after service of the Memorandum of Costs after Judgment (MC-012) to oppose it by filing a motion to tax costs (CCP § 685.070(c)). For more information on the procedure and forms, see our guide on Memorandum of Costs After Judgment.

1.c

Obtain a File-Endorsed Copy of Your Judgment

You will need to provide the court with a file-endorsed (stamped) copy of your judgment. If you do not have one, you may download a copy from the court’s website.

1.d

File Your Documents

File the following items with the court:

- Writ of Execution (EJ-130) (original + 2 photocopies)

- Memorandum of Costs after Judgment (MC-012), if desired (original + 2 photocopies)

- File-endorsed (stamped) copy of the judgment

- Filing fee (see court fee schedule to determine current fee)

- Self-address stamped envelope

File in the drop box at the courthouse at 720 Ninth Street. Fill out and attach the Civil Document Drop-Off Sheet, and date stamp the back of your original documents.

If you filed a Memorandum of Costs after Judgment (MC-012) along with your Writ of Execution (EJ-130), and your costs are more than $100, the clerk will wait 10 days (15 days, if served by mail) to issue Writ of Execution, to allow the judgment debtor to oppose your costs by filing a Motion to Tax Costs (CCP § 685.070). If your costs are less than $100, or if you did not file a Memorandum of Costs, the clerk will issue your Writ immediately. The clerk will return the documents to you by mail. Your Writ of Execution (EJ-130) will be valid for 180 days after it is issued.

