Claim of Exemption: Wage Garnishment

Templates and Forms

If you receive notice from your employer that your wages are being garnished, and you want to object, act fast. The sheriff will hold your wages for 10 days before delivering them to the creditor. You can file a claim of exemption at any time, but until you do, the garnishment will continue, and you will not be entitled to have the money returned.

Wage garnishment — automatic collection of up to 20% of your wages — is a main tool creditors use to collect judgments. Part or all of your pay may be exempt from garnishment. This guide shows how to claim that exemption.

To garnish your wages, the creditor must have a valid court judgment against you. The creditor must then ask the court for a Writ of Execution, which is an order directing the Sheriff to enforce the judgment, and an Earnings Withholding Order (WG-002) (EWO). The Sheriff serves your employer with the EWO, requiring the employer to pay part of your earnings directly to the Sheriff, who passes it to the creditor. If your employer is served, they will let you know and you will have a chance to claim an exemption.

File a Claim of Exemption (WG-006) and Financial Statement (WG-007) with the sheriff’s department listed on the Notice of Levy. Use these forms to explain why some or all of the wages the creditor wants your employer to garnish should be exempt (excluded) from being taken. There are laws and rules that say which types of income or property are exempt. You can read about many of these exemptions in Exemption from the Enforcement of Judgments (EJ-155). Exemptions from Enforcement of Judgments, an adaptation of this document, with hyperlinks to the applicable code sections, is available on the Law Library’s website. It is very important to read and understand the specific exemption(s) that may apply to you, because not all of these exemptions are complete (for example, employment wages are only 80% exempt), and some have limits on the amount of the exemption (for example, $2300 in a vehicle’s equity is exempt).

Even if the court orders part of your wages exempt from collection, the judgment still exists, and will continue to accrue 10% simple interest each year (5% for judgments entered after January 1, 2023 for medical expenses or personal debt).

Step-by-Step Instructions

1

Gather the Required Information

Before completing your forms, it may be useful to gather these documents, which will provide needed information:

- Notice of Wage Garnishment from your employer

- At least one month of pay stubs

- A list of your monthly expenses, such as rent, utilities, insurance, etc.

2

Complete the Required Forms

The Judicial Council forms needed for a claim of exemption for wage garnishment are:

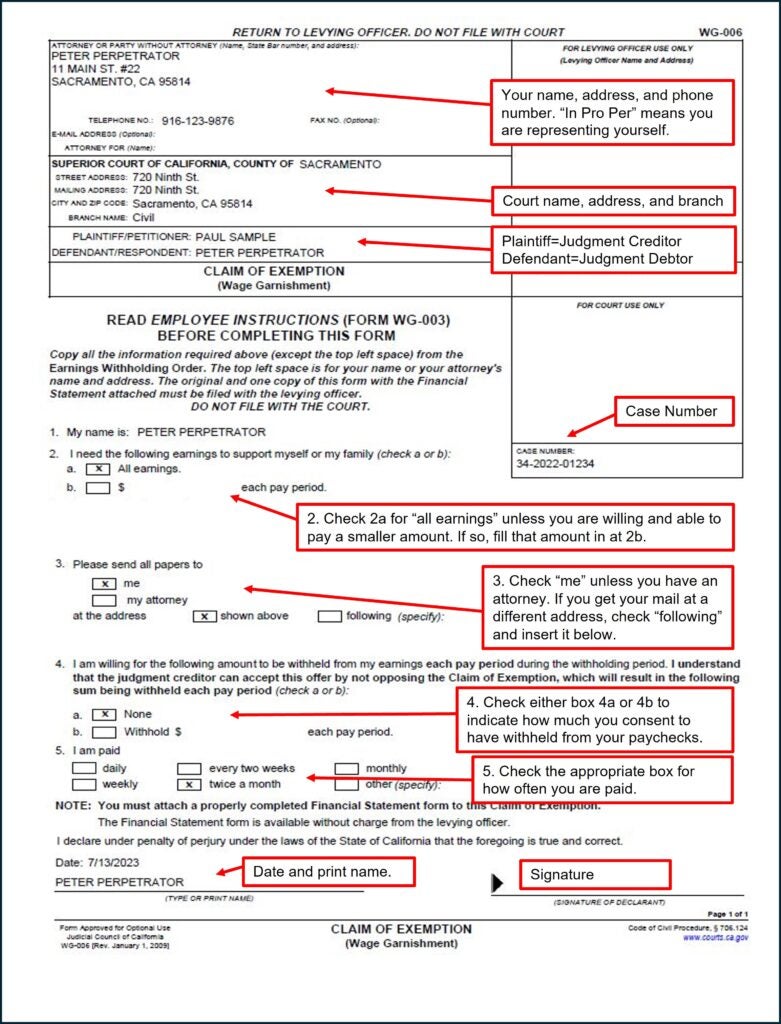

- Claim of Exemption (WG-006)