2

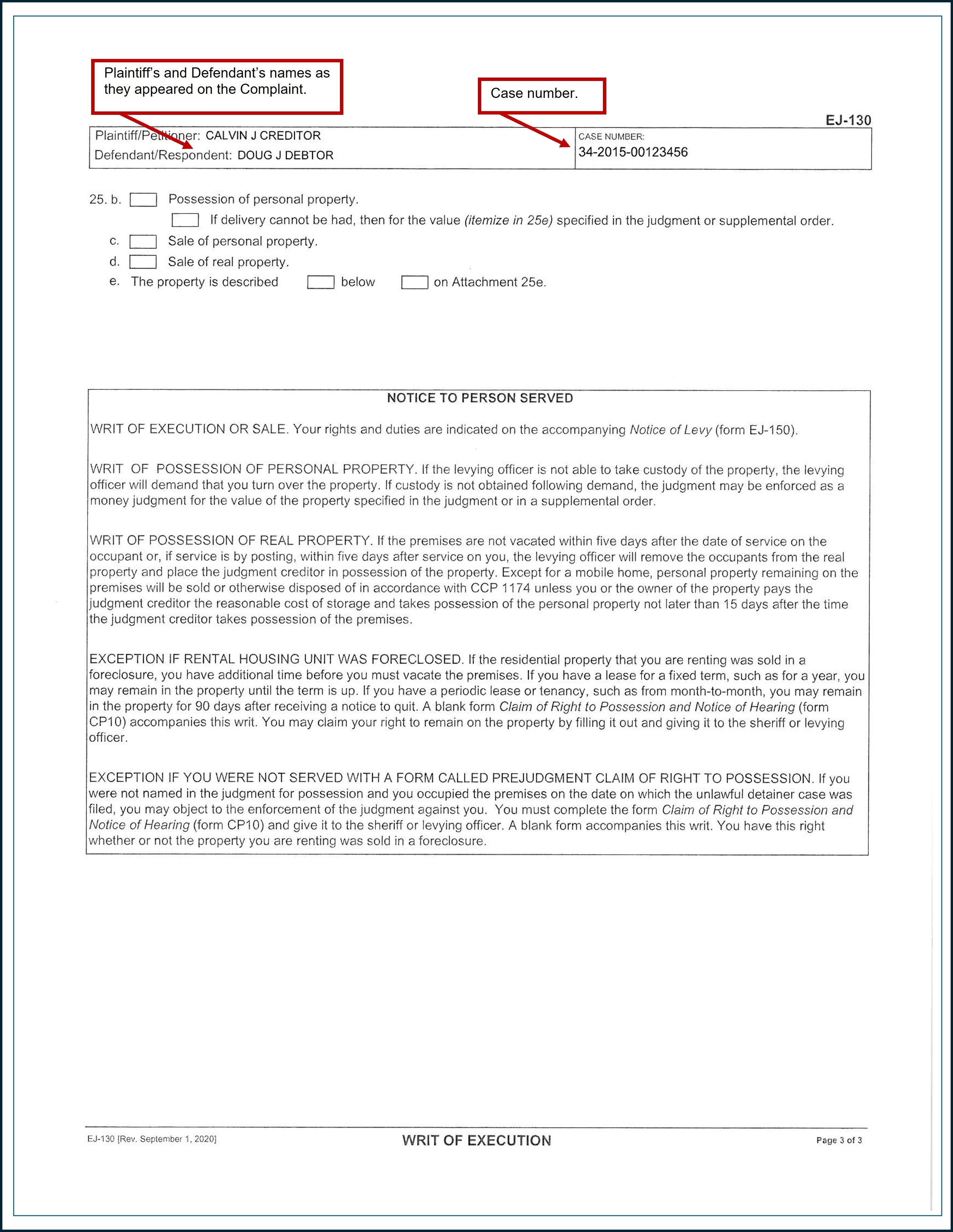

Complete the Application for Earnings Withholding Order

The Writ of Execution (EJ-130) simply tells the sheriff to enforce a judgment, but does not specify the method(s) to be used. You must provide the Sheriff’s Department with the details of how they are to enforce your judgment. The Judicial Council forms used to have the Sheriff garnish the debtor’s wages are:

- Application for Earnings Withholding Order (Wage Garnishment) (WG-001)

- Confidential Statement of Judgment Debtor’s Social Security Number (WG-035) (if debtor’s Social Security Number is known)

Instructions for completing these forms are available at the end of this Guide.

3

Have Your Documents Served

An “Earnings Withholding Order packet” must be served on the employer by a sheriff or registered process server. This packet includes the Writ of Execution (EJ-130), which must be valid at the time it is served on the employer. Be sure to time this properly, so that the packet is not served to the employer more than 180 days after the Writ of Execution (EJ-130) is issued. The Sacramento County Sheriff requests that you give them the packet no more than 120 days after the Writ of Execution (EJ-130) is issued, so they have enough time to serve the employer before it expires.

To have your documents served by the sheriff, bring the following items to the Sacramento County Sheriff’s Civil Division, 2969 Prospect Park Drive, Suite 200, Rancho Cordova, CA 95670 (telephone: 916-875-2665):

- Original Writ of Execution (EJ-130)

- Original Application for Earnings Withholding Order (WG-001)

- Confidential Statement of Judgment Debtor’s Social Security Number (WG-035) (if debtor’s Social Security Number is known)

- Cash or check for service fee (see the department’s fee schedule for current charges).

The Sacramento County Sheriff will provide copies of the additional required documents, including:

- Earnings Withholding Order (WG-002)

- Employer’s Return (Wage Garnishment) (WG-005)

- Employee Instructions (Wage Garnishment) (WG-003)

The Sheriff will issue the Earnings Withholding Order (WG-002) based on your application. They will note the Levying Officer’s file number on the order – keep track of this number, so you can to track the status of your file at the Sacramento County Sheriff’s Office through the E-Services Portal.

The Employer will complete and sign the Employer’s Return (Wage Garnishment) (WG-005), and give it to the Sheriff, who will mail it to you. At the end of the process, you will have a “packet” for your files, which will include:

- Writ of Execution (EJ-130)

- Application for Earnings Withholding Order (Wage Garnishment) (WG-001)

- Earnings Withholding Order (WG-002)

- Employer’s Return (WG-005)

- Employee Instructions (WG-003)

If served outside Sacramento County, check with the local Sheriff to determine if they will provide these documents.

If you hire a registered process server to serve your documents, contact the server to determine their fees, what documents you must provide, and any additional information they will require.