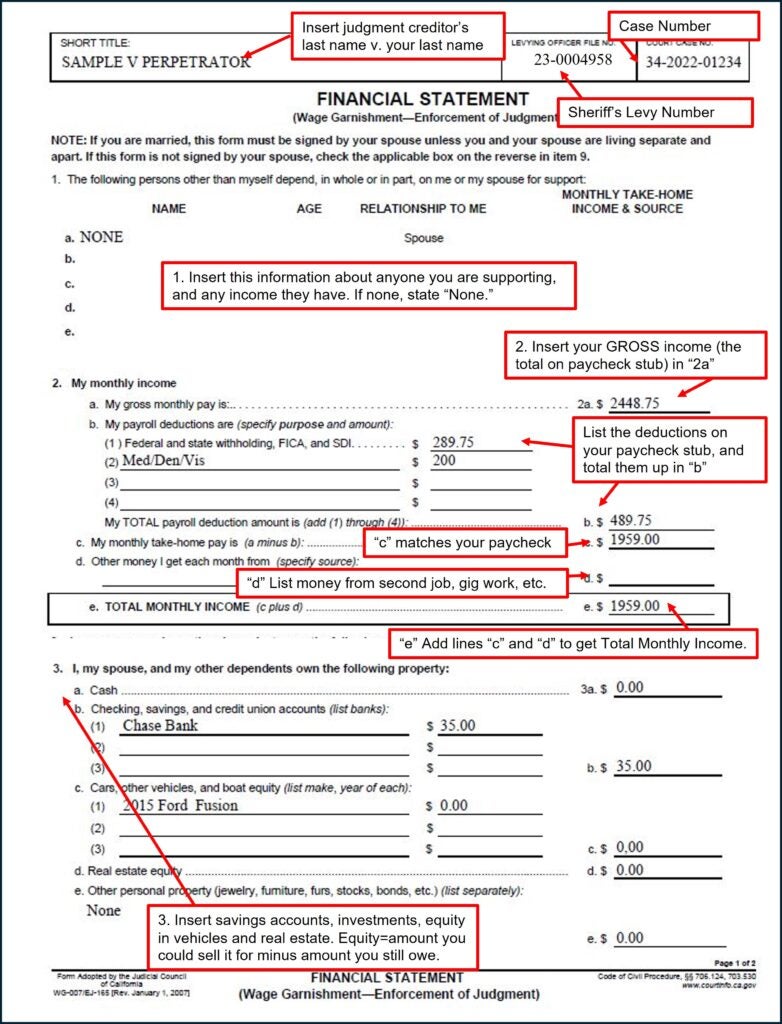

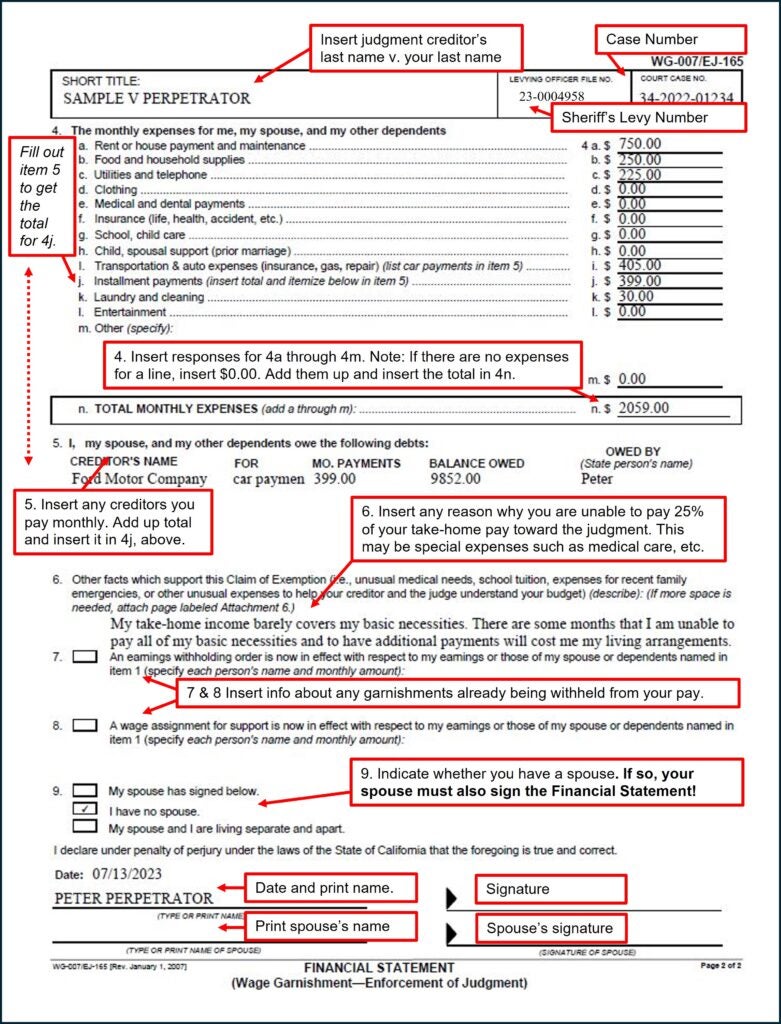

- Financial Statement (WG-007)