Only the Sheriff can issue the Earnings Withholding Order, so a process server will need to first obtain the Order from the Sheriff, then serve the Earnings Withholding Order packet on the employer, and return the appropriate documentation, along with your fee, to the Sheriff, who is responsible for collecting and disbursing funds. Therefore, it is more practical for most litigants to have the Sheriff handle the entire procedure. All steps can be completed by the Sheriff for just a single fee. When a process server is used, the litigant is responsible for paying the Sheriff’s fee, plus the process server’s fee.

For the purposes of this guide, we will assume the Sheriff is handling the entire process.

4

Wait for Response from the Debtor, if Any

Under state and federal law, some types of income and property are exempt from garnishment. If the judgment debtor believes his or her wages are exempt, the debtor has 10 days after receiving notice from his or her employer about the Earnings Withholding Order (WG-002) to file a Claim of Exemption (WG-006) with the Sheriff’s Department to prevent the garnishment from beginning. The judgment debtor may file a Claim of Exemption (WG-006) at any time, but the wages already garnished will not be returned. The Sheriff’s Department will mail the judgment creditor a Notice of Filing of Claim of Exemption (WG-008), along with a copy of the judgment debtor’s Claim of Exemption (WG-006) and Financial Statement (WG-007).

5

Oppose the Claim of Exemption, if Appropriate

Be sure to review the judgment debtor’s Claim of Exemption (WG-006) and Financial Statement (WG-007) carefully, to determine if you agree whether the funds are exempt from collection. You can read about most of these exemptions in Exemptions from the Enforcement of Judgments (EJ-155). An adaptation of the Exemptions list, with hyperlinks to the applicable code sections, is available on the Law Library’s website. If you agree that the funds are exempt, you do not need to do anything. After 10 days, the exemptions are automatically granted and the funds claimed exempt will be returned to the debtor.

If the judgment debtor does not file a Claim of Exemption (WG-006), skip to Step 7.

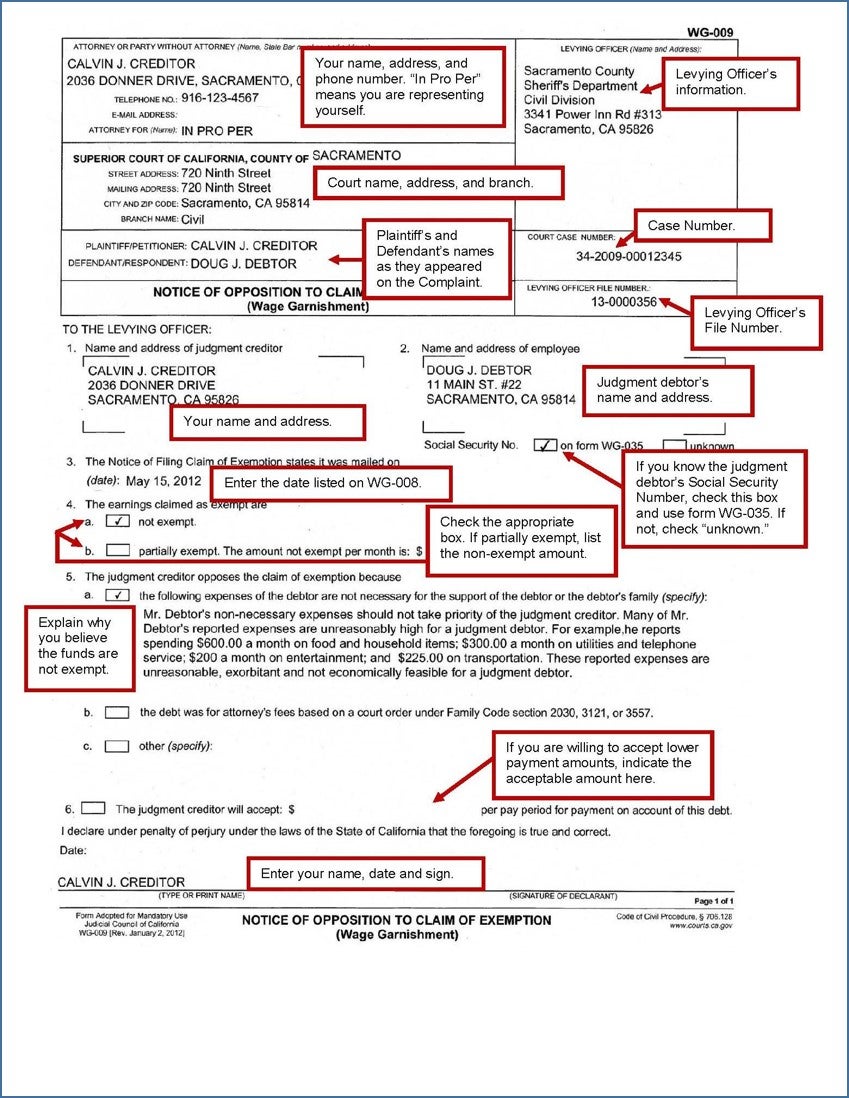

If you do not believe the funds are exempt from collection, and decide to oppose the claim of exemption, you must act quickly. There is an extremely tight turnaround on the deadlines for oppositions.

5.a

Determine when to schedule your hearing.

You, as the person filing the opposition, are responsible for selecting the hearing date. The timing for opposing a Claim of Exemption can be very tricky. There are three different time periods you have to consider, all of which may overlap.

Your Notice of Opposition to Claim of Exemption (WG-009/EJ-170) must be served on the judgment debtor, given to the levying officer and filed with the court within 10 calendar days after the Sheriff mails you the judgment debtor’s Notice of Filing of Claim of Exemption (WG-008) (CCP § 706.105(d), (e)).

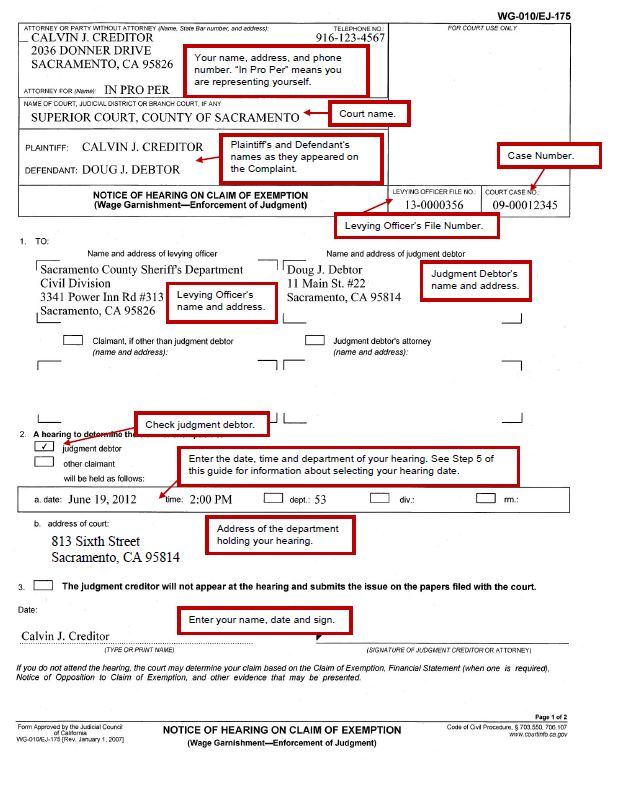

Your Notice of Opposition to Claim of Exemption (WG-009/EJ-170) and Notice of Hearing on Claim of Exemption (WG-010/EJ-175) must be filed with the court, given to the levying officer and served on the judgment debtor at least 16 court days before your hearing. If served by mail, add 5 calendar days (CCP § 1005).

Your hearing must be held within 30 calendar days of filing your Notice of Opposition to Claim of Exemption (WG-009/EJ-170) (CCP § 706.105(e)).

For example, let’s say the Sheriff mails the Notice of Claim of Exemption to you on May 11th. You have 10 days to serve your opposition to the sheriff and judgment debtor, and file it with the court. The last day to file your opposition is May 21st (shown in Green above). Your hearing must be held within 30 days of filing, so if you file on May 21st, the last day for your hearing is June 20th (shown in Blue above).