Instructions for completing the necessary forms are included at the end of this packet.

3

Make Photocopies

Make two copies of each:

- Claim of Exemption (WG-006)

- Financial Statement (WG-007)

4

File Your Documents

Take or send your completed documents to the Sheriff’s Department listed on the Earnings Withholding Order (WG-002). The Sheriff will mail one copy to the judgment creditor and keep the original. The other copy is for you to keep for your records.

5

Creditor Can Oppose the Claim of Exemption

The levied money will be held until either: 1) 10 days go by and the creditor does not oppose your claim of exemption; or 2) the judge makes a decision on the claim of exemption. If the creditor does not oppose your claim of exemption, the garnished money will be returned to you.

If the creditor opposes your claim of exemption, you will receive a Notice of Opposition to Claim of Exemption (EJ-170) and Notice of Hearing on Claim of Exemption (EJ-175) that will set a court date for a judge to make a decision, probably within the month. You do not need to file anything; the judge will rely on your Claim of Exemption.

If the judge agrees with your claim of exemption, you will get your money back. If the judge agrees with the creditor, your employer will send the money to the creditor every month until your judgment is paid in full. The judge may also find that the creditor is entitled to money from your wages, but in an amount less than 20%. In that situation, your employer will send the court-ordered amount to your creditor each month until the judgment is paid in full.

6

Checking the Tentative Ruling the Day Before the Hearing

In Sacramento (and most counties), the judges read the papers and decide how they are going to rule ahead of time. Then their decisions are posted on the court’s online case portal at 2 p.m. the business day before the hearing date. The parties must check the tentative ruling online or call the department to hear the decision.

If You Agree With The Tentative Ruling…

You do not need to do anything. If the other party disagrees, they must contact you and the court by 4:00 pm the same day. If the other party does not contact you by 4:00 pm, the Tentative Ruling will become the order of the Court at the hearing.

If You Disagree With The Tentative Ruling...

Call the opposing party by 4:00 p.m. and tell them that you are appearing, and that they can appear via Zoom.

Call the Law and Motion Oral Argument Request Line at (916) 874-2615 by 4:00 p.m. Leave a message with the following information: 1. Your name, and that you want to appear; the item number (to the left of your case number on the Tentative Ruling); that you have let the other parties know you are appearing, and that they can appear via Zoom.

More info: How to Look Up a Tentative Ruling and Attend a Hearing

If Neither Party Calls…

If neither you nor the opposing party requests oral argument, the court will simply make the tentative ruling the official order of the court. If you go to court anyway, you will find that the hearing is cancelled.

7

Attending the Hearing

If you or the other party request oral argument, arrive or log onto Zoom early. There will probably be other cases scheduled at the same time; there is usually a list posted on the wall outside the courtroom that lists the order in which cases will be heard. Go into the courtroom or Zoom waiting room and check in with the bailiff or clerk.

Remote (Video or Telephone) Hearings are an Option

For most types of motions, you can appear remotely by connecting on the Zoom app. The tentative ruling will explain how to connect.

When your name is called, be ready to speak and to answer any questions the judge has. You will only have a few minutes. After both sides speak, the judge may make a decision right away, or may “take it under consideration” and mail out the decision in a few days.

For help

SH@LL (Self-Help at the Law Library) (formerly Civil Self Help Center)

609 9th Street, Sacramento CA 95814

(916) 476-2731 (Appointment Request Line)

Services Provided: SH@LL provides general information and basic assistance to self-represented litigants on a variety of civil legal issues, including name changes. All assistance is provided by telephone. Visit “What we can help with” for a list of qualifying cases.

Eligibility: Must be a Sacramento County resident or have a qualifying case in the Sacramento County Superior Court.

For assistance with a Claim of Exemption- Wage Garnishment, you must bring:

- Notice of Wage Garnishment from your employer

- At least one month of paystubs (more if income varies monthly)

- A list of your monthly expenses (for example, rent, utilities, insurance, etc.).

Samples

Claim of Exemption (Wage Garnishment)

Financial Statement

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.