Now comes the tricky part. As the party making this motion, you are responsible for selecting the hearing date. You may select any date that is convenient for you, as long as it provides the minimum required notice to the judgment debtor. CCP § 1005 requires you to provide 16 court days’ notice. If you serve your documents by mail within California, you must add 5 calendar days. These days are counted backwards from the hearing date. CCP § 12c. The court dates that will allow you to provide the required amount of notice will typically fall near the end of your 30 day window to have the hearing. In this example, we will be using June 20th as our desired hearing date. You may have to check several dates until you find one that will work for your situation.

To confirm that a hearing date will allow sufficient notice, count backward (CCP § 12c) 16 court days (shown in Red above). Day one is the day before the hearing date (June 19th). Do not count weekends or court holidays (there is only one court holiday in this example, which is Memorial Day, May 28th). May 29th is the 16th court day. This is the last day to serve your documents if personally served. If your documents are served by first-class mail, additional time is added to the calculation, depending on where the mail originates and where it is sent (CCP § 1005). For example, if the documents are mailed from California to an address in California, five calendar days are added before the sixteen court days. Calendar days include weekends and holidays, but if the final day lands on a weekend or holiday, it is rolled over to the previous court day. Counting backward 5 calendar days makes the last date for service May 24th (shown in Purple above). However, this date is after the 10 day window for service after mailing of the Notice of Claim of Exemption (requiring service to be made by May 21st). So if you filed and served your Notice of Hearing on Claim of Exemption and Notice of Opposition to Claim of Exemption (WG-009/EJ-170) on May 21st, you will have provided sufficient notice for a hearing on June 20th.

In the previous example, we filed and served our documents on the same day (May 21st). Filing and service do not have to occur on the same day; there are often advantages to doing these steps separately. Let’s say instead you wanted your hearing on June 19th. Counting backward 16 court days plus 5 calendar days makes the last day for service May 18th (the 5th day is May 20th, a Sunday, so the last day for service is the previous court day, Friday May 18th). However, you could not file your papers on the 18th, because that would make the final date for your hearing June 18th (the 30th day is June 17th, but rolls to the next court day). Your June 19th hearing would be too late. In a situation like this, you may want to consider serving your documents on the earlier date (May 18th) so you give proper notice, and waiting until the later date (May 21st) to file them with the court.

To give yourself the widest window to have your hearing:

- Serve your opposition early in the 10 day window. Since your hearing date requires you to provide 16 court days’ plus 5 calendar days’ notice, the earlier you serve your documents, the earlier your first possible hearing date.

- File your opposition with the court late in your 10 day window. The last possible date for your hearing is 30 calendar days after filing your Notice of Opposition with the court. The later you file with the court, the later your final possible hearing date will be.

If you wait until the last day to serve and file your documents, you may find that there is only one possible day to have your hearing!

5.b

Determining the Department to Hear and the Time of the Motion

In Sacramento, Oppositions to Claims of Exemption are heard in Department 53 at 1:30 p.m. or Department 54 at 9:00 a.m., depending on your case number, Tuesday-Thursday except for holidays. To determine whether your motion is in Department 53 or 54:

- For cases filed after April, 2023: check the online portal to determine which department your case is assigned to.

- For cases filed after January 1, 2013: If your case number ends in an odd number, then your Law and Motion department is 53 at 1:30 p.m. If it ends in an even number, it is department 54 at 9:00 a.m.

- All Law and Motion matters for cases filed prior to January 1, 2013 shall be heard by the Law and Motion department previously assigned.

5.c

Reserve your Hearing Date

In Sacramento’s law and motion departments, all hearing dates must be reserved online by logging on to the court’s website before submitting moving documents to the Court. Any paperwork submitted without a reserved hearing date will be rejected. Phone hours are Monday through Friday, 8:30 a.m. to 4:00 p.m. (closed from 12:00-1:00).

- Department 53 – 916-874-7858

- Department 54 – 916-874-7848

5.d

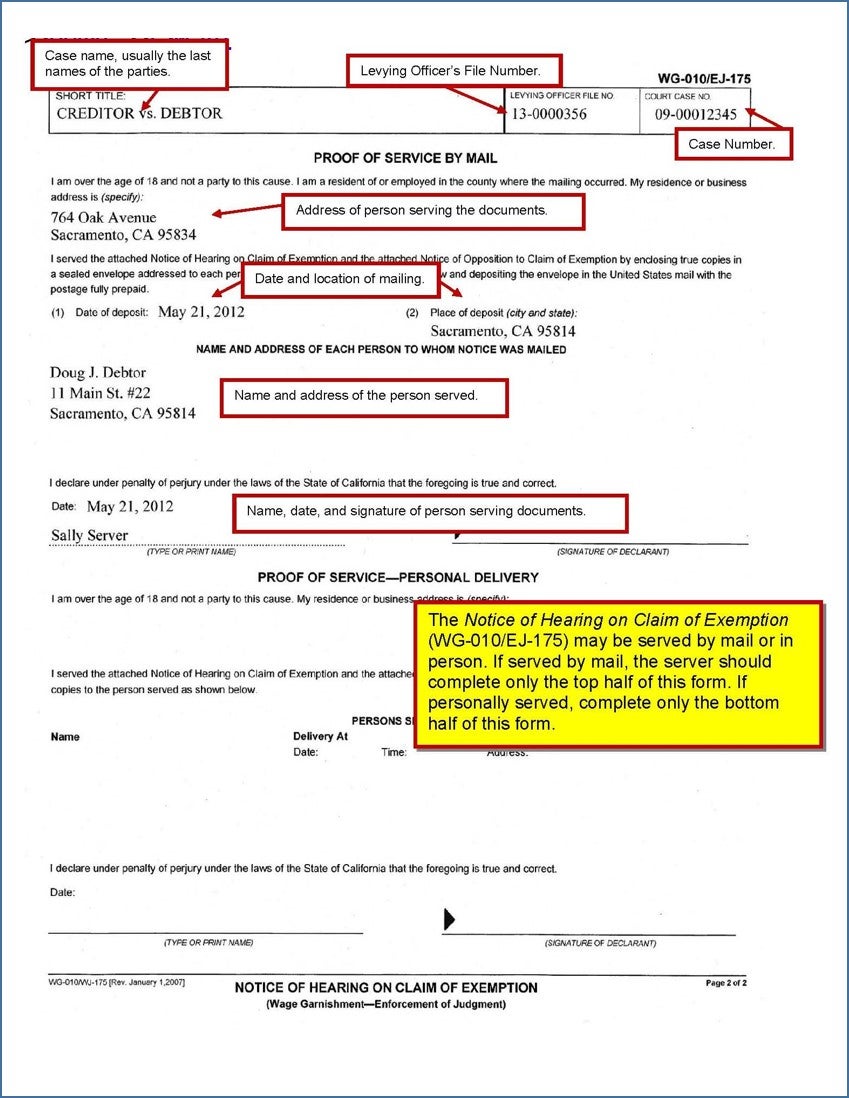

File and Serve your Documents

The Notice of Filing of Claim of Exemption (WG-008) provides detailed instructions for filing and serving your Notice of Opposition to Claim of Exemption (WG-009/EJ-170) and Notice of Hearing on Claim of Exemption (WG-010/EJ-175). Be sure to follow the instructions carefully.

You must include notice of the tentative ruling system with your documents. You can create your own notice on pleading paper using the language for this notice available from the Sacramento County Superior Court’s website at Local Rules, rule 1.06 (1.06 Posting of Civil Tentative Rulings).

6

Check Your Tentative Ruling

Sacramento Superior Court uses a Tentative Ruling System. Pursuant to Local Rule 1.06, the court will make a tentative ruling on the merits of your matter by 2:00 p.m. the court day before the hearing. You may read the tentative ruling online, or may call the clerk for Department 53 ((916) 874-7858) or Department 54 ((916) 874-7848) to hear it.

In the tentative ruling, the judge will determine what funds, if any, are exempt from collection. The ruling will typically order the release of non-exempt funds to the creditor, and order the continued garnishment of non-exempt funds.

If you are happy with the tentative ruling, you do not need to do anything. You won’t have to go to court unless ordered to appear in the tentative ruling or unless the other side calls you and the court between 2:00 p.m. and 4:00 p.m. the court day before your hearing date to request an oral argument in front of the judge. If that happens, you should go to the court hearing and be prepared to argue your case.

If you are not happy with the tentative ruling, and wish to present arguments in front of the judge, you must call all opposing counsel and/or self-represented parties and the clerk for Department 53 (916- 874-7858) or Department 54 (916-874-7848) no later than 4:00 p.m. the court day before your hearing and state that you are requesting oral argument on the motion. If neither you nor the opposing counsel or self-represented party requests oral argument, the court will simply make the tentative ruling the order of the court, and no oral argument will be permitted.

For information on how to view the tentative ruling online, see Public Portal from the Sacramento County Superior Court’s website.

7

Sheriff Will Release Funds to You

The Earnings Withholding Order remains in effect, and the sheriff will continue to collect on it, until your judgment is fully satisfied, released, or expires (10 years after entry, unless you renew it), or until the debtor’s employment is terminated. If the debtor changes jobs, you will need to set up a new wage garnishment.

The sheriff will collect the appropriate amount from each paycheck. A check will be mailed to you at the address shown on the Application for Earnings Withholding Order (Wage Garnishment) (WG-001) within 10 days after the funds are collected.

For Help

SH@LL (Self-Help at the Law Library)

609 9th Street, Sacramento CA 95814

(916) 476-2731 (Appointment Request Line)

Services Provided: SH@LL provides general information and basic assistance to self-represented litigants on a variety of legal issues. All assistance is provided by telephone. Visit “What we can help with” for a list of qualifying cases.

Eligibility: Must be a Sacramento County resident or have a qualifying case in the Sacramento County Superior Court.

For More Information

On the Web:

California Courts Self-Help Website – Collect Your Judgment

Enforcement of Judgments

This four-part video series from the Sacramento County Public Law Library’s Civil Self Help Center covers the most successful methods of collection, including obtaining an earnings withholding order and bank levy.

California Forms of Pleading and Practice KFC 1010 .A65 C3 (Ready Reference)

Electronic Access: On the Law Library’s computers, using Lexis Advance.

California Practice Guide: Enforcing Judgments and Debts KFC 1065 .A9 S3

Debt Collection Practice in California KFC 256 .C83

Electronic Access: On the Law Library’s computers, using OnLaw.

Enforcing Civil Money Judgments KFC 1065 .C34

Electronic Access: On the Law Library’s computers, using OnLaw.

How to Collect When You Win a Lawsuit in California KFC 1065 .Z9 H69 (Reference)

Matthew Bender Practice Guide: California Debt Collection and Enforcement of Judgments KFC 1065 .E5 M38

Electronic Access: On the Law Library’s computers, using Lexis Advance.

Samples

Writ of Execution

Application for Earnings Withholding Order

Confidential Statement of Judgment Debtor’s Social Security Number

Next steps:

After you provide the Sheriff with the Writ of Execution, the Sheriff will provide copies of the additional required documents, including an Earnings Withholding Order (WG-002), Employer’s Return (Wage Garnishment) (WG-005), and the Employee Instructions (Wage Garnishment) (WG-003) to the employer.

If the debtor makes a Claim of Exemption, the Sheriff will send you a Notice of Filing of Claim of Exemption along with a copy of the Claim of Exemption (EJ-160) and Financial Statement (EJ-165). If after you review those documents you feel that the claim of exemption is unjustified, you can set a hearing on the Claim of Exemption. Use the Notice of Hearing on Claim of Exemption to notify the debtor.

Notice of Opposition to Claim of Exemption

Notice of Hearing on Claim of Exemption

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